Avalanche (AVAX) has broken the downward momentum and is eyeing a surge in its value, in line with the entire crypto market. The overall market is turning from bearish to bullish as major crypto coins have started upward momentum. If a successful breakout occurs, then it will lead to a maximum breakout zone around $55.

Currently, AVAX is trading at $23.96 with a 24-hour trading volume of $263.5 million and a market capitalization of $10.12 billion. The AVAX price over the last 24 hours is up by 1.28%, but over the last week it is slightly down by 8.82%.

Grayscale moves to launch spot Avalanche ETF

A prominent crypto analyst, Ash Crypto, highlighted that Grayscale Investments filed an S-1 with the SEC for a spot Avalanche (AVAX) ETF, seeking to offer regulated Wall Street access to the layer-1 blockchain.

If the fund goes through approval, investors will gain access to AVAX without holding the tokens themselves, another vote of confidence in Avalanche’s place alongside Bitcoin and Ethereum in the institutional market.

The timing is key, as the crypto market is in Q4, seasonally correlated with altcoin seasons. Possessing a rapid, horizontal-scaling network available and a growing DeFi environment on top, Avalanche is in prime position to benefit from new institutional flows that can catalyze the broader altseason and open the gates to other large-cap altcoins.

Avalanche gains momentum and eyes $55

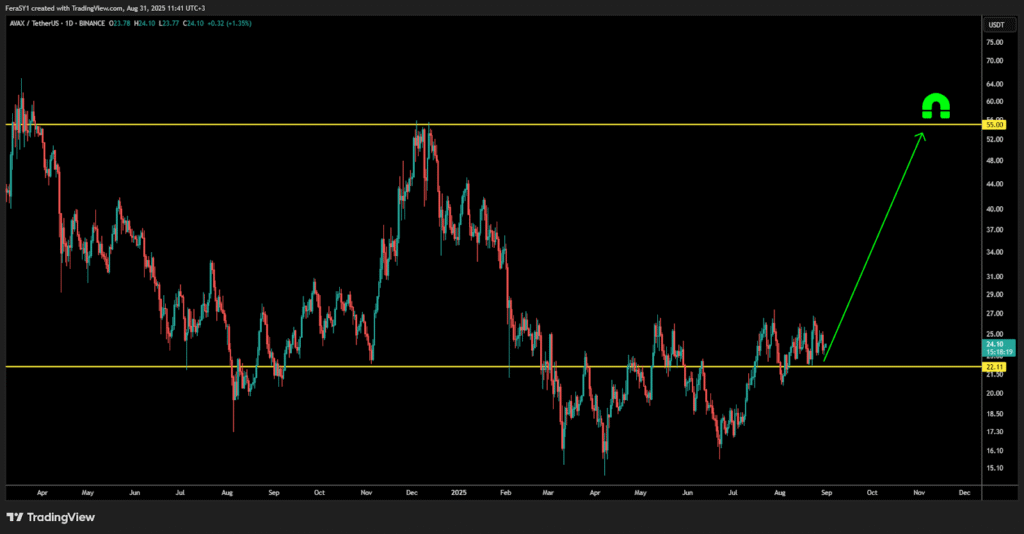

According to the crypto analyst, Avalanche (AVAX) has successfully reclaimed the crucial $22 support level, in the process noting a big change in market sentiment. After breaking above the significant barrier, the token is now consolidating just above the area, something that is viewed as a good sign towards resilience. As long as AVAX is able to stay above $22, the pattern suggests that bulls remain in control and the asset is priming for the next phase upwards.

On the higher time frames, the technical stance is towards the $55 objective, which is good for more than a 100% return from here. This setup arises as the broader crypto market continues to rebound back into Q4, a time frame commonly related to altcoin seasons. Along with Avalanche’s expanding DeFi platform and institutional interest, the potential is laid for a potential breakout, with $27 as the next near-term resistance ahead of larger moves.