Avalanche (AVAX) continues to collect market interest as it is still in a positive direction, despite larger crypto market declines. The token recorded a slight 4% drop in the last 24 hours but pulled off a conclusive 15.63% price gain in a week.

Currently, AVAX is trading at $14.70 with a 24-hour volume of $538.29 million and a total market capitalization of $8.77 billion. Even as volume fell 11.36%, the price structure shows firm buying interest and repeated efforts at defending primary support levels.

The seven-day candlestick chart displays a bullish pattern that began with a breakout above $18 and progressed further past $20. That move was supported with high buying volume along with a series of green candles indicative of active market participant involvement.

At midweek, the price consolidated between $20.80 and $21.60, indicating that bulls may be taking a break to reassess directionality after the abrupt surge. This month had mixed feelings with red and green candles, but did not affect the overall bullish direction of trends.

At the end of the week, AVAX attempted one more push but encountered resistance below $22 and corrected slightly lower. There were some red candles subsequently as the price retraced below $21, with trading volumes starting a slow downtrend. Despite this retracement, AVAX held above $20.50, and this is a focal point now to monitor extremely closely.

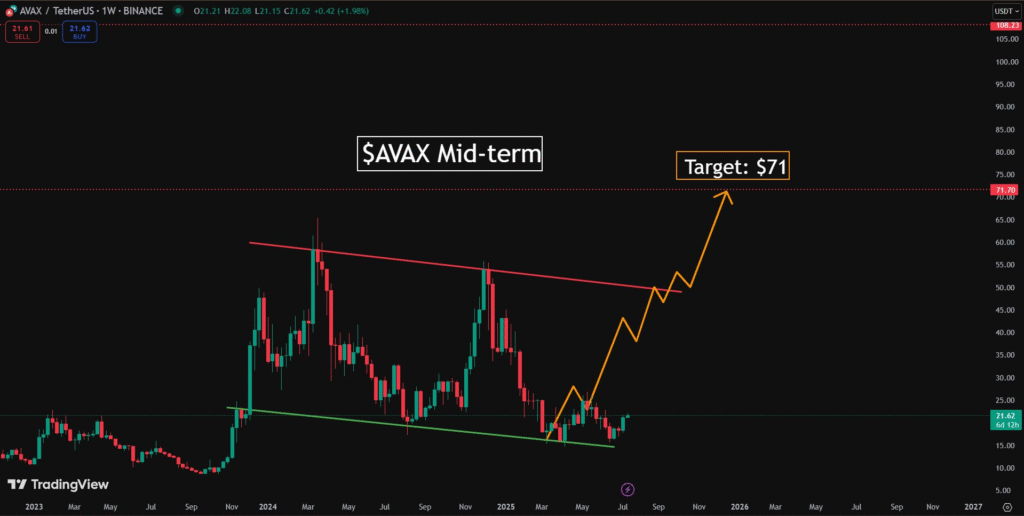

AVAX technical pattern signals $69 first target

Solberg Invest, a crypto expert, spotted a double bottom near $20.69, showing a strong chance of the price going up. The chart shows a green line for the current price rise and a red line for old resistance levels.

AVAX recently moved above the red line, showing a possible trend change and stronger belief in a longer upward move. Solberg set the first target at $69, which means a 243% increase from the current AVAX price level.

The second target is $108, offering a possible 422% rise if the price keeps gaining with market and project growth. Back in May 2025, analysts predicted a $71 target based on a cup and handle pattern in AVAX’s price chart.

Avalanche’s fast DAG-based system may help long-term growth, but buyers should watch support zones and use stop-losses carefully.