Tinian was the first U.S. territory to release its own government-supported digital currency, the Marianas US Dollar (MUSD). The Tinian Municipal Treasury will manage MUSD with help from Marianas Rai Corporation, a blockchain company. Backed by U.S. dollars and Treasury bills, the stablecoin is a strong sign of digital money and the economy’s growth.

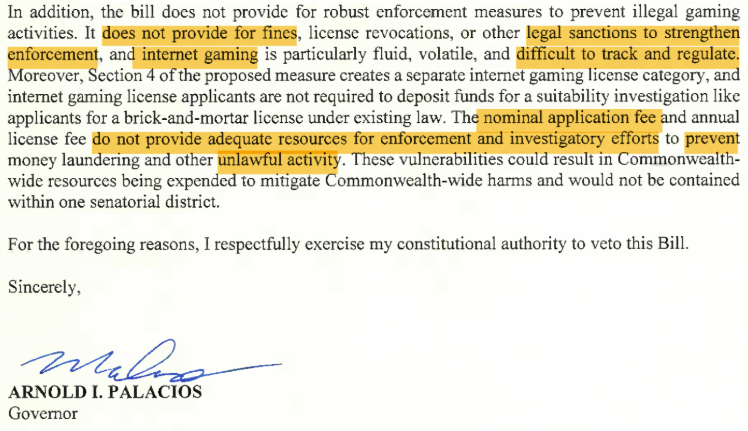

Despite the bill’s veto, the legislature continued with its efforts. On May 9, a vote of 7-1 in the Senate overrode the governor’s veto. The bill became law following a 14 – 2 House vote to override the governor’s veto.

Blockchain powers economic shift.

Since it depends on tourism, Tinian is embracing technology to find new ways to make money. With MUSD, users will enjoy safe and decentralized transactions on the eCash blockchain. It helps Tinian strive for an open and straightforward system of finance.

MUSD reserves are kept at safe 1:1 rates of the U.S. dollar. All backing comes from liquid reserves and U.S. Treasury securities. As a result, cryptocurrencies are more transparent, trusted by investors, and meet the standards set by platforms worldwide.

Lawmakers back stablecoin future

Governor Palacios rejected the bill because of questions about law and enforcement. At the same time, legislators considered it a key chance to strengthen economic freedom and make the country a technological leader.

Congressman Patrick San Nicolas supported the bill, saying it helps Guam’s future. Vin Armani of Marianas Rai Corporation stated that investing in MUSD could help Tinian emerge as the top place for blockchain-based administration.

Tinian is boldly entering the next stage of finance. With MUSD, the island is leading the way in developing digital currencies. With full asset backing, legal authority, and a clear strategy, Tinian sets a new standard for U.S. public entities. Since acquiring its national crypto policy, this island nation has shown others how to govern blockchain activity locally.