Hyperliquid (HYPE) struggled since early July, failing to breach the $50 psychological level. Another mid-August attempt met strong selling pressure. The rejection pushed HYPE lower by nearly 17% for the week.

Despite the recent losses, HYPE surged 4.47% in the last 24 hours, trading at $43.56. This sharp rebound attracted market attention. The sudden recovery suggests renewed investor confidence. Short-term traders are eyeing accumulation opportunities as the token digests its recent downturn.

Currently, HYPE’s market capitalization stands at $14.5 billion. This positions the token among the largest digital assets despite market fluctuations. Its enduring price tags reflect resilience in a volatile market. Investors continue to watch for key levels to determine whether bullish trends might return.

Technical setup shows consolidation zone

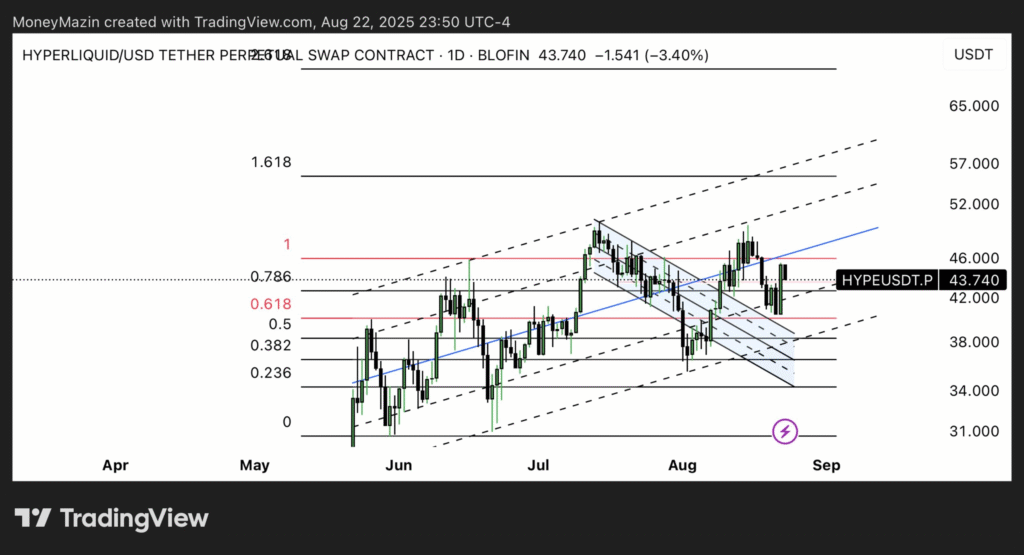

Technical indicators show HYPE trading slightly below EMA5/EMA10 at $44.22 but above EMA120 at $42.78. This structure suggests healthy consolidation. MACD remains slightly negative at 0.248 while RSI levels sit between 46-58. Fibonacci levels indicate accumulation zones near $43.22 and $42.68 for strategic buying.

Critical resistance sits at $46.14. A positive breakout over this threshold with a volume higher than 80M USDT may lead to a price of $52. The risk/reward ratio is on the side of the possible upside. The risk of going down seems to be limited to $41, while the chances of a bullish move are estimated at 60%. Traders interpret this as a move with calculated risk during the consolidation period.

Hyperliquid displays a trend going upward on the higher time frame and a breakout of the lower time frame downtrend. D1 lows and midrange flips give support to the continuation of the bullish trend. If important levels still stand, the token could be heading toward the $50 region in the near future.

Hyperliquid rally potential toward $80 gains attention

According to Analyst Degen Ape Trader post on X, HYPE has been within a 60% range for three months. Retesting $50 is likely to hand over the control to the buyers. A breakout from this consolidation may compel the bears to defend lower levels, thus allowing bulls to gain more strength and continue driving the token upwards.

If the price climbs decisively above $50 we could see a quick move up to $80. A wave of new buying power would be ignited as the negative resistance was eliminated. The swing could gather pace due to market forces and good scenarios in the next few weeks.

On the other hand, the lower trading range has been repeatedly defended, according to watchers. This indicates persistent buyer interest supporting the token. A crossover of $50 by HYPE would likely attract momentum traders, thereby ramping up the bullish trend.