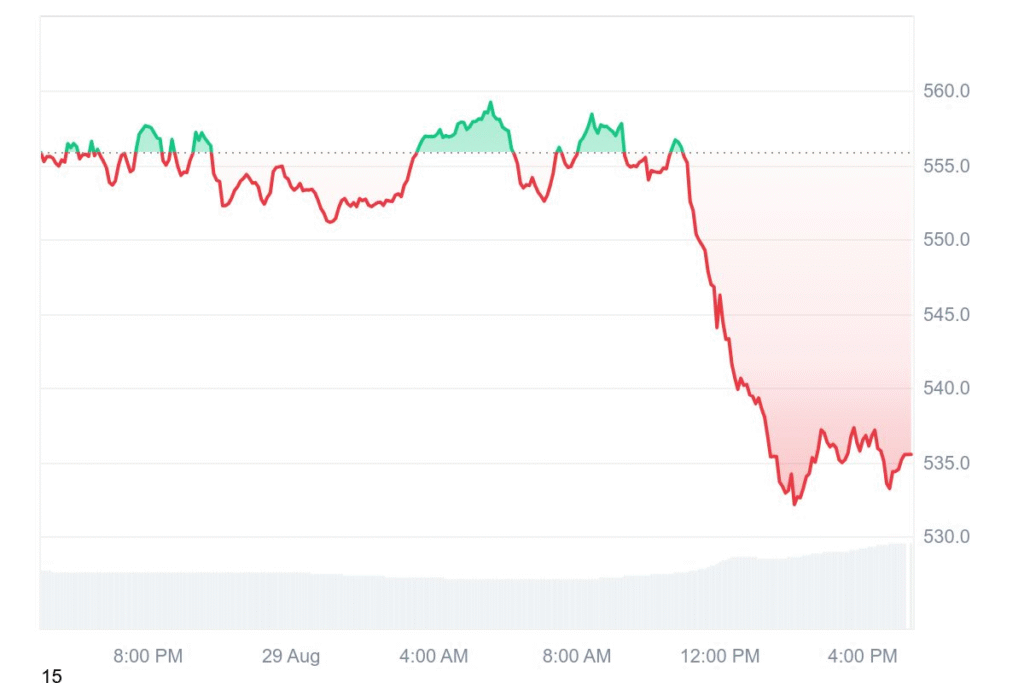

Bitcoin Cash (BCH) is currently at $535.32, down by 3.63% in the last 24 hours. Trading escalated to $477.64 million with a growth of 49.4% from yesterday. The last week registered a small gain where BCH had risen from $535.34, up by 3.37%. Investors appear cautious with momentum oscillating in the wake of the latest surges.

Analysts refer to a bearish breakout in a rising wedge formation. The support level of $550 failed to hold, indicating potential short-term weakness. BCH may test the $500 level in the event of continued downward pressure. Traders are cautioned to monitor technical levels prior to entering positions.

Short-term trend remains bearish

CoinCodeCap Trading advises that the breakdown spells further downside risk. The upward wedge is a classic bear reversal pattern. The near-term momentum is bearish since there was a MACD crossover approximately 28 days ago. This RSI also remains in neutral position, a sign of indecisiveness in buying pressure.

Support regions lie between $500 and $390. Resistance levels are at $625 and $700. Medium-term trends remain positive, and long-term trends also suggest high bullish potential. Investors may wait for relatively safe points of entry closer to $500.

BCH price predictions for 2025

DigitalCoinPrice predicts BCH touching $1,177.55 in December 2025. Analysts feel that there lies a potential for BCH touching its all-time historic high of $4,355.62 and stabilizing at levels of $1,125–$1,177. Investors are optimistic even in the face of short-term correctives.

Changelly’s outlook is in accordance with careful optimism. The lowest trade price of BCH would be around $475.41, and the maximum would be around $556.91. The average trade rate could move around $638.40, and August 2025 would have slight deviations. Analysts consider that BCH would reach its maximum at $559.17 and a possible ROI of 0.70%, describing steady yet sluggish growth.