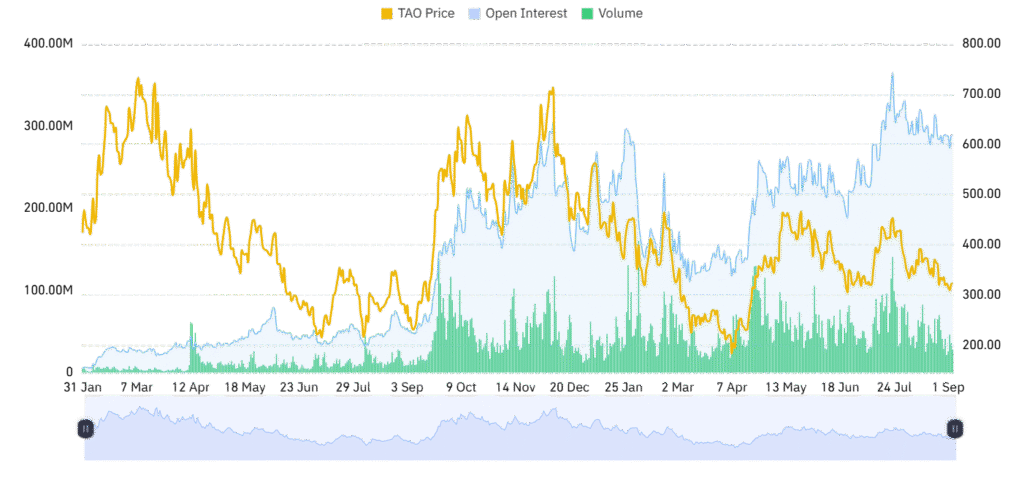

Bittensor (TAO) has not managed to gain ground since it mirrors the overall market’s negative mood. In the last 24 hours, the token fell by 1.37%, continuing the week-long decline of 5.59%.

Presently, TAO is changing hands at $317.97 on a volume of $89.04 million, which has declined 3.92% on the day. Its market cap is $3.11 billion, which means liquidity and investor interest persist despite the decline.

The current sentiment of the market is one of indecision, with investors balancing sentiment globally against the technical indications of TAO. The prices are rangebound around wedge resistance, and the investors remain vigilant awaiting the breakdown or the breakout.

TAO falling wedge signals possible breakout

Technical indicators on the TAO 4-hour chart show the formation of a declining wedge formation. The indicator tends to show fading bearish momentum and a probable bullish reversal. TAO is also trading just below the $330–$335 resistance area, which is the key breakout level. A clean close above the zone, along with high volume, could be the basis of a rapid surge.

Targets range as high as $340–$345 on the opening, more on the upside at $370–$380. The very bullish estimates target $445–$460, which will be nearly a 35% jump above the breakdown point. Traders do have some reservations, however, since the consolidation still allows room for the volatility. A breakdown of the current support of $310–$312 might lead to the test of the $300 psychological level, which will do much to dampen the bullish cause.

Sentiment and participation market trends

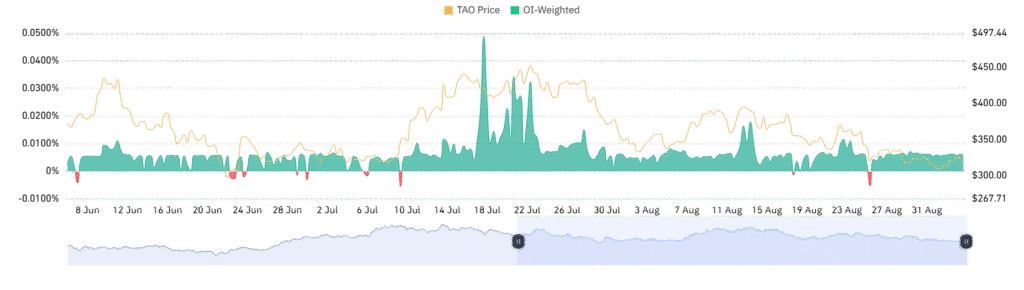

Aside from price action, indicators of the market reflect mixed steady interest. Open Interest also fell by 3.46 last week to $278.37 million, showing some traders reducing exposure. Though the level fell, it is still healthy and reflects continued interest in the market of TAO. Spurts of buying and selling volume continue and follow price movements, which show speculations surrounding high volatilities.

Conversely, the OI-weighted funding rate is neutral at 0.0057%. This small positive bias suggests that longs are still predominant over shorts, though not on extreme levels. Neutral phases on the long term have typically been resetting periods that reduce risk of sudden liquidation waves. With evenly balanced positioning, the stage is set for a decisive move.