Crypto-linked cards are reshaping how Europeans handle small transactions. A new report from CEX.IO shows that nearly half of crypto card purchases fall under €10, a category long dominated by cash.

With stablecoins like USDT powering most transactions, crypto users are confidently using their digital wallets at supermarkets, restaurants, and transport hubs.

This shift is not limited to one provider. CEX.IO saw a 15% rise in newly issued cards in 2025, hinting at a broader movement toward alternative payments.

The average crypto transaction came in at €23.7, notably lower than the €33.6 average for traditional bank card purchases, according to Mastercard’s Q1 data.

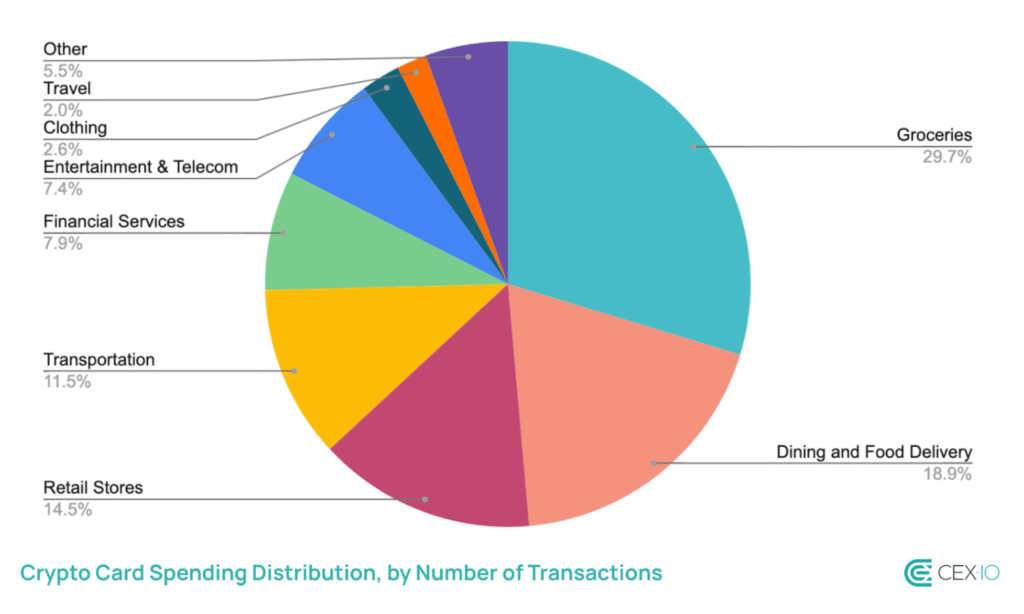

Groceries made up the bulk of crypto card purchases, closely mirroring the European Central Bank’s reported trends. Dining and nightlife came second. Users aren’t just testing these cards, they’re replacing everyday payments with them.

Crypto card transactions lead online spending trends

Crypto card users also lead the way in digital spending. While ECB data shows 21% of card payments across the euro area occur online, CEX.IO users conduct 40% of their purchases digitally. Other platforms confirm this behavior.

Crypto.com reported a 16% jump in card usage, with 52% of spending now online. Amazon topped e-commerce traffic, although its share dipped from 50% to 33%.

Health, education, and fashion spending also saw moderate growth, while communication services declined. Travel-related crypto spending remained dominant in Europe, with Trip.com and Booking.com leading.

Oobit recorded strong usage in Central and Eastern Europe, especially Romania, Poland, and Hungary. These countries introduced favorable crypto tax laws and regulations, spurring widespread adoption. USDT accounted for 92% of transactions on Oobit’s Tap & Pay app, with the average spend at $8.36.

The increasing adoption of crypto in everyday transactions does not resonate with everyone. Last week Barclays confirmed it would stop supporting transactions involving digital currency on its customers’ Barclaycard credit cards.

The move is driven by concerns related to asset volatility and regulatory uncertainty. In addition to purchase protections, the bank is worried that users may incur severe financial losses during abrupt token value crashes.