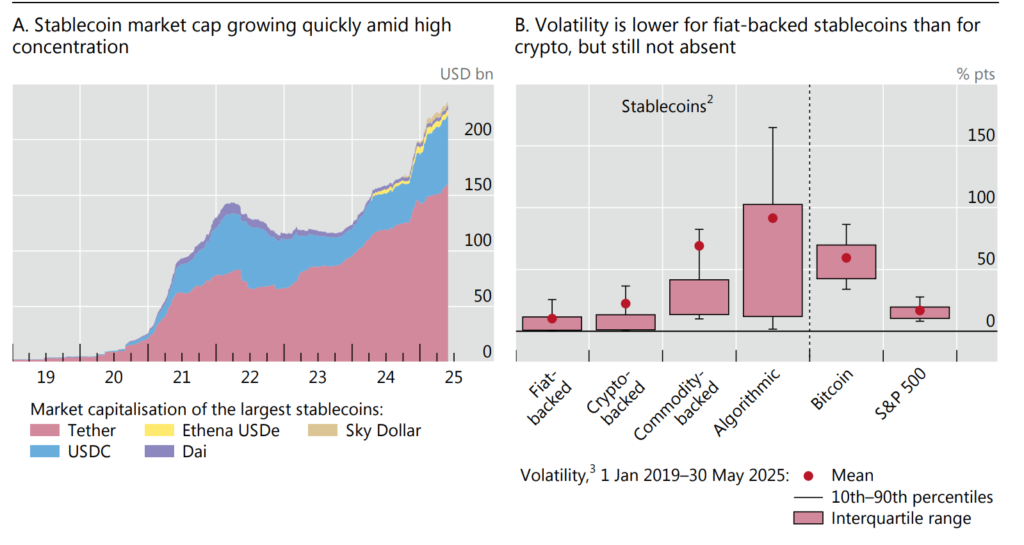

A new report from the Bank for International Settlements (BIS) questions the idea that stablecoins can function as money in today’s financial system.

Stablecoins fail the core standards of “singleness,” “elasticity,” and “integrity,” three essential qualities that define a reliable form of money, according to the BIS Annual Economic Report 2025.

The BIS described stablecoins as “digital bearer instruments” that are more like financial assets than real money. The report stated, “Stablecoins perform poorly when measured against the three key criteria for being a core part of the monetary system.”

Unlike money from central banks, which is accepted at par and requires no background checks, private companies issue stablecoins, and their value can change. This, the report said, challenges the basic idea that all money should be equal.

Stablecoins fail elasticity and integrity tests

The BIS report said that the second test, Elasticity, is essential for handling shocks and fulfilling high-value payment needs.

It noted that creating more stablecoins requires users to pay the full amount upfront, similar to a strict cash-before-delivery system. It is very different from modern banking, where central banks can supply money as needed.

The third and perhaps most serious failure is in integrity. The report said stablecoins, especially when used through unhosted wallets on public blockchains, are vulnerable to financial crime.

“Stablecoins have significant flaws when it comes to supporting a trustworthy financial system,” the BIS said. Moreover, they emphasized their risk of money laundering, evading sanctions, and funding terrorism.

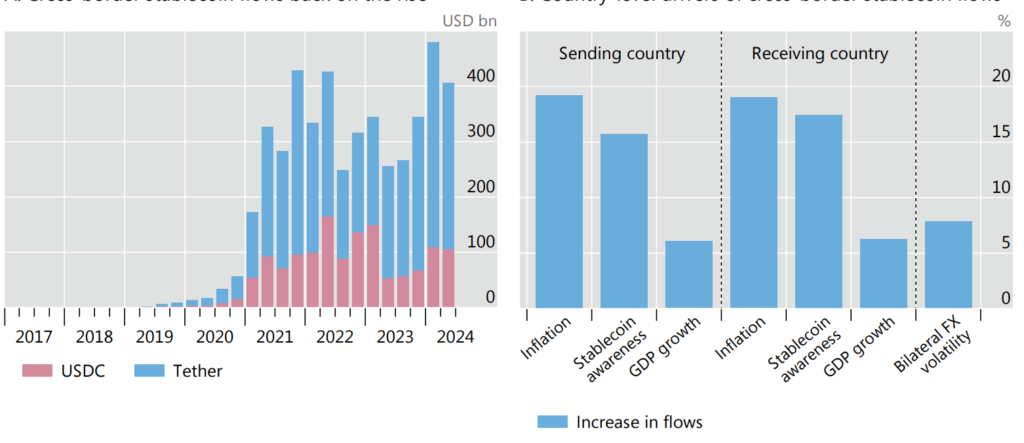

The BIS acknowledged that stablecoins remain popular for things like easier cross-border payments and lower fees. However, they should have a limited and carefully regulated role.