Dogecoin is navigating a challenging phase as its price continues on a downward trajectory, yet trading activity has surged in recent sessions. Over the past 24 hours, the token dropped nearly 4.37%, while its weekly decline stood at 1.38%.

At the time of reporting, Dogecoin is priced at $0.2190 with a market capitalization of $33.02 billion. Trading volume surged to $4.03 billion, marking a sharp 134.23% increase in one day.

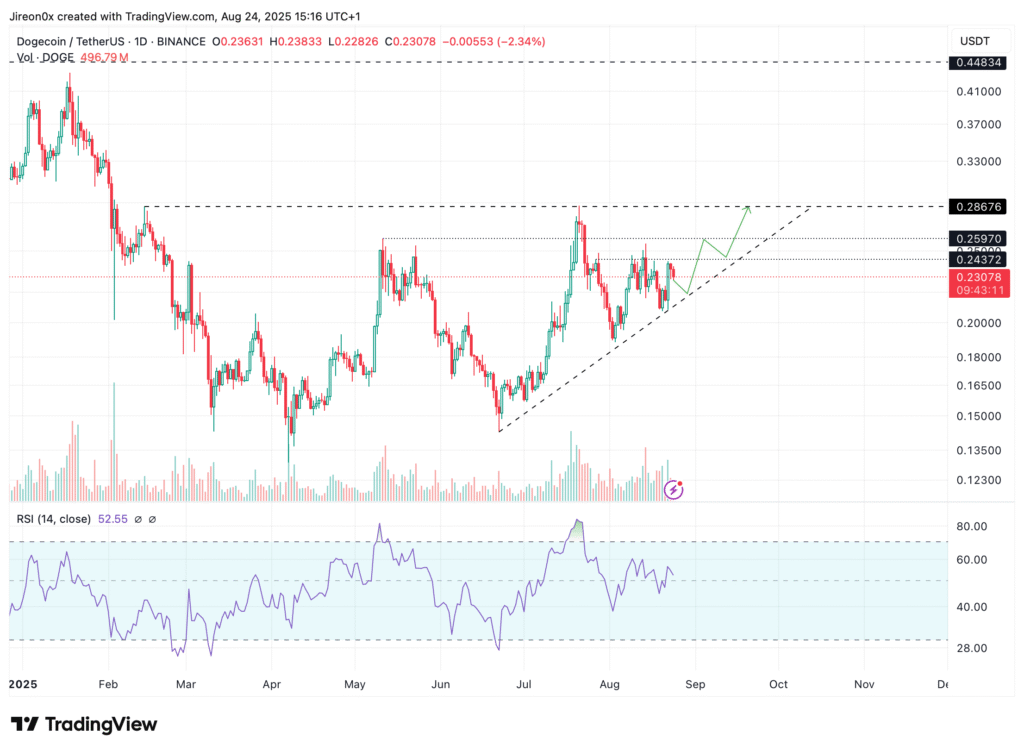

In spite of the push, Dogecoin remains at a crucial rising trendline around $0.2189. This trendline was unchanged since June and kept finding buying interest time and again. The setup shows a possible bullish formation by an ascending triangle formation, where the buyers keep entering on the higher levels in a slow manner.

For the time being, the support zone continues to be a critical battleground since it decides whether the price continues gaining momentum or falls into further losses.

Resistance levels continue to be the major obstacle. Bull rallies remain capped near the levels of $0.2437 and $0.2597 that halted moves higher over the past few weeks. A close above the resistance levels with good volume support would potentially allow Dogecoin to take on the larger resistance near the level of $0.2867.

Breakout above this level would be a sign of bullish continuation, the subsequent upside zone observed around $0.33 to $0.45. Until that the price should oscillate back and forth within support and resistance levels, fluctuating within levels it trades currently.

Dogecoin downside risks and market signals

On the other hand, a failure to support the $0.2180–$0.2200 area may nullify the bullish formation. A resulting breakdown would transfer the momentum into the hands of sellers, threatening to see Dogecoin retest the $0.2000 level, a psychological level as well as a past support. Should that fail, the fall may extend into the zone of the reversal level seen earlier this year near $0.1650.

The technical indicators signal cautious sentiment. Relative Strength Index is 52.55, displaying neutral momentum that has scope on both sides. Market volume is larger but still does not demonstrate the conviction seen on strong accumulation. This indicates the trader is waiting to confirm a definitive move before committing forcefully.

Overall, the price action of Dogecoin continues to remain delicately balanced. A move above the resistance level would continue its current recovery phase, whereas a fall below the trendline would re-establish bearish sentiment. The near-term outcome will be shaped by the ensuing sessions.