Chainlink (LINK) is on a positive price trajectory and experiencing a surge in its value despite the neutral market conditions. Over the last 24 hours, LINK is up by almost 1.98% and most interestingly, looking at the last week, LINK is down 13.82%.

At the time of writing, LINK is trading at $16.15 with a 24-hour trading volume of $422.22 million, which is down by 35.9% in the last 24 hours, with a market cap of $10.95B.

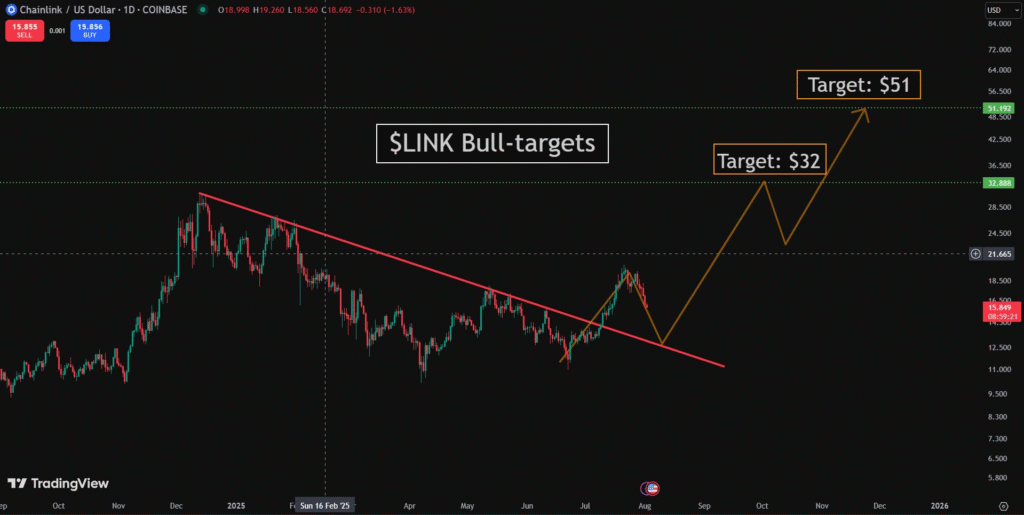

LINK has surged out of a long-term declining trendline interpreted by most traders as a reversal sign on the daily time frame. This breakout, as can be seen on Coinbase data, is indicative of the conclusion of the long-standing downtrend, which has plagued the token for months.

Key Levels Could Shape LINK’s Next Rally

Price action at $15.85 indicates a soft pullback after the breakout, typically viewed as healthy in the context of an upward-moving market. Technicians are looking at two crucial resistance levels.

The first comes at $32, which has been the magnet for intense selling and has caused consolidation in the past. Breaking this barrier with persuasive momentum can bring the roadmap for more aggressive movements into clearer focus.

The second bullish target is $51, which is a long-term breakout level, provided it holds at this stage. LINK will require increased volume and general market support for this to materialize.

The short-term action implies the creation of a higher-low pattern, one typically associated with further bullish action. In combination with the breakout and the developing series of higher highs, the setup is bullish, although sentiment for the entire crypto universe is to remain one of the most crucial drivers.

While optimism is building, seasoned traders warn that sudden reversals are commonplace in volatile markets. Selective position sizing along with disciplined risk controls continue to hold the keys for those betting on another rally.