Dogecoin (DOGE) continues to show resilience, holding its ground despite a largely neutral market backdrop. At the time of reporting, the token trades at $0.2400, almost steady over the past day. The weekly chart, however, highlights a strong 11.56% gain, reflecting sustained buyer confidence. Dogecoin’s market capitalization now stands at $36.27 billion, ranking it among the largest digital assets.

The 24-hour trading volume reached $3.64 billion, marking a 3.17% dip compared with the previous session. This suggests short-term caution among traders, yet the price action indicates steady accumulation at lower levels. The broader trend remains constructive, with DOGE forming higher lows since the $0.2050 support zone.

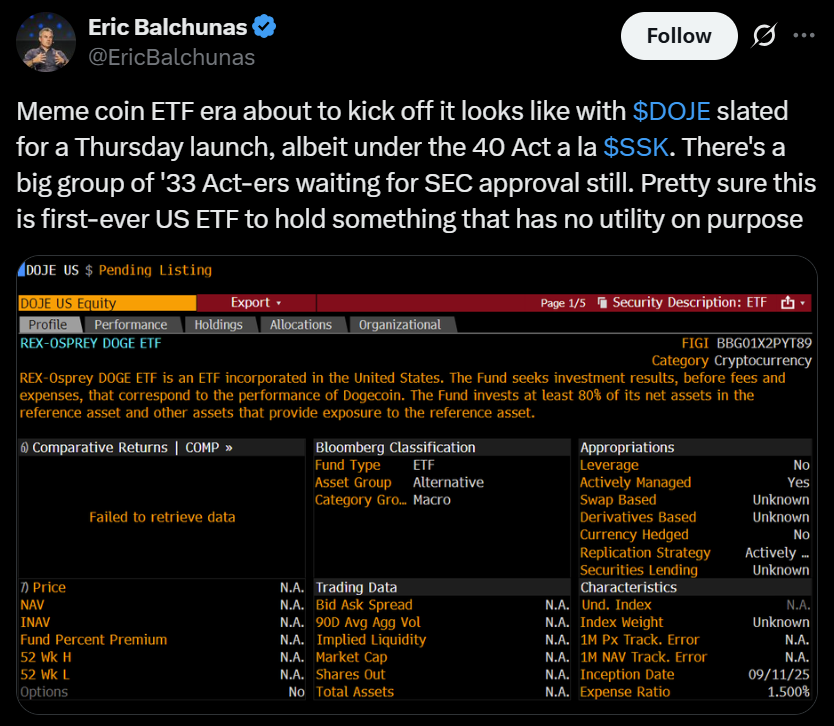

ETF debut marks new milestone

A major development on the horizon is the launch of the Rex-Osprey DOGE ETF ($DOJE), expected this Thursday. This will be the first exchange-traded fund in the United States centered on a memecoin. The fund will operate under the Investment Company Act of 1940, distinguishing it from other pending crypto ETF applications filed under the 1933 Act.

It highlights just how far Dogecoin has come from where it started as a cultural token without any direct utility. Coming on the back of a series of successful Bitcoin and Ether ETF approvals in the past year, the move reflects regulators’ increased enthusiasm for embracing varied crypto products. Market analysts describe DOGE ETF’s entry as a start of a bright new page for speculative crypto assets in regulated markets.

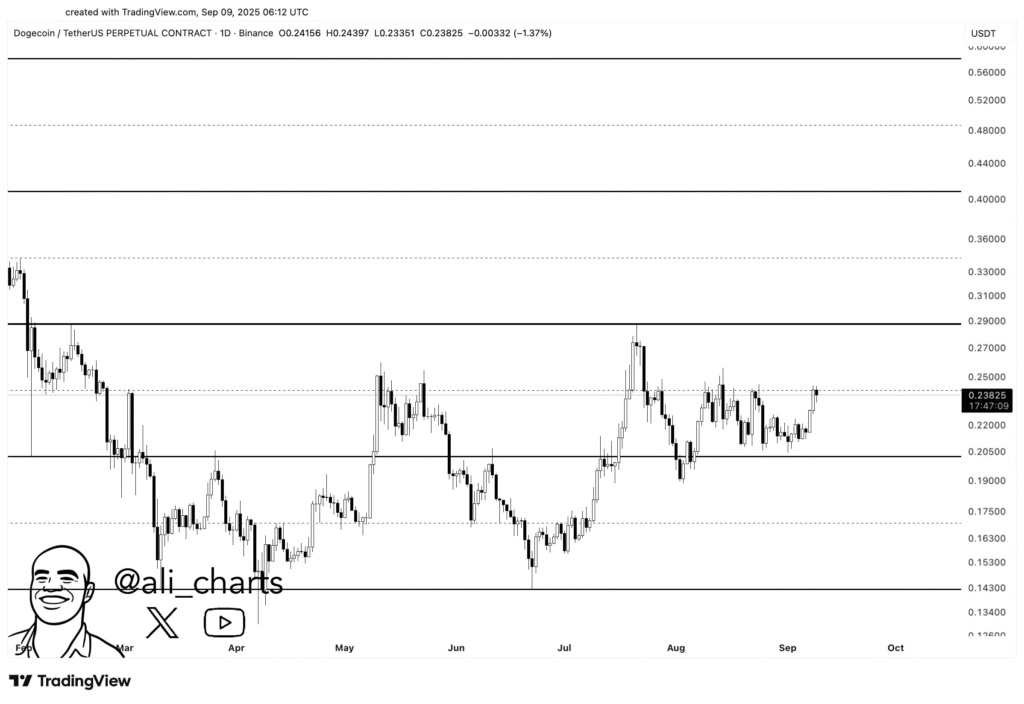

Dogecoin key resistance levels ahead

Technically, Dogecoin’s future lies in the major resistance corridor $0.27 to $0.29. It has steadily topped rallies and is therefore the immediate battlefield for the bulls. A clear close on the daily or weekly chart above $0.29 could validate a breakout from the consolidation to growth.

If such breakdown does occur, DOGE can first target $0.40 and then $0.50, comparable to market analysts’ expectations. Both those levels are technical and psychological in nature and will definitely attract profit-taking. On the downside, a breakdown from the supporting $0.23-$0.22 region could attract selling pressure, and deeper corrections could reach $0.2050 or even $0.1750.

Dogecoin remains in a neutral-to-bullish stance, with buyers anticipating confirmation of the next major movement.