Celestia (TIA) continues to trade on a positive trajectory, showing resilience despite broader market hesitation. Over the last 24 hours, the token advanced by 2.93%, while the past week recorded a modest 1.47% gain.

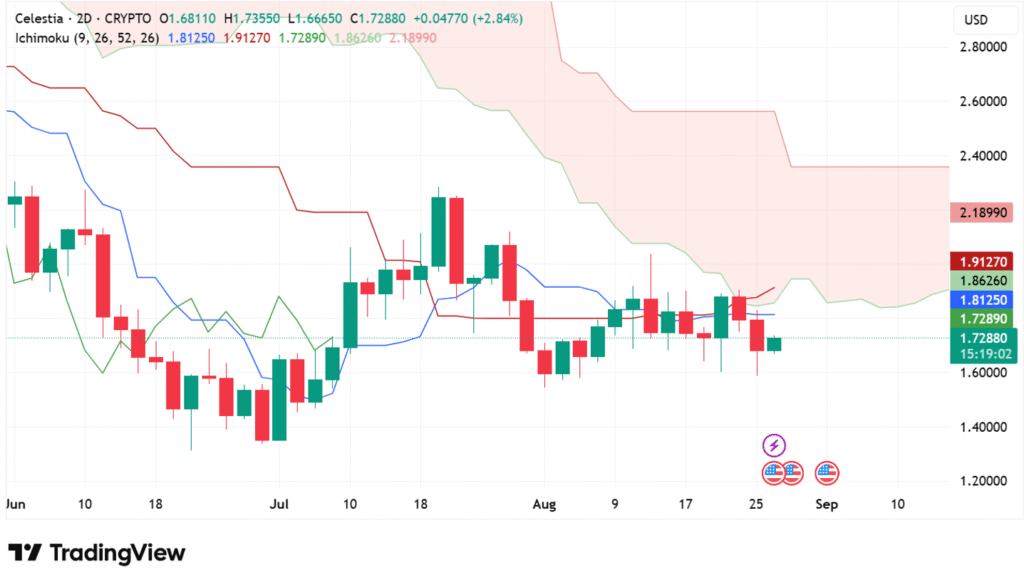

At press time, TIA is trading at $1.73, aligning closely with the Tenkan-sen level of $1.7289. Trading volume over the same period reached $100.3 million, reflecting a 2.75% decline, and the project maintains a market capitalization of $1.31 billion.

This performance indicates that while buyers remain active, momentum has cooled slightly as traders wait for a stronger breakout. Market participants appear cautious, balancing optimism with the technical reality of tough resistance ahead.

Bullish TIA breakout needs $1.86 close

Repeated attempts to climb higher have stalled near the $1.81–$1.86 range. This resistance zone has blocked upward momentum multiple times in recent sessions, leaving the token locked in sideways consolidation. The Kijun-sen at $1.8125 now stands as the immediate hurdle for bulls.

Above this, the Ichimoku cloud presents an even larger obstacle. The lower span rests at $1.8626, while the upper span extends to $2.1899. With the cloud’s future projection turning red, the technical picture shows continued dominance by sellers, suggesting rallies may face heavy selling pressure before clearing these barriers.

Support remains level at around $1.66 on the bear side, tested repeatedly without a breakout. Should this range soften, a next psychological floor is at $1.60, a level which could define the line between consolidation versus bear continuation. A clean breakout on the bottom risks unveiling even further losses, a signal sellers may take full control once again.

For sentiment to come firmly bullish, initially a close above $1.81 should take place, followed by a breakout above the $1.86–$1.91 resistance area. Failure here would most likely initiate a breakout towards the $2.18 level, which corresponds with a high at a peak at Ichimoku cloud ceiling. Until such a breakout happens, technical sentiment remains cautious and leaning towards sideways movement.

Derivatives data shows neutral bias

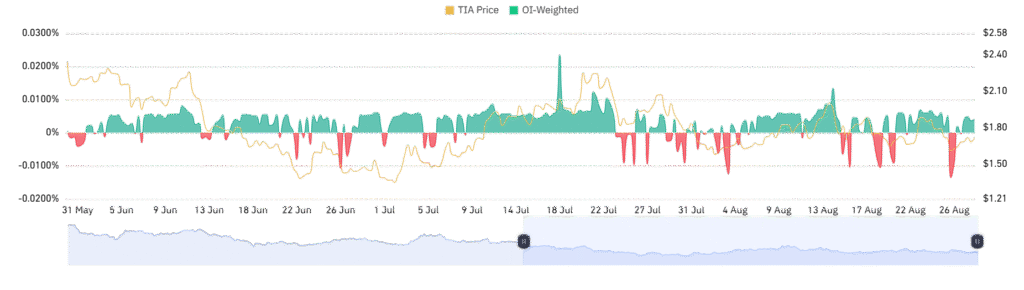

Derivatives segment shows a neutral undertone. Open interest is at $184.35 million which is a 0.79% decline indicative of lower positioning accompanied with some profit taking. Participation is still high which is an indication that participants are still active though in subdued belief.

Meanwhile, the OI-weighted funding rate is at +0.0040%, reflecting subdued bullish bias but no aggressive directional bets. Such a equilibrium means the marketplace is waiting for a trigger. Such set-ups are known to precede swift moves once sentiment irrevocably takes a direction, predicting the next breakout may arrive sooner once resistance or support levels are breached.