Market veterans are warning of choppy waters ahead for Bitcoin as the cryptocurrency treads its traditional end-of-year trading pattern. Top analyst Emperor points to striking similarities with last year’s movements, highlighting the October-November pump followed by December volatility.

“We’re seeing history repeat itself,” Emperor notes, predicting a temporary bounce from the daily 55EMA before more range-bound trading. The analyst maintains bullish long-term conviction, targeting a potential bottom near $85,000 in early January before a fresh push to new all-time highs.

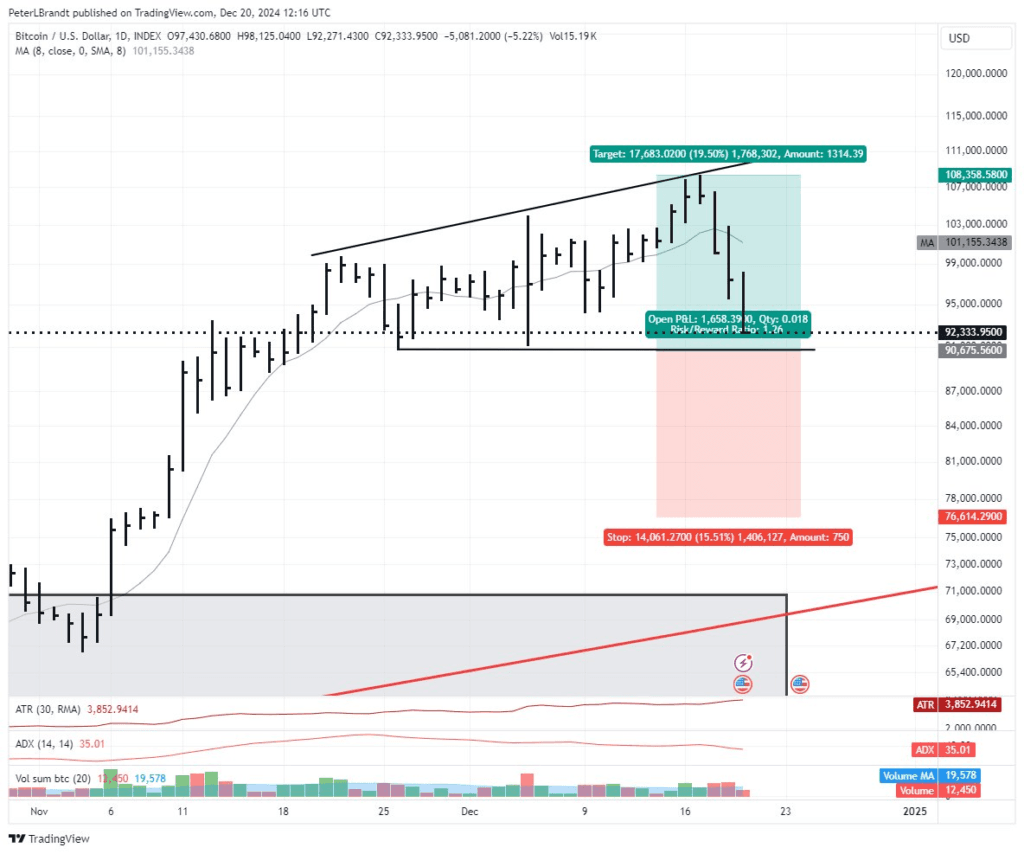

Storm clouds are, however, now gathering on the technical horizon. According to analyst Ali, a veteran trader, Tone Vays warns that if Bitcoin trades below $95,000, it will eventually fall back to $73,000. Chart expert Peter Brandt sees a menacing “broadening triangle” formation, pointing to the $70,000 price level.

They are not the only bears in the den. Market insight provider Fundstrat also keeps its target of an optimistic $250,000 for 2025, but its technical analyst Mark Newton sees a first pit stop at $60,000. Into Crypto Verse draws parallels with the QQQ index for a probable sharp correction that could see Trump’s potential inauguration timing.

