Ethereum’s market activity remains intriguing despite Bitcoin’s dominant bullish rise post-U.S. elections. While Ethereum hasn’t hit a new all-time high yet, its fundamentals are showing bullish signs that shouldn’t be ignored.

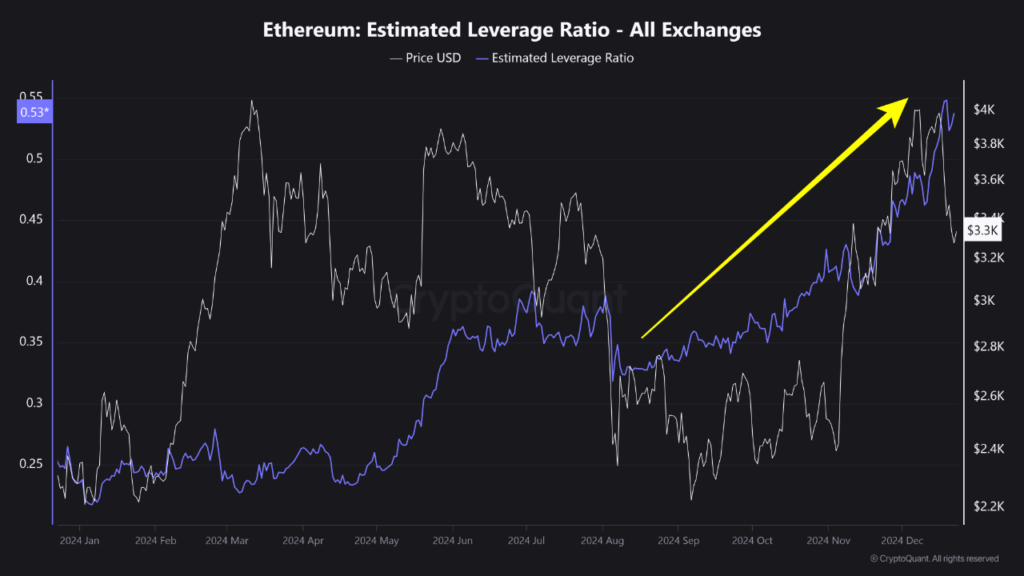

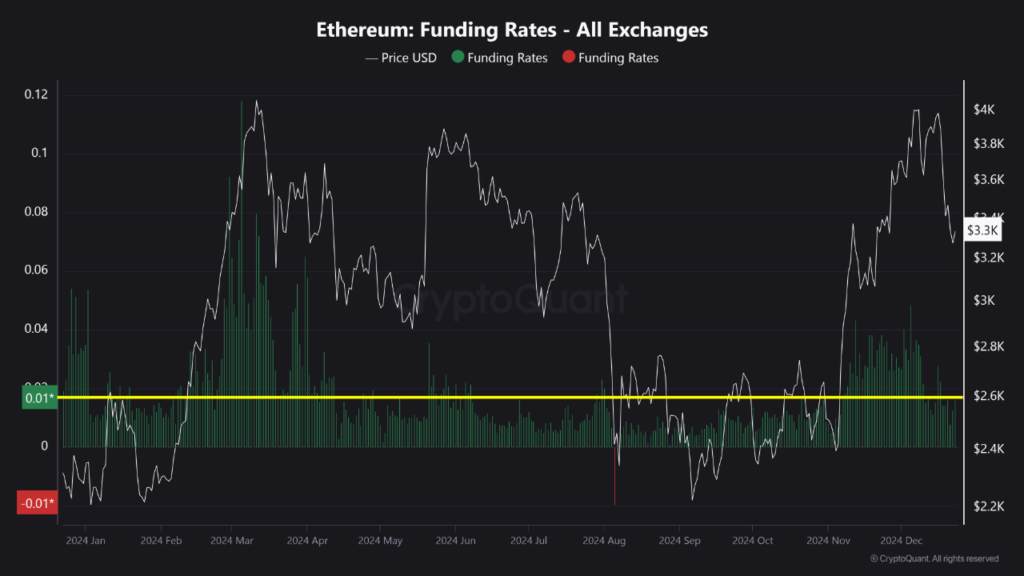

According to the data from CryptoQuant, the Ethereum Estimated Leverage Ratio is at its highest, indicating strong interest in leveraged derivatives trading, which suggests traders are willing to take on risk. Ethereum’s funding rates are also moderately positive, a saign of balanced optimism with the potential for price growth without excessive liquidation risk.

Korean premium index reflects a growing demand

Another positive factor is the Korea Premium Index, which shows Ethereum’s price gap between South Korean exchanges and others is both a positive and substantial sign of strong demand in the region that adds to the overall market sentiment.

Further, institutional and retail investors alike continue to build their Ethereum holdings even at the recent dip in the market. This continuous accumulation sends signals that there is still confidence in the long-term potential of the asset. In the long run, Ethereum looks like it is going to break out. A large ascending triangle is forming on the monthly chart, signalling a surge.

Recent trends, such as the golden cross on Dec. 4th, have combined with rising Ethereum outflows from exchanges to indicate an increasing belief in Ethereum’s future. Over 7.9 million ETH were withdrawn from exchanges in the last two months. It clearly shows strong investor confidence.

Deutsche bank’s layer 2 solution on the Ethereum blockchain

Furthermore, the continuous accumulation by Ethereum whales below the $4,000 level implies further upward momentum. More importantly, Deutsche Bank’s entrance to develop a Layer 2 solution on Ethereum’s blockchain further confirms its use case to solve financial regulatory problems.

Because the network’s growth increases Ethereum’s real-world utility, the token’s future seems quite bright. The price target may reach $6,000 in the upcoming months and, later in the coming days, can go up to $8,000 until the end of 2025.