Ethereum price is entering a crucial stage as technical patterns converge with institutional demand. Analysts highlight similarities to past breakout phases. Spot ETFs absorbed more than 286,000 ETH in recent weeks, supporting bull hopes. Overall, these signs substantiate optimism that Ethereum can reach $10,000 this cycle.

Ethereum price action mirrors historic setup

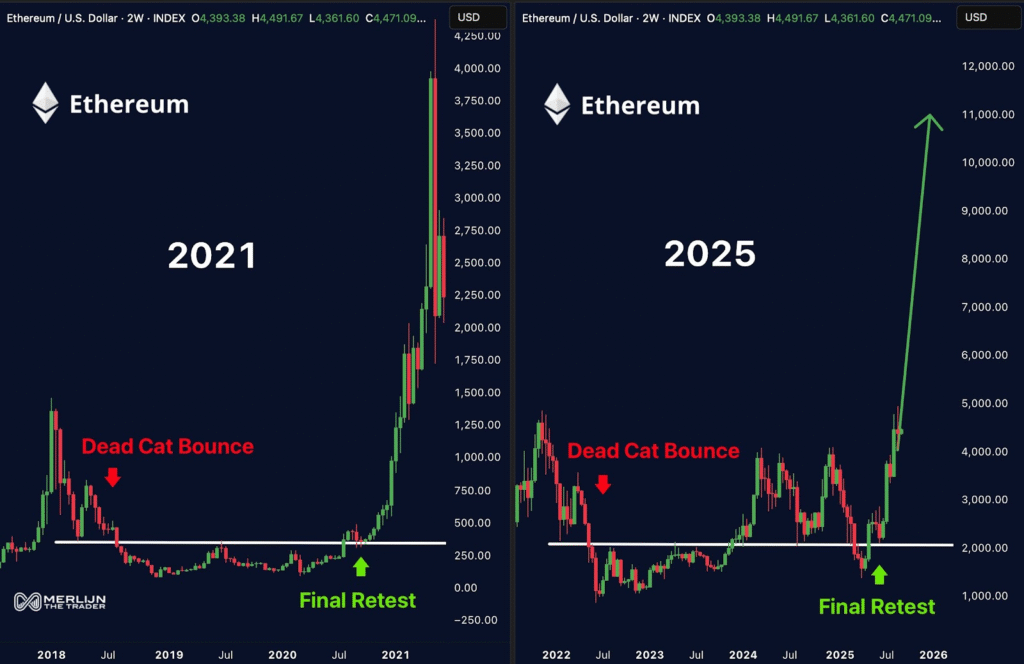

Analyst Merlijn The Trader points to a structure echoing Ethereum’s 2021 bull run. Graphs suggest a dead-cat bounce, consolidation during months, and a retest. Subsequently, Ethereum skyrocketed from $200 to $4,000. Now, a highly similar pattern is formed around $2,000, raising hopes regarding a bull run.

