SEI is currently trading at $1,828.34, and its 24-hour volume has reached $382.33 million. The market cap of the cryptocurrency stands at $1.68 billion and signals strong market interest.

Over the recent 24 hours, SEI’s worth increased by 6.03%, and its return over a week is a stunning 51.74%, displaying good positive strength and growing bullish sentiment among investors.

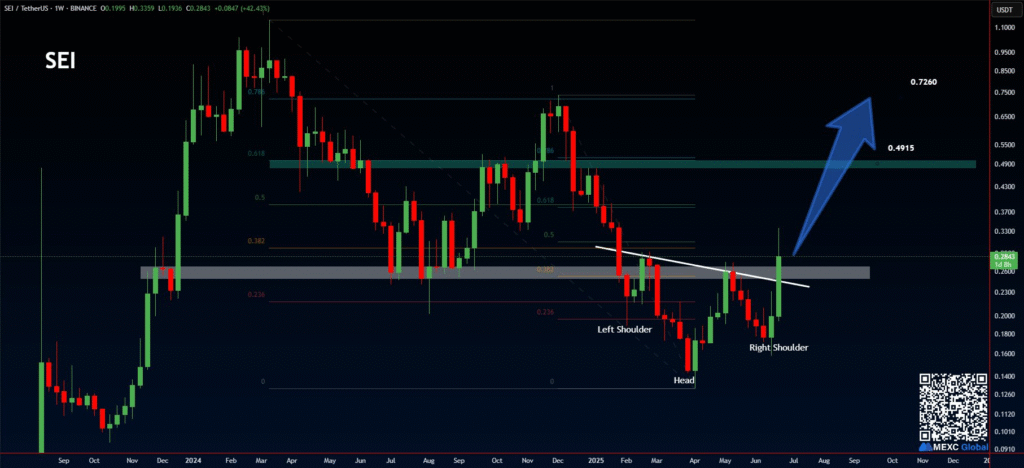

SEI recently broke out from an inverse head and shoulders pattern, a good technical formation that many times signals a breakout from a downtrend back into an uptrend.

The pattern forms through three troughs in the price movement. The left shoulder appears around $0.3 to $0.35, the head near $0.25 to $0.3, and the right shoulder around $0.35.

The neckline, which acts as a resistance level, is approximately at $0.4. SEI’s price crossing above this neckline confirms a breakout and supports the possibility of further price increases.

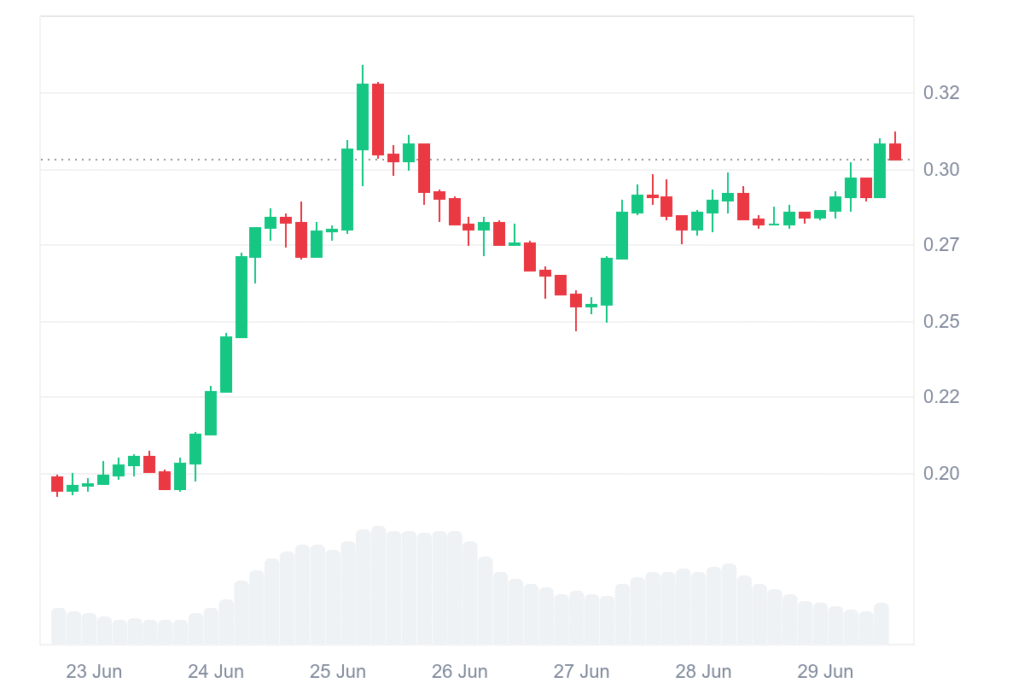

SEI trading volume drops despite price surge

Price targets following this breakout are set at $0.4915 and $0.7260. They are found by adding the vertical depth of the pattern plus the breakout point and making adjustments for today’s market environment.

The previous resistance level at $0.4 is currently a critical support area. Investors monitor this area constantly for potential retests or pullbacks. Support may also form near the right shoulder at $0.35 and the head between $0.25 and $0.3 if the price pulls back.

Despite a 46.40% decrease in 24-hour trading volume, SEI’s weekly price increase of 46.10% outperforms the broader cryptocurrency market, which grew about 6.60% in the same period. Before this breakout, SEI was experiencing a downturn that led to the creation of the inverse head and shoulders pattern.

The current range is between $0.4 and $0.4915. If SEI’s upward momentum persists, there can be a rally towards $0.7260. But traders must keep their guard up and wait for volume validation to prevent false breakouts, particularly because hype surrounding “SEI Summer” provides volatility risk.