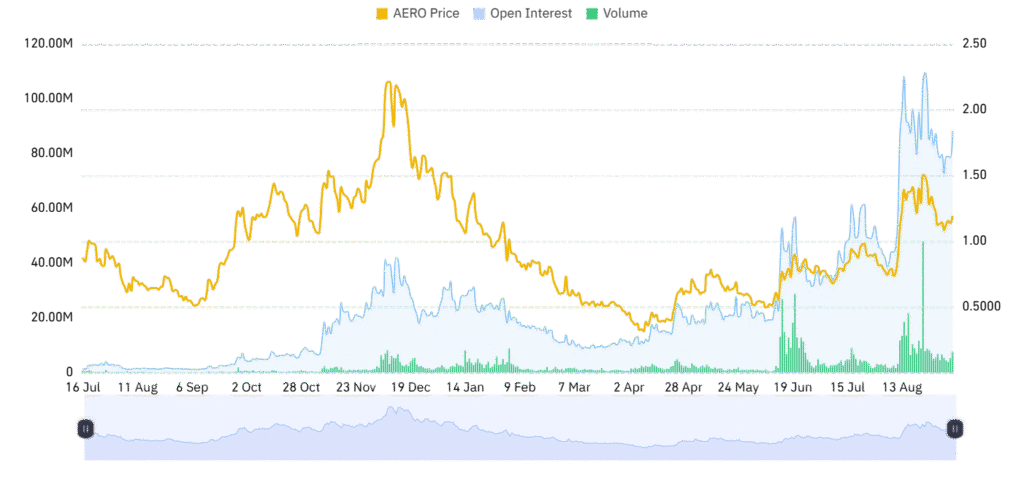

Aerodrome Finance (AERO), the native token of Hyperliquid, continues to face selling pressure. The token is down by almost 2.5% in the last 24 hours, though it still holds a weekly gain of 2.38%. At press time, AERO trades at $1.16 with a market capitalization of $1.03 billion. Trading activity has slightly improved, with 24-hour volume climbing 2.56% to $72.97 million.

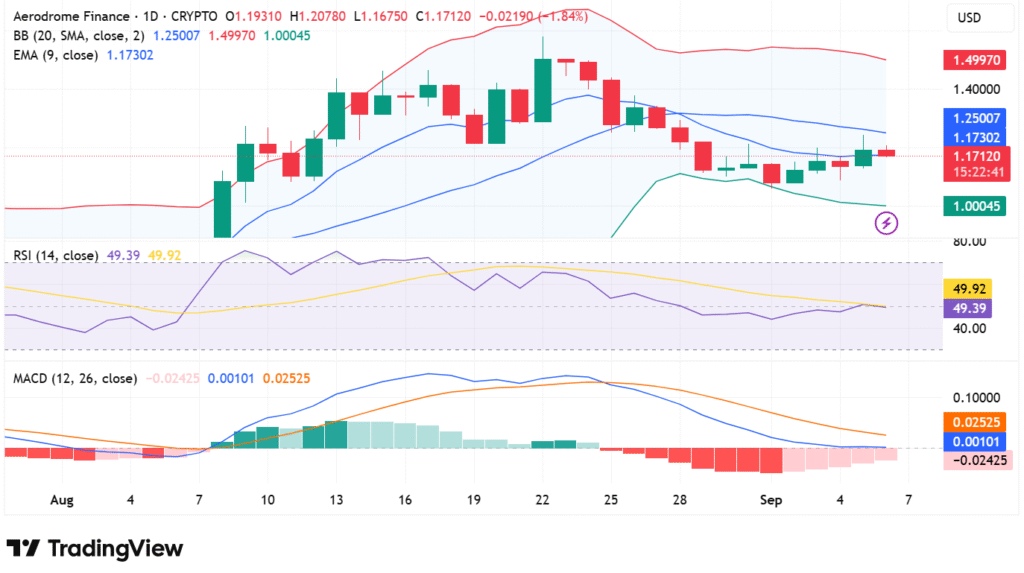

AERO remains below its 9-day EMA at $1.17, showing weakness in reclaiming short-term momentum. Bollinger Bands highlight resistance around $1.25 and support near $1.00. Price action is trapped in this range, with little sign of a breakout. Unless the token clears its EMA and moves toward the 20-day SMA, recovery will likely be limited.

AERO technical indicators signal consolidation

The Relative Strength Index (RSI) stands at 49.39, hovering close to neutral. The reading suggests neither strong buying nor selling dominance but hints at slight bearishness. RSI flattening points to sideways movement, with traders waiting for fresh momentum.

The MACD chart indicates a cautious stance. The line stands at 0.00101 and the Keltner’s signal line at 0.02525, holding the histogram bearish at -0.02425. Contracting red bars mean bearish momentum fading. A bullish crossover is feasible if MACD closes the gap with the signal line and head back to $1.25. A clean break down of $1.00, on the other hand, would elicit more significant selling.

Market activity reflects caution

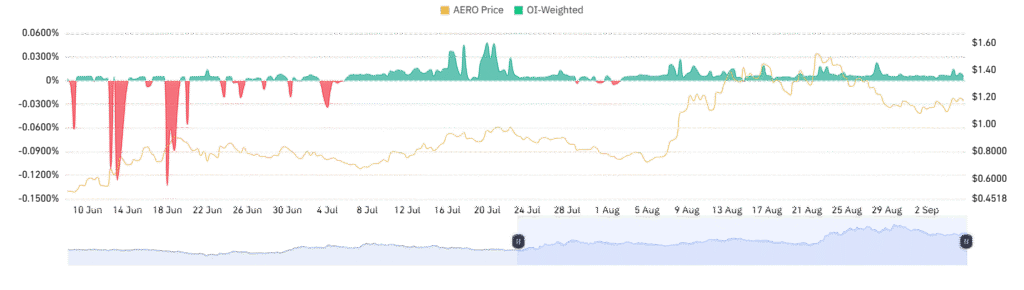

Except for spot trading, the decline in confidence is evident from the derivatives. The Open Interest decreased by -3.72% to $82.47 million. The decline indicates that leveraged positions have been shed by traders following recent volatility. The decline reflects defensive stance as participants trim risk exposure.

The OI-weighted funding rate is at 0.0045%. Longs are paying shorts, showing weak bullish bias. The fact that such a rate is unchanged suggests well-balanced position taking, not over-speculation. Both of these indications confirm the fact that AERO is consolidding, and its next move relies on bulls picking up steam above $1.17.