Pudgy Penguins (PENGU) continues to surprise traders with its resilience. Despite a neutral broader market environment, the token has managed to climb 3.07% over the past 24 hours.

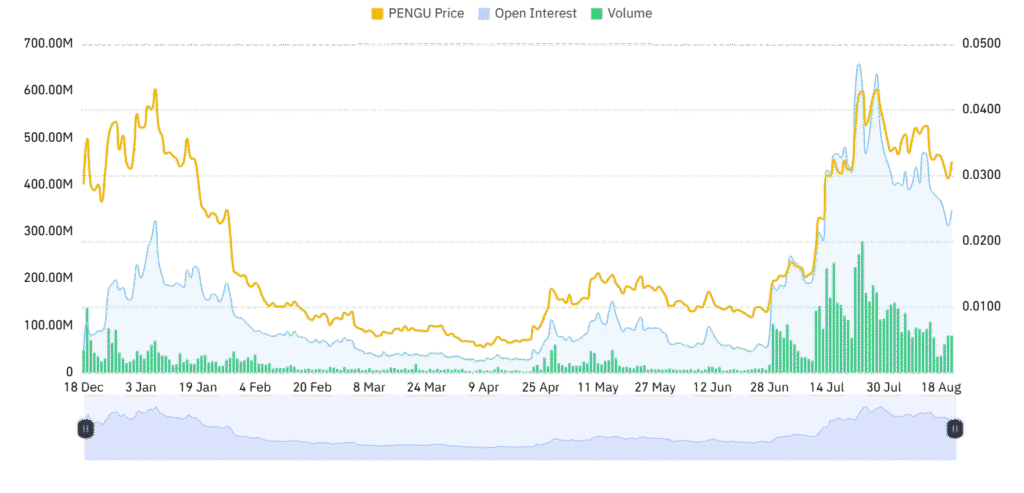

At the time of writing, PENGU trades at $0.03111 with a 24-hour trading volume of $493.95 million, marking a modest 0.21% increase. The token holds a market capitalization of $1.95 billion, reflecting its growing presence among altcoins.

Interestingly, while the daily chart points toward recovery, PENGU remains down 14.14% on the weekly timeframe. This mixed performance illustrates the volatility around the asset, as short bursts of bullish momentum attempt to counter the broader corrective trend. Analysts highlight the potential for a breakout if current patterns sustain, targeting higher levels between $0.055 and $0.069.

Pengu Chart Structure Signals Potential Upside

A closer look at the daily PENGU chart reveals a significant shift in trajectory. From January to April 2025, the asset faced a prolonged downtrend with consistent lower highs and lows. This bearish spell eventually ended in late April, when the descending pattern was broken. The reversal paved the way for a bullish structure to emerge.

Two bull flag formations are now visible on the chart, both characterized by downward-sloping parallel channels. The first flag in July produced a sharp upward rally after a breakout, confirming continuation momentum.

Presently, PENGU is forming a second flag near the $0.026 support. If the structure repeats its previous performance, a breakout above $0.040 could push the price toward the projected $0.055 to $0.069 range.

Yet there are still some risks involved. A failure in the $0.026 support may see the bullish configuration quickly break down, subjecting the token to new downside tension. Traders are monitoring these levels, awaiting the next definitive action.

Derivatives data reflects trader optimism

Derivatives market movement is in support of the technical view. Open interest is higher by 2.60% and stands at $326.53 million. It is a positive indicator that more money is being put in by traders, hopefully anticipating a breakout scenario. The rise in speculative interest coincides with the present consolidation, implying that anticipation for a larger price action has grown.

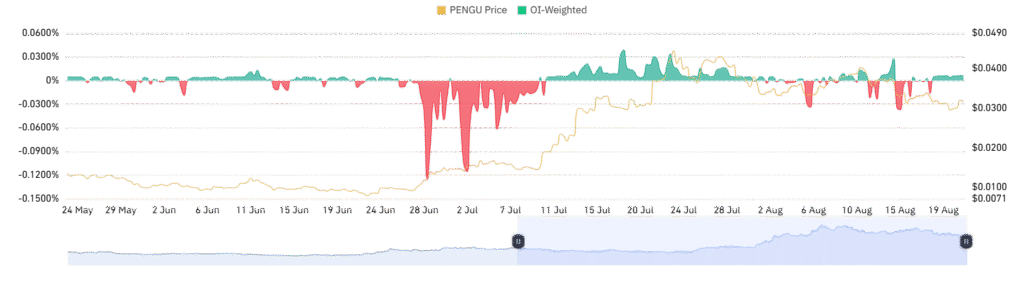

Funding rates also reflect sentiment. The OI-weighted rate is at +0.0059%, revealing neutral to mildly bullish positioning. Traders seem cautiously bullish, not using excessive leverage that tends to cause sharp corrections.

Pudgy Penguins demonstrates signs of strength in spite of weekly losses. The technical patterns, increasing open interest, and neutral sentiment all point towards the $0.055 to $0.069 area remaining within reach in the event the volume accelerates and the flag breakout occurs. Support at $0.026 is still the level that determines whether or not the momentum continues or abates.