Chainlink (LINK) is trading under pressure as the broader crypto market faces turbulence. Over the past 24 hours, LINK slipped by nearly 1.16%. Despite this dip, the token has shown resilience over the week, holding close to stable levels.

At press time, LINK is trading at $23.42, with a daily volume of $863.04 million in the last day, having dropped 17.02%. Its market cap stands at $15.87 billion, still in the top cryptocurrencies in terms of size.

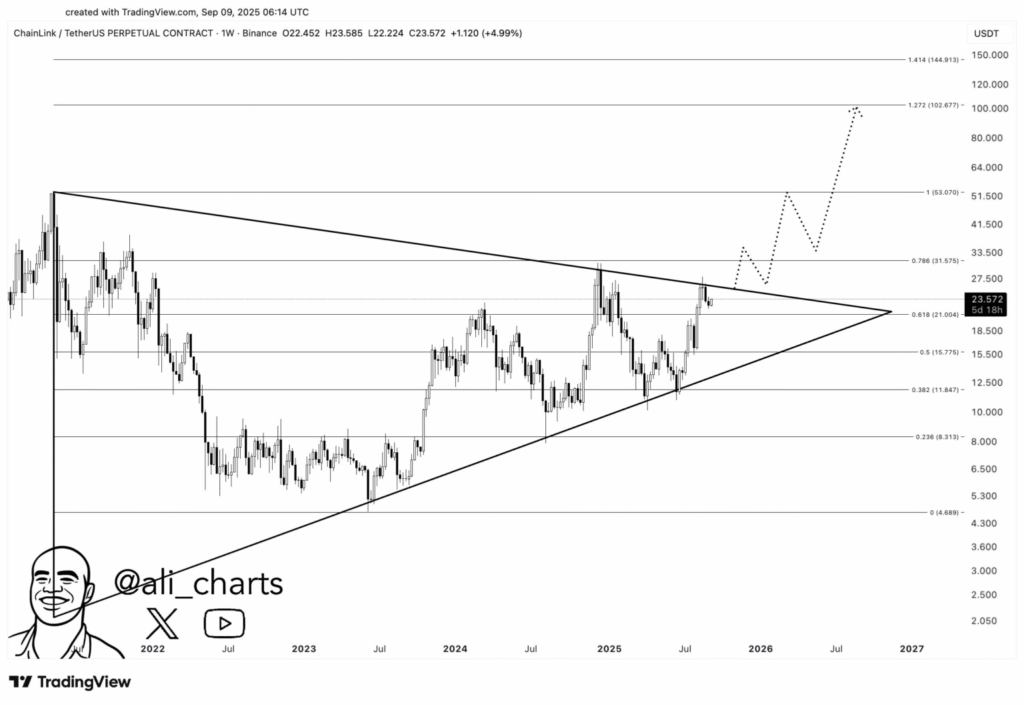

Breakout Above Multi-Year Resistance

LINK recently confirmed a large breakout by rising through the long-standing resistance ceiling of $21 to $23. The token is currently at a multi-year high, highlighting renewed bull optimism. Technically, a symmetrical triangle formation is in play, dating back to the high in 2021.

Stopping this trend from proceeding put the spotlight on Fibonacci retracement levels, where near-term bull objectives are still in the $27.50 to $31.50 range. On a further extension of the rally, a mid-term adjustment towards $51–$53 is not to be excluded, while on a far-term, LINK crosses $100.

