Ethena (ENA) is going through a neutral trend, mirroring the overall market downturn. The token decreased by 3.08% over the last 24 hours, and the current price is $0.7843. Trading volume decreased dramatically by more than 50%, and it currently is $734.62 million. Nevertheless, ENA is prominent with a market cap of $5.4 billion.

Despite the recent decline, weekly sentiment is still bullish, since an 11.55% surge implies rising interest among buyers. There are bullish undertones on the chart, though short-term selling continues to be a dampener for momentum.

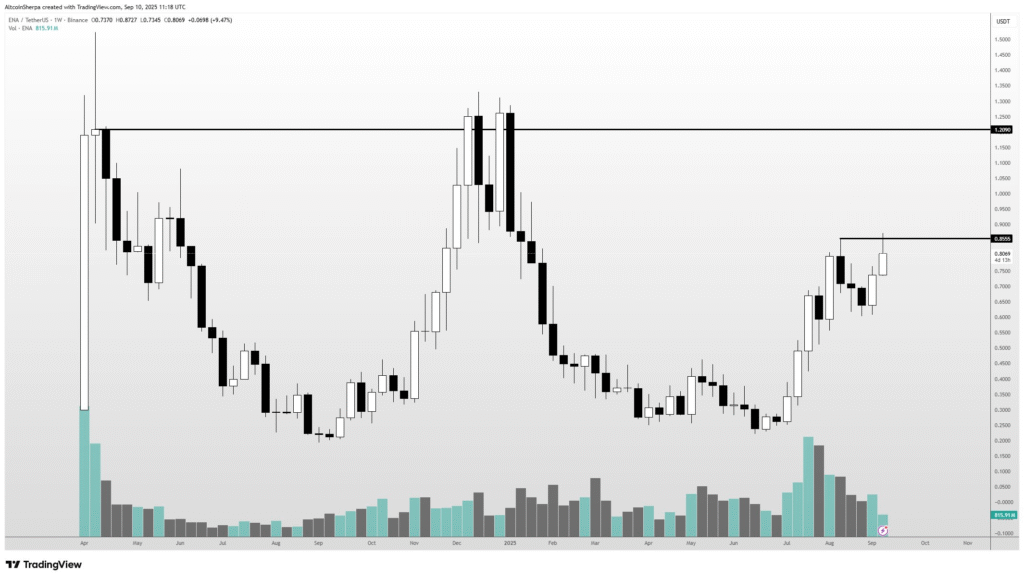

ENA resistance and support zones Shape outlook

ENA tested resistance at $0.8555 recently, a level that has derailed follow-through rallies before. A clear breakout and close above the line could trigger fresh momentum, leaving some room toward the $1.00–$1.20 region, where the next resistance is located.

To the contrary, support is within the $0.65 and $0.70 zone, the area where the price stabilized over the previous consolidation phases. Should the selling pressure increase further, the $0.50 area is the key cushion point. A break through it can reverse sentiment and put the sellers back in the driving seat again. However, the overall configuration charts higher highs and higher lows since May 2025 and thus supports the dominant bullish sentiment.

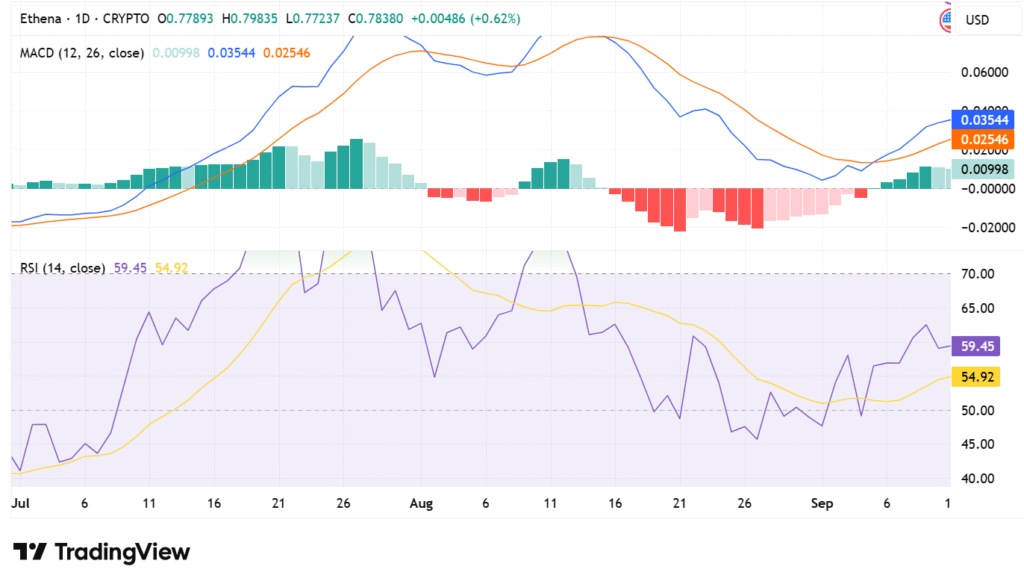

Technical indicators signal bullish momentum

Momentum indicators support the bullish ENA argument. The Relative Strength Index (RSI) is at 59.45, which is higher than the neutral line of 50 and suggests buyers are dominant. Its consistent upward direction since the final week of August also underpins the upswing scenario.

Meanwhile, the MACD reveals a bullish crossover with the MACD line above the signal line and the histogram expanding positively. This pattern is a sign of rising strength among buyers and decreases the possibility of an early reversal. Should the momentum be sustained, ENA should target the $0.8555 barrier again and a breakthrough can pave the way for a jump toward psychological resistance at $1.00.