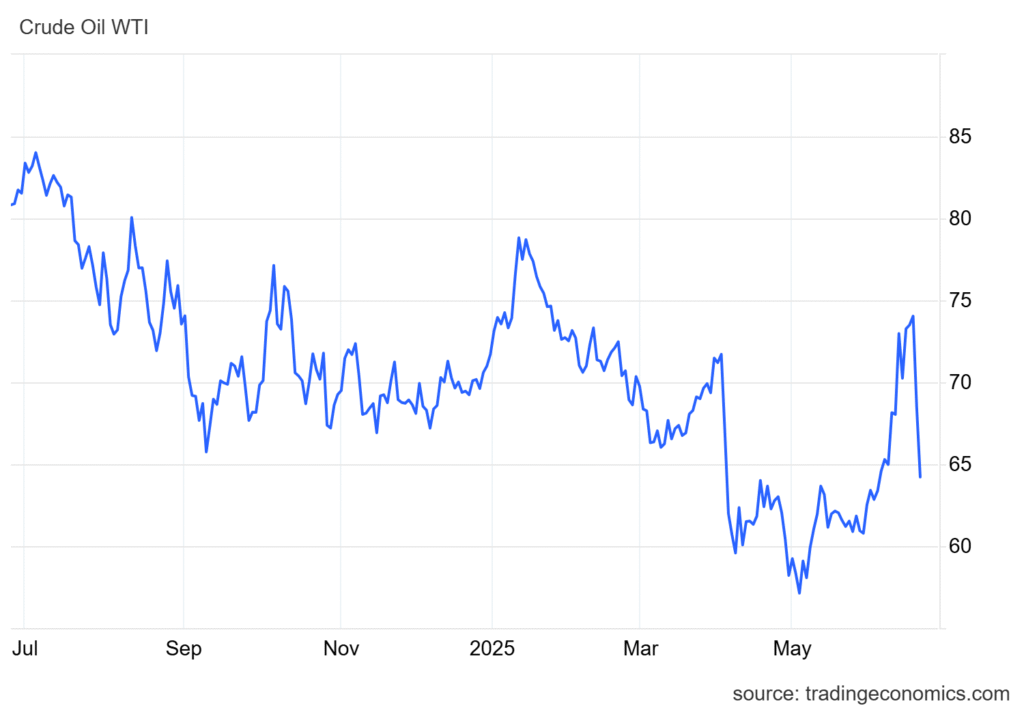

Oil prices dropped further today, falling below levels seen before the recent conflict between Israel and Iran. Earlier fears of a global supply disruption have now faded. The market saw calm after key developments in the region and calls from the United States. At the same time, Bitcoin gained momentum as investors shifted focus toward digital assets amid easing geopolitical risks.

Bitcoin climbed as oil slipped. The digital asset recovered strongly Tuesday morning. The rise followed news that U.S. President Donald Trump allowed China to continue buying oil from Iran. This decision came days after the Islamic Republic clashed with Israel.

Bitcoin grows while Oil worries shrink

Iran, a top global oil producer, pumps nearly 4 million barrels daily. On June 13, Israel attacked Iranian facilities. The strike raised fears of a major supply shock. Then, over the weekend, the U.S. launched heavy strikes on three major Iranian nuclear sites. The Pentagon called it the largest B-2 bomber operation in history.

Iran responded with threats to close the Strait of Hormuz. This narrow waterway handles about 20% of the world’s oil-related shipping. The threat caused a brief spike in crude prices. However, Iran did not act on its warning. Markets took that as a sign of restraint. Supply concerns began to fade.

As oil retreated, Bitcoin moved higher. Investors seemed to shift focus to digital assets amid easing geopolitical tensions. Confidence returned to the market. Today’s development brought further calm. President Trump posted online that China could resume buying oil from Iran.

Bitcoin shows strength as oil prices dip

China is Iran’s biggest oil customer. The green light added downward pressure on crude prices. Markets saw the move as a sign that oil flows would remain stable. Bitcoin crossed the $105,000 mark after the news. The surge reflected investor appetite for alternative assets in a time of political maneuvering.

The oil market reacted quickly to these updates. Prices are now lower than before the Israel-Iran war. Supply appears secure for now, and global fears have eased. Analysts expect price movements to stay closely tied to future diplomatic signals.

Meanwhile, Bitcoin’s climb highlights its role in uncertain markets. As oil loses steam, digital assets are again capturing the attention of traders looking for value beyond traditional commodities. The markets continue to adjust to fast-moving geopolitical changes.