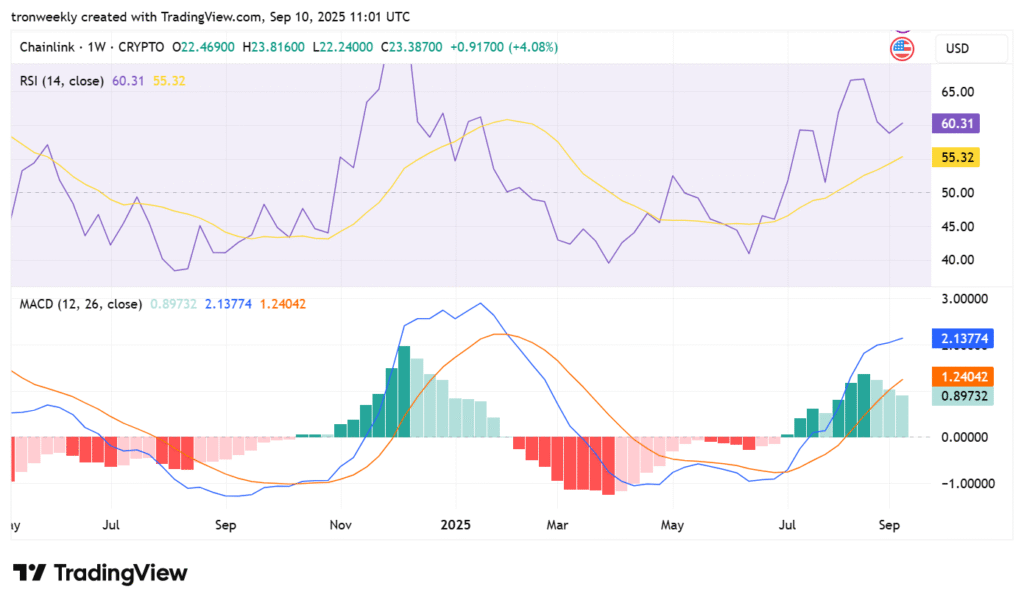

Indicators Reflect Strengthening Momentum

Momentum indicators provide further verification for the positive sentiment in LINK. The Relative Strength Index (RSI) is 60.31, well above the neutral 50 level but below the overbought level of 70. Such a position places buyers firmly in the driver’s seat without taking the asset into hot regions.

Conversely, the MACD line at 2.13774 continues to be higher than the signal line at 1.24042, with a bullish histogram of +0.89732. It validates a bullish crossover, assisted by favorable buying momentum and stable upward movement.

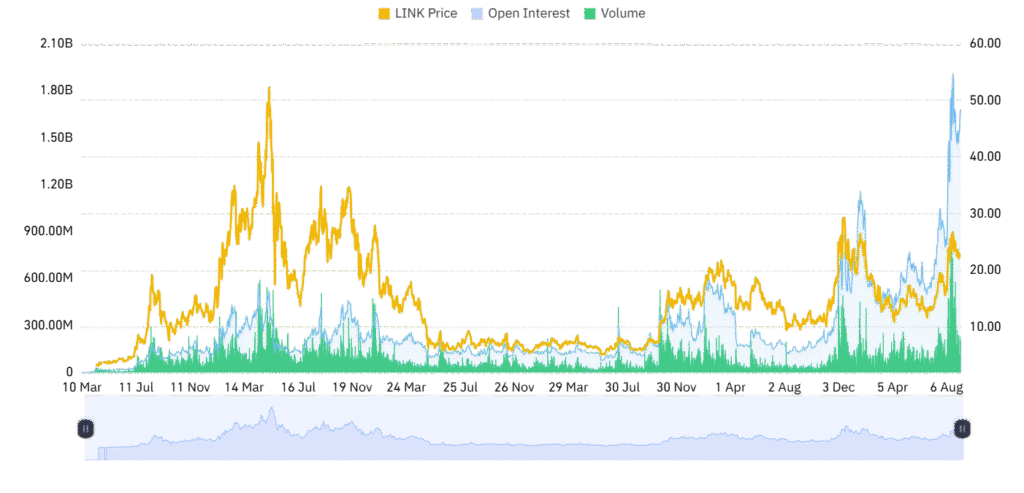

Chainlink Market Sentiment and Risks Ahead

Open interest in LINK futures is $1.66 billion, reflecting heavy market activity in spite of a small 3.58% retracement. A 0.0085% funding rate reflects a small bias in favor of long positions, a sense of confidence but not aggressive risk-taking. Such a balanced setup increases the likelihood of yet another breakout on the higher side and decreases the risk of deep falls.

Conversely, the breakout point of $21 is then a very important level of support. A continued residence above sustains the bull case, but a break through could open the way for $18.50 or $15.70. Retracements or corrections are in the near future, but the medium-term trend remains constructive inasmuch as the price continues to seek higher targets.