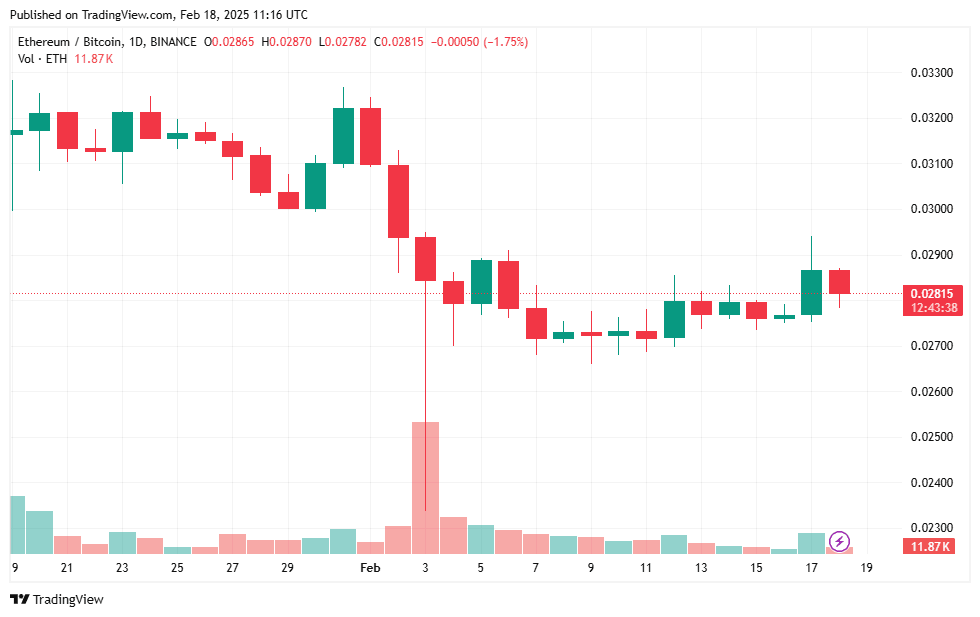

Current data indicates Ethereum (ETH) is demonstrating encouraging signs of joystick after an extended period of price decline. The cryptocurrency displays strong signals of price growth due to its better on-chain indicators. Moreover, a positive technical analysis is increasing investor optimism.

Ethereum suffered a major 21% decrease in the previous month. Thereby, prompting investors to consider the platform’s short-run prospects. Available indications reveal ETH may be recovering from its recent downturn. Retail investors from Korea and the United States alongside derivatives traders exhibit new buying patterns that might enable Ethereum to recover its previous value in the upcoming weeks.

Supply Dynamics

The current supply of Ethereum on exchanges shows a significant downward trend. The supply of ETH available for exchange holds a historic low of 6.38% at present. The recent shift of holdings into cold wallets suggests investors choose long-term holding instead of short-term sales. Consequently, decreasing the probability of substantial market sell-offs.

Ethereum has received increased attention in community discussions, with 9.2% of all coin discussions in February focusing on ETH. Additionally, on February 17, Ethereum became the top-traded asset on Coinbase, surpassing Bitcoin (BTC), Solana, and XRP. This marks a significant milestone because it is the first time it has achieved this position since 2022.

Technical analysis and price projections

Technical analysis indicates that Ethereum is consolidating after a sharp decline and is on the brink of a breakout from a long-lasting descending structure. Fibonacci levels, at $3,495 and $3,730, serve as key price targets. Furthermore, its momentum remains uncertain, requiring confirmation of an uptrend.

Analysts predict it could reach $3,300 within a week, fueled by technical patterns and bullish sentiment. This projection is supported by the recent reduction in supply on exchanges and increased investor interest.

However, the latest market decline has not prevented an improvement in Ethereum’s market sentiment. Market participants tend to make long-term investments according to current supply-chain dynamics and social dominance indicators. The present market momentum suggests Ethereum might soon recover from its current price.

Although Ethereum currently faces obstacles, it indicates through marketplace signals and chart analysis that it may experience a comeback. The price rebound potential increases for Ethereum because investors need to track these evolving market dynamics, which unite decreased exchange supply and rising dominance with positive technical indicators.