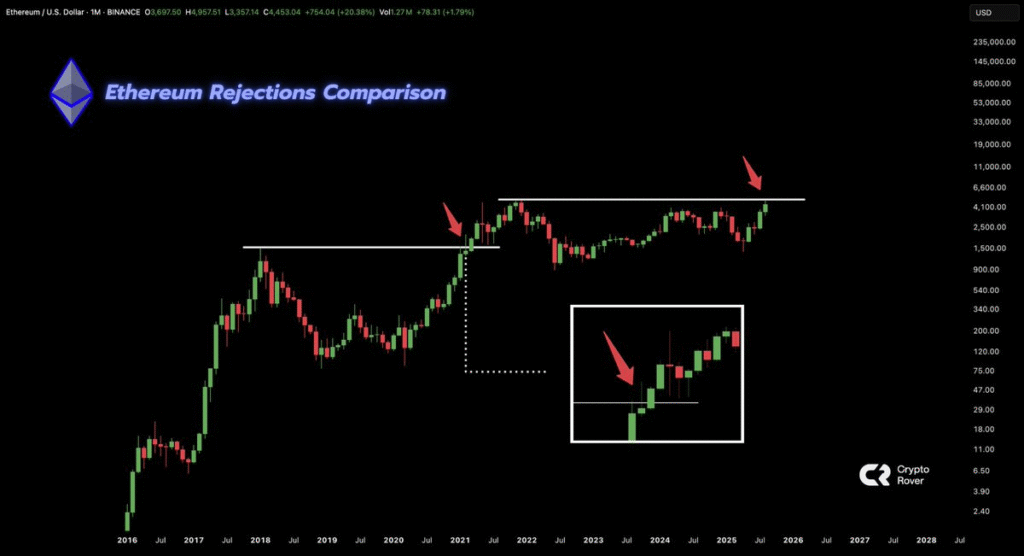

Ethereum’s weekly chart also outlines an inverse head-and-shoulders formation. The left shoulder is at $2,200, the head approximately $1,500, and the right shoulder is above $3,500. $4,943 resistance again remains central. Momentum indicators suggest a cooling down and a likely retest around $4,100 before a more forceful demand-driven bounce on Ethereum’s development trajectory.

On the daily chart, Ethereum is in an uptrending channel built since July’s breakout at $3,200. Support is at $4,380, and stiffer support is around the 50-day EMA at $4,004. Resistance is around $4,600 and $4,700. Bulls aim for a breakout while bears warn about repeated rejections around resistance.

Ethereum’s RSI is at 53, a sign that it’s neutral. Crypto Rover highlighted that Crypto’s retracement is typical of 2021 trends, where rapid retracements gave way to big rallies. Bulls are watching a clear breakout above $4,700 to unleash targets at $5,000 and $7,000. Bears put out warnings below $4,380, pointing to $4,000.

Source: X

Predictions diverge between experts. Wallet Investor looks at Ethereum crossing $7,000 in a span of five years. InvestingHaven targets $7,500 in 2025. Finder experts opine $6,100 at the end of this year and $12,000 in 2030. Diverging estimates highlight Ethereum’s volatile journey but validate solid long-term prospects amidst improving technicals and institutional backing.

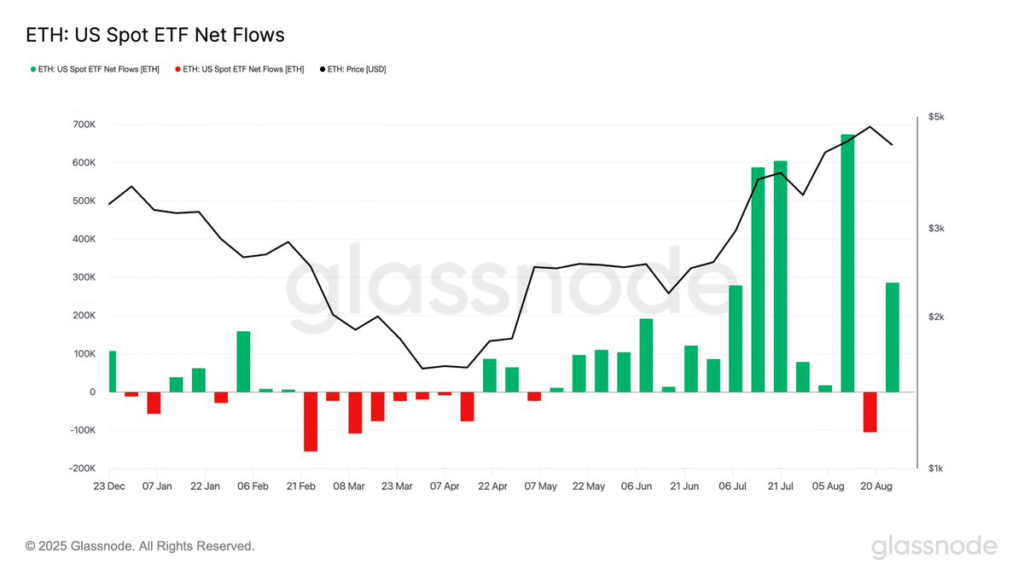

ETFs absorb 286K ETH, fueling confidence

Ethereum ETFs recorded inflows exceeding 286,000 ETH within a week, one of the largest recorded since inception. Prices closed at approximately $4,400 in ongoing demand. Glassnode data highlights ongoing inflows behind the ongoing strong buying demand. Unlike during 2021, institutional demand now underpins the market, capping the chances of sharp selloffs.

ETF-based liquidity reduces exchange supply, boosting Ethereum’s strength. Additional inflows suggest a sustainable support layer reinforcing bullish technical setups.

Institutional accumulation bolsters optimism and renders bearish cases less tenable. With ETFs persisting to absorb supply continuously, Ethereum’s ascent to $10,000 increasingly seems within reach. Optimism regarding ETH remain strong.