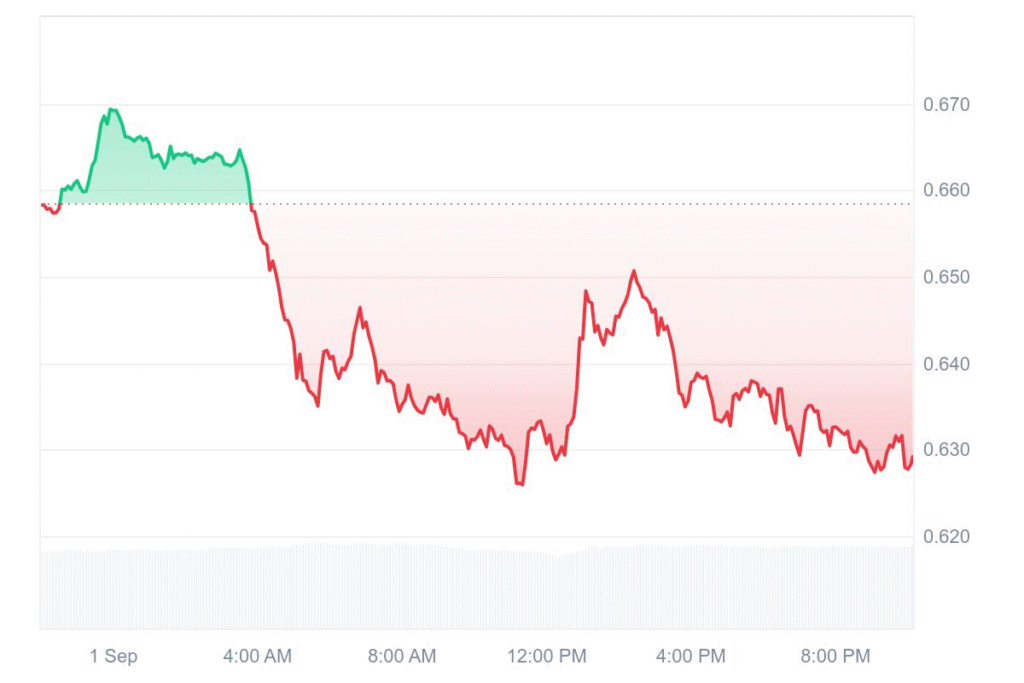

Ethena (ENA) is currently trading at $0.6288 and has seen a 4.53% fall. At a 24-hour volume of $374.48M, it was up 7.02%. Over the past 7 days, ENA dropped 2.72% and has traded at or near the price of $0.6291. Token price movement has created confusion among retail and institutional traders.

The decline comes with the bigger crypto market sending mixed signals. Bitcoin and Ethereum are steady while altcoins like Ethena are fluctuant. Here, traders are now waiting on technical signals of what the next move of ENA is. Sentiment remains negative but optimism is still at play based on speculation of a turnaround.

Bullish setup brings investor optimism

Crypto analyst Jonathan Carter said Ethena is back at retracing the $0.635 channel midline. He recognized the formation of a bullish divergence in a downtrending channel. This price pattern is pointing toward a prospective reversal of trend higher in the short term, said Carter.

His forecast is that the break of a channel with momentum has the ability to take ENA higher. His top-level targets are $0.775, $0.855, $1.000, and $1.200. This forecast is welcome news to waiting investors. However, traders must factor risks in because rapid fluctuations can take place within technical configurations when markets are very volatile.

ENA mixed predictions for 2025 outlook

Ethena 2025 performance predictions are very distant. DigitalCoinPrice is anticipating ENA beyond $1.38 end of year. The platform is predicting it can even retest the all-time high of $1.52, but consolidate within $1.32 and $1.38. Analysts believe strong investor demand being a catalyst of this positive outlook.

Conversely, Coincodex produces a September 2025 bearish outlook. It points toward a decline to $0.513234 based on their data and expects a trading corridor of $0.450545 and $0.645302. This is predictive of a negative cycle toward the market soon but goes on to mention a possible 28.05% short ROI. These divergent projections reflect just how unpredictable ENA’s trajectory is.