Aerodrome Finance (AERO) is showing resilience despite a mixed market backdrop. The token has seen declines in the short term, with a 1.87% drop over the last 24 hours and a weekly decline of 6.19%. However, its broader chart formation points toward a strengthening trend.

At the time of writing, AERO is trading at $0.01470 with a 24-hour trading volume of $359.28 million, reflecting a sharp 146% increase. Its market capitalization stands at $1.18 billion, giving it a notable position in the digital asset market.

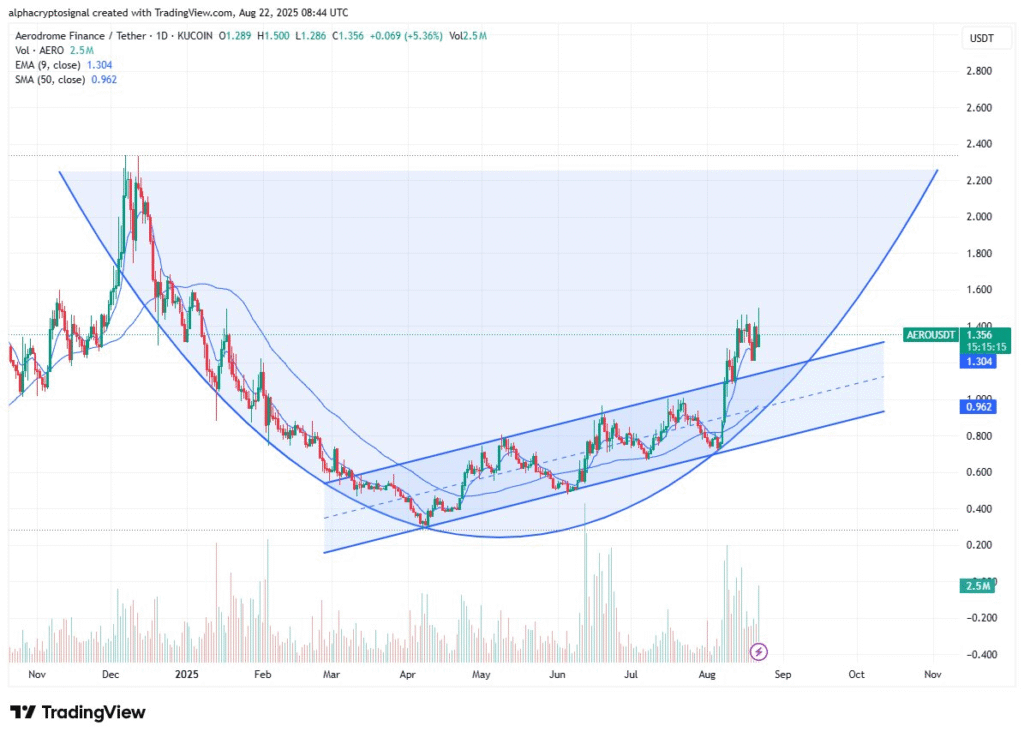

Technical indicators are aligning in favor of continued growth. The token has formed a clean rounding bottom on the daily chart, supported by heavy buying volume. A breakout from the ascending channel further reinforces this shift, while price consolidation above the 9-day EMA at $1.30 highlights stable support. The 50-day SMA, trending upward at $0.96, underlines a supportive structure for near-term momentum.

AERO chart patterns signal strong bullish momentum

The AERO chart reflects a recovery from earlier lows of 2025, forming a cup-shaped reversal pattern and pushing steadily within a rising channel. The breakout above this structure confirms the ongoing bullish shift, aided by price action remaining above both the EMA and SMA.

Resistance of $1.30 and $0.96 acts as a buffer from potential pullbacks, and the first key resistance of $1.50 may test bullish sentiment. A breach of this psychological barrier by high volumes may push the rally further towards mid-term targets of $1.80 and $2.00. These are in line with the previous trading areas and imply significant upside potential.

The parabolic curve on the chart implies the price action might extend further, and the key bullish target of $2.40 comes into view. That equates to an upside of over 80% from the present levels.

Volume also supports the bull case by showing increased action during the ascents and minor corrections, which are signs of healthy accumulation, a phenomenon typically behind long-term growth phases. For as long as AERO keeps its support base above $1.30, the momentum will likely remain intact.

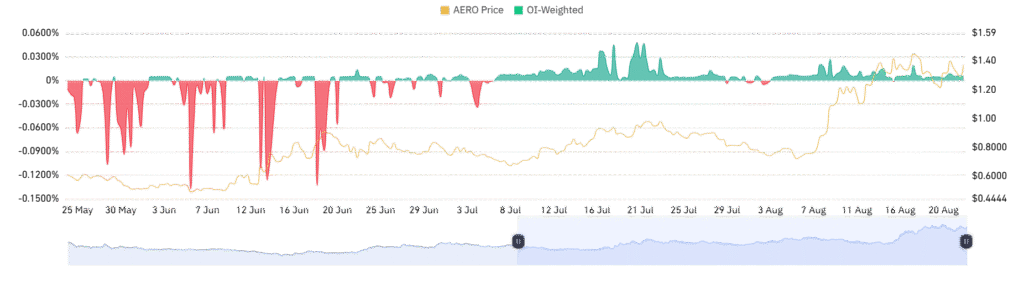

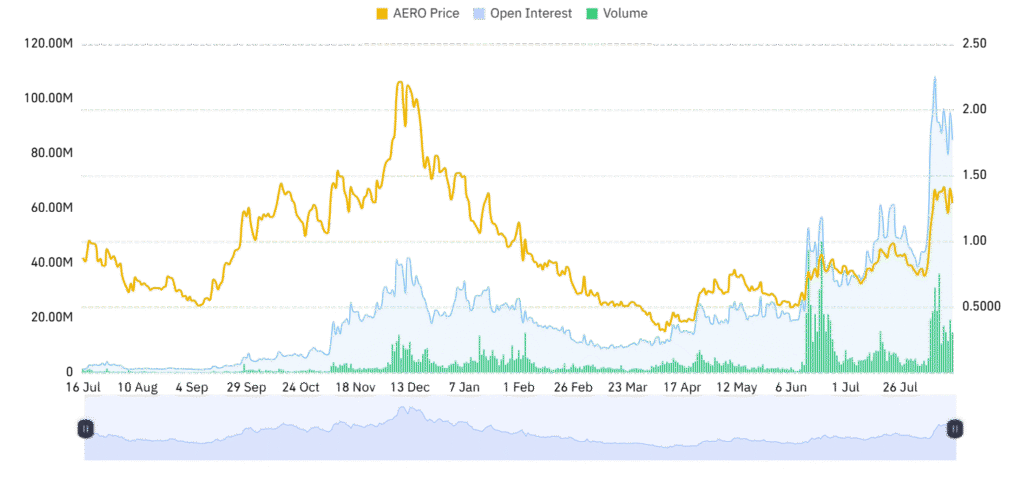

Open interest reflects market confidence

Recent action indicates that the traders are forming positions with increased confidence. AERO has evidenced a strong bounce from its bear trend, underpinned by increased trading action and better price action. The open interest stands at $88.51 million, a small drop of just 0.57%, but high enough to suggest active involvement.

The OI-weighted figure of 0.0052% signals balanced positioning,which is a switch from previous periods of liquidations and bearish sentiment. The fact indicates support of long exposure, which strengthens the bullish contention. Provided participation continues steady, AERO stands strongly poised to continue its momentum into increased price areas.