Ethereum whales are betting hundreds of millions of dollars into the world’s second-largest cryptocurrency despite global tensions that are making other investors more cautious.

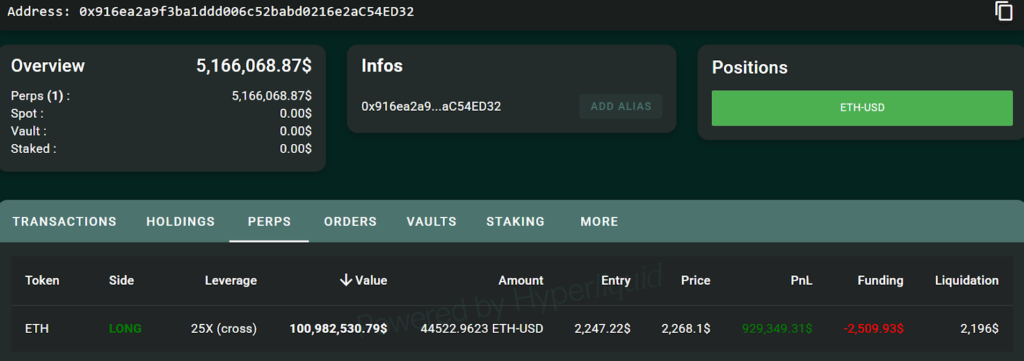

A large crypto investor has opened a $101 million long position on Ether with 25x leverage at an entry price of $2,247, according to blockchain data from Hypurrscan.

The investor made over $900,000 in unrealized profit but spent more than $2.5 million on funding fees. His position will be liquidated if Ether’s price falls below $2,196.

Whales stack $112M Ethereum amid Iran tensions

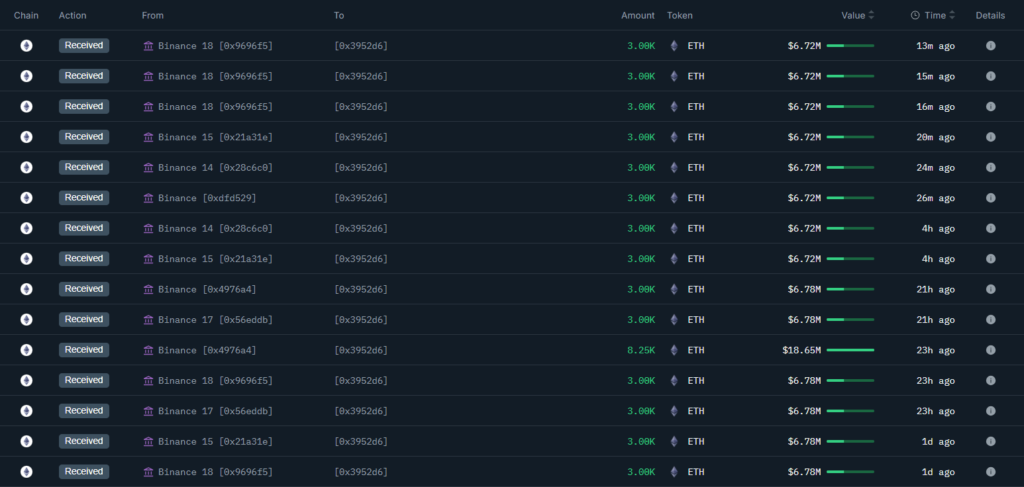

A major investor made a big leveraged bet before the second whale withdrew $40 million worth of ETH from Binance. According to blockchain data provider Onchain Lens, this brought their combined ETH holdings to a massive $112 million.

The activity follows Ethereum fell to a one-month low of $2,113 on Sunday, after U.S. airstrikes targeted Iran’s nuclear sites. President Donald Trump called the strikes a “spectacular military success” and warned of more attacks if Iran doesn’t pursue peace, Reuters reported.

The two countries have been locked in a strategic missile conflict since June. 13, when Israel launched its largest attack on Iran since the Iran-Iraq War of the 1980s. Most Bitcoin and Ethereum traders think prices will likely fall further after the latest rise in conflict.

Ethereum investors in “wait-and-see” mode

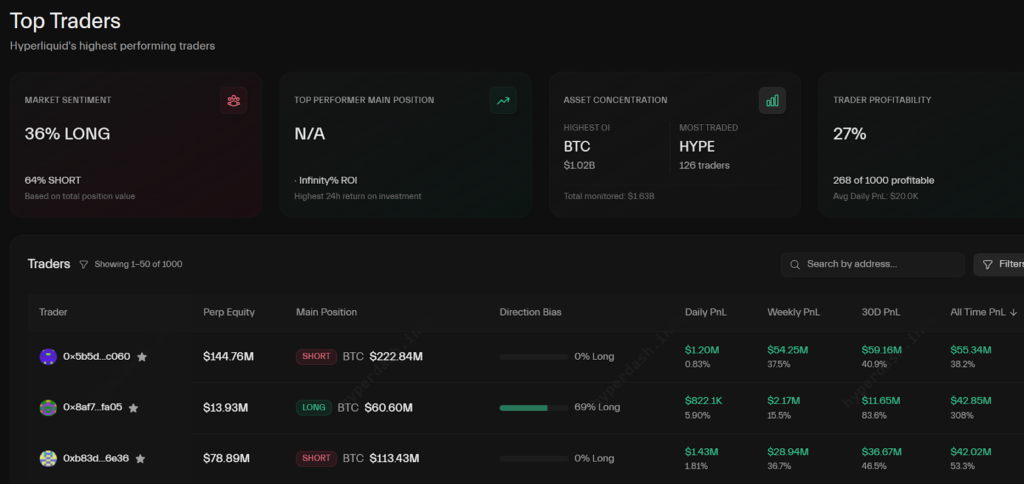

Around 64% of the top-performing crypto traders are currently betting against the two largest cryptocurrencies, while only 36% are betting on their prices to rise, according to leading Hyperliquid traders tracked by HyperDash.

Most Ethereum investors are sidelined due to ongoing global conflicts and economic uncertainty, according to Nansen research analyst Nicolai Sondergaard. Additionally, the analyst said:

These factors, combined with the fact that if we look at options data, the view is still somewhat neutral, we are still in a sort of wait-and-see stage.