Dogecoin is showing strength in the current bullish market environment. Over the past 24 hours, the cryptocurrency gained 8.81%, adding to its steady climb of 2.52% over the last week.

At the time of writing, the token is trading at $0.01470 with a significant 24-hour trading volume of $35.77 billion. This represents an increase of more than 155% compared with the previous day, placing Dogecoin’s market capitalization at $5.22 billion.

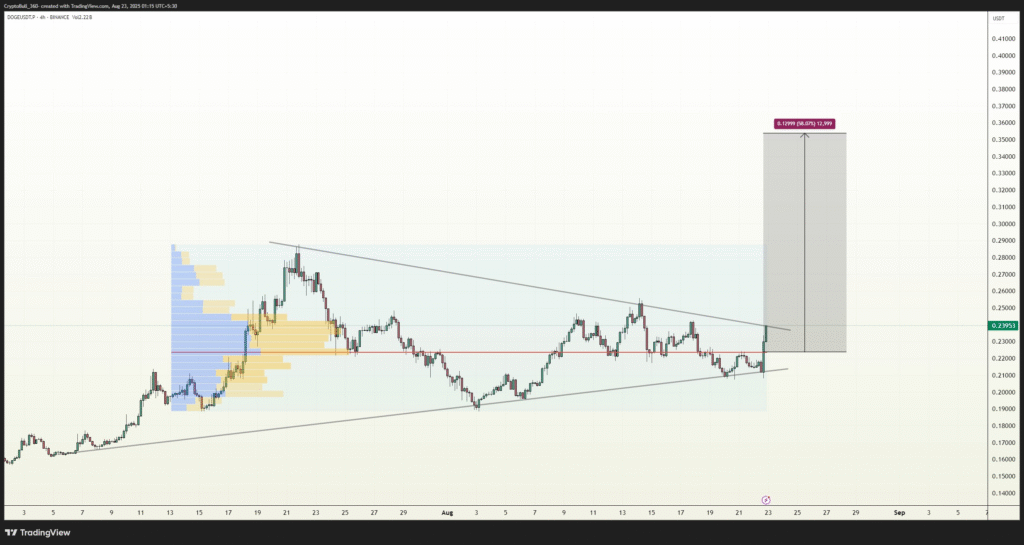

The DOGE chart on the four-hour timeframe highlights a breakout from a symmetrical triangle formation. Such patterns often indicate price consolidation before a decisive trend emerges.

The breakout occurred above the $0.2374 resistance level, suggesting that buyers are stepping in with conviction. Analysts note that this level must hold for momentum to remain intact, as it has shifted from resistance into an important support base.

Doge volume profile strengthens market outlook

Trading activity shows strong accumulation in the $0.21 to $0.23 range, a zone where investors demonstrated confidence. This accumulation now serves as a floor beneath the market. Above the breakout zone, liquidity appears thinner, pointing to fewer barriers against upward movement. That dynamic could ease the path toward higher targets.

A measured projection from the triangle’s height suggests the possibility of reaching around $0.3674, an estimated 55% advance from the breakout point. Along the way, Dogecoin may face interim hurdles near the $0.30 and $0.35 levels.

These levels hold psychological weight and have historically acted as resistance. Still, the thin resistance ahead, paired with expanding volume, supports the case for an extended move if buying pressure sustains.

Traders are still on their guard, though, as fake breakouts are characteristic in very volatile markets. A test back into the breakout point around $0.23 could be a safer confirmation point. Lack of support above this point could negate the bull case and prompt a reversal back into the triangle formation.

Open interest confirms investor participation

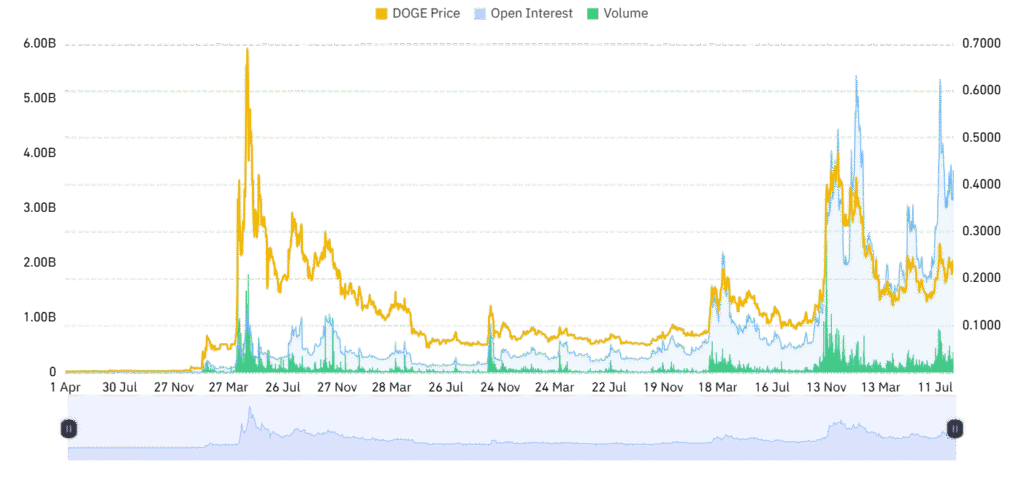

In tandem with the price action, derivatives data also supports the bullish frame. Open Interest increased by 13.83% to $3.65 billion, highlighting heightened trader participation and new capital flowing into the market.

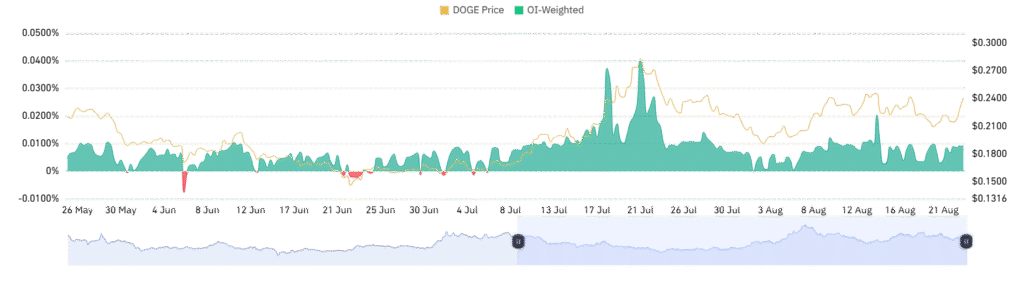

The OI-weighted funding rate at +0.0091% reflects mildly bullish sentiment without over-leveraging. This balance is a sign of the rally being driven by sincere demand and not short-term speculation or compelled liquidations.

If the price holds above $0.24 with strong supporting volume, Dogecoin may be in a new bull trend. Solid follow-through would undoubtedly validate the strength of the breakout, and a break below $0.23 is still the key to invalidation.