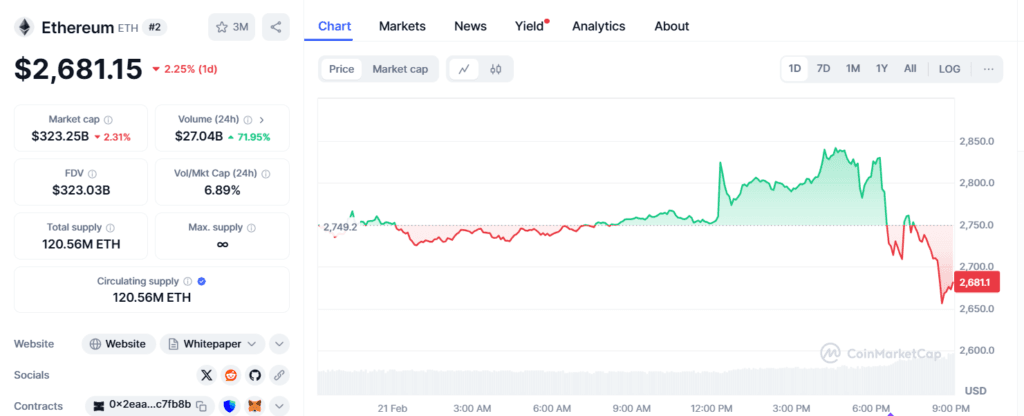

Ethereum (ETH) is showing resilience despite recent market turbulence. It traded at $2,680, marking a 0.82% gain over the past 24 hours. Price fluctuations ranged between $2,719 and highs exceeding $2,825.0, highlighting intraday volatility.

Despite experiencing sharp price swings, ETH maintained an upward trend for much of the day before a late-session dip. Market capitalization stands at approximately $329 billion, up 0.79%, while 24-hour trading volume has surged 57%

Bybit hack triggers sharp decline but ETH shows recovery

Ethereum’s recent price action was heavily influenced by news of a $1.4 billion hack involving the Bybit exchange. Following the breach, ETH plunged to $2,675 before rebounding to $2,763. Before t the hack, it had traded around $2,837. The derivatives market reacted swiftly, with $48 million in ETH-linked positions liquidated within an hour, including $25 million from short contracts.

The hack highlighted persistent vulnerabilities in centralized exchanges, reviving concerns over custodial risks and investor safety. Despite these challenges, Ethereum has demonstrated resilience. The token’s ability to maintain a steady trading range amid external shocks underscores its position within the cryptocurrency ecosystem.

Technical indicators suggest a potential upside

Technical analysis reveals Ethereum is forming a consolidation pattern after recent declines. The MACD indicator shows signs of a potential bullish crossover, with the MACD line nearing the signal line. This suggests upward momentum could develop. Meanwhile, the RSI stands at 42.53, indicating the asset is moving out of oversold territory but remains neutral.

Immediate support lies around $2,675, with stronger backing near $2,600. If bullish momentum continues, ETH could test resistance at $2,850 and $3,000. A successful breakout above these levels may drive the price toward the next significant resistance near $3,250. Conversely, a drop below current support could lead to declines toward the $2,500 zone.

Ethereum eyes $3000 as resistance levels nears

Key resistance between $2,800 and $3,000. The recent surge in trading volume, up 75%, suggests that market participants anticipate a potential price rally. Some view the current price as a buying opportunity, especially if ETH can sustain momentum and surpass resistance levels. While external factors like the Bybit hack have shaken short-term confidence, Ethereum’s technical setup points to possible gains if upward momentum holds.