On-chain metrics flash warning signs for Bitcoin price

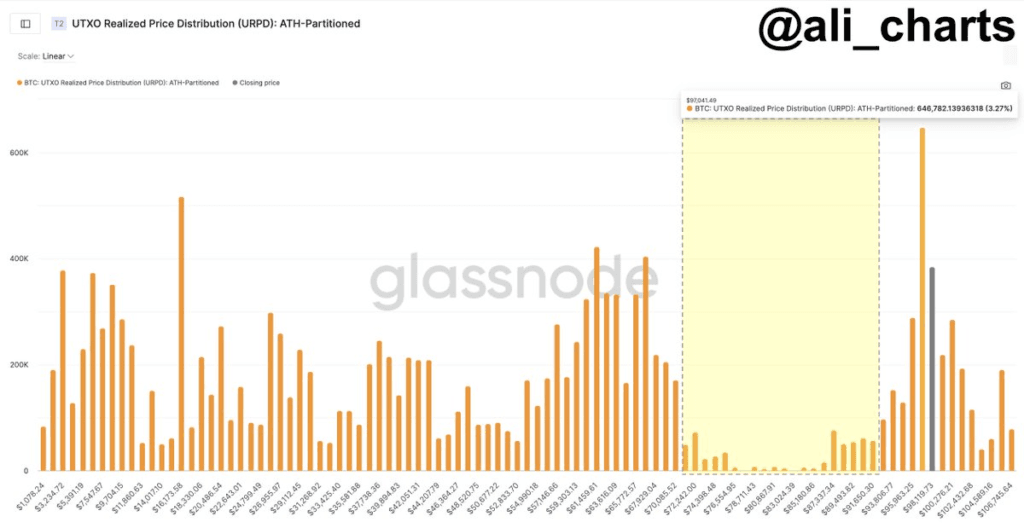

A cautious picture is painted by on-chain data. There is little support for Bitcoin between $93,806 and $70,085, which could lead to a freefall. With investors sending 33000 Bitcoin worth $3.23 billion to exchanges this week alone, it appears that smart money is sensing trouble.

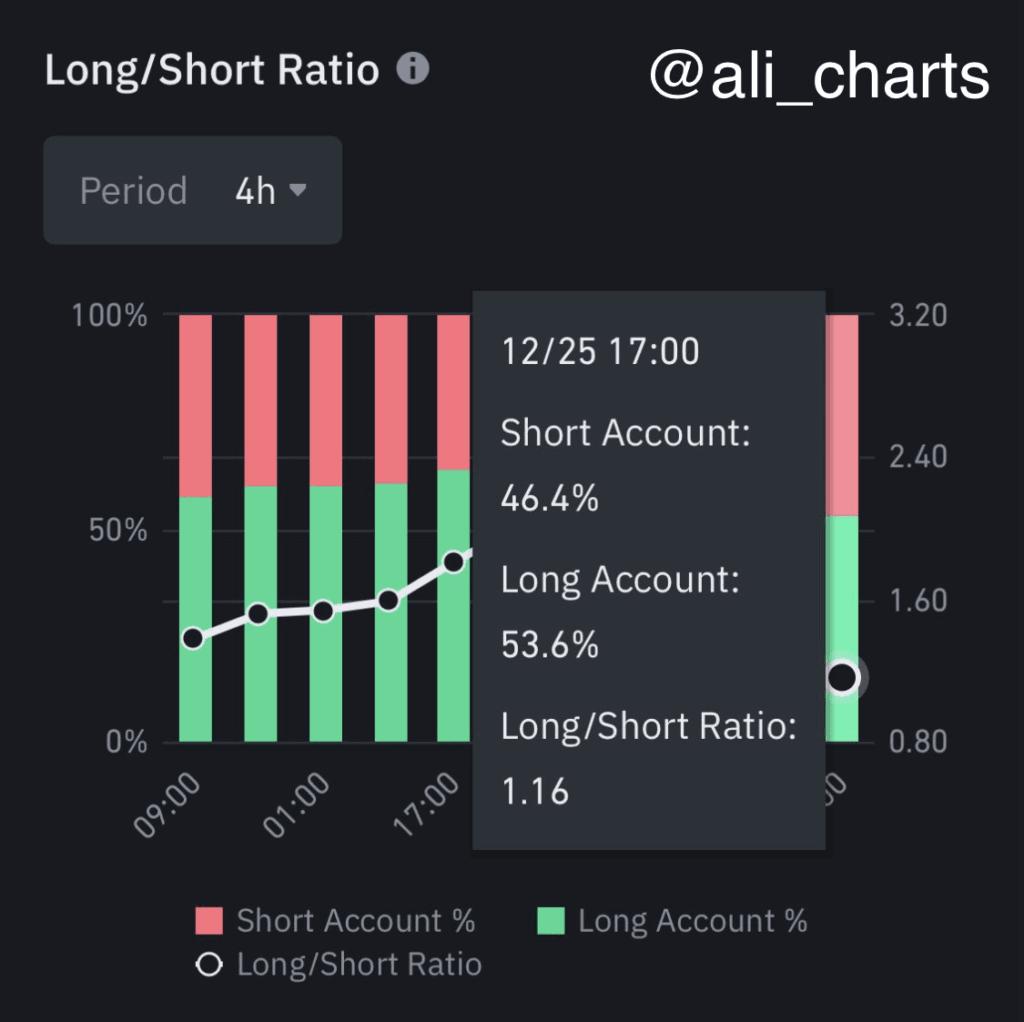

Traders locked in $7. 17 billion in gains on Dec. 23 as profit-taking reached a fever pitch. With long positions falling from 66.73% to 53.60% Binance sentiment changed to one of pessimism.

Nevertheless, the critical battlefield is set at $97,300, which was recently breached to the downside. Bulls need to recapture this level and push above $100,000 to revive hopes of reaching $168,500. Till then, market participants will have to brace for turbulence as 2023 draws to a close.