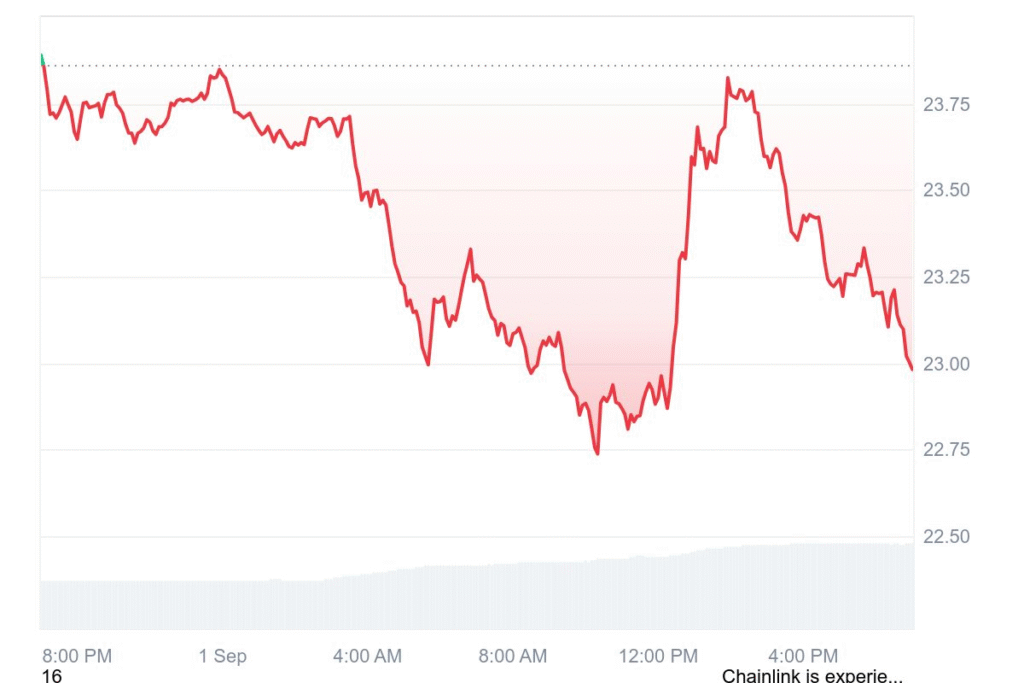

Chainlink (LINK) is currently trading at $22.97 and has seen a fall of 3.82% in value. Traders were highly active with the volume within 24 hours reaching $1.24 billion. That is up 77.98% from the previous day. Weekly, the trend has LINK at $22.98 and is 5.98% lower than what was seen last week.

Market analysts registered high volatility where traders ponder possible gains. Analysts emphasize that LINK is always under great vigilance of retail and institutional traders. Current drop has raised interest whether it is a low-cost entry period or downward dips.

On-Chain Government economic data released

Crypto analyst Tall Man Crypto suggests that LINK is currently cruising at $23.17. He points at signs of a probable breakout. It is now on-chain live with the government economic data and has the technicals pointing towards $26.60. Institutional interest is further rising and propelling the market narrative.

Traders are placed on notice by Tall Man Crypto to expect likely appreciation up to $31 and possibly $50. He warns it may happen before the bigger market realizes. LINK is rated as an “oracle king,” which shows strong confidence about its long-term trajectory.

LINK price forecast 2025

DigitalCoinPrice is predicting that LINK could go beyond $50.46 by year-end. It could even overcome its previous all-time high of $52.88. This range of where it is likely to trade is indicating a very robust performance, with prices from $45.42 all the way up to $50.46.

On the other hand, Changelly is more conservative. They project LINK’s lowest price at $17.42 and a high of roughly $21.14 by 2025. Average trading price is expected at $24.86 and potential ROI at -8.2%.

Specifically at September 2025, LINK can reach $24.86 at its peak but go all the way down to $22.58 and average at $23.72. Experts reiterate that short-term price changes may bring risks and opportunities for traders.