Hyperliquid (HYPE) has been moving along a positive path, attracting fresh market attention and steady buying pressure. Over the past 24 hours, the token has posted a modest gain of 0.64%. On a weekly scale, its performance is stronger, recording a 1.64% rise.

At the time of writing, HYPE trades at $45.60, supported by a market capitalization of $15.23 billion. Trading activity, however, has softened slightly, with 24-hour volume down 12.17% at $198.06 million.

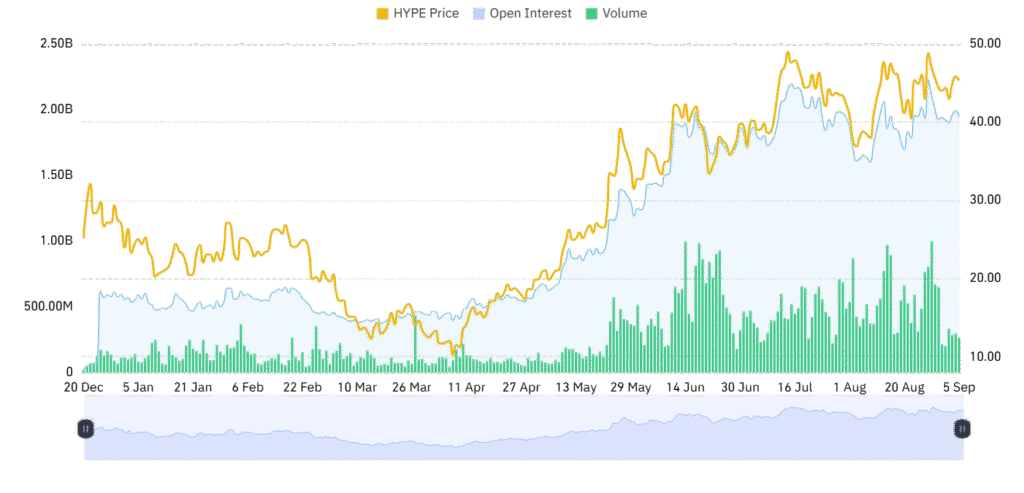

The bar chart has been on a distinct upward trend since May of 2025, with the price remaining within a very tight range of $42 and $48. This type of tight range tends to precede a large move in one direction. Both the buying volume days and the selling volume days confirm the outlook — buying volume days have greater volume, and selling volume days have smaller activity.

HYPE Technical Setup and Breakout Potential

The charting outlook indicates a bullish trend because HYPE shares are moving in the high-end of their range of consolidation. Experts deem the current period very significant, and $48 to be the critical resistance level. An explosive crossover thereafter may be ushering the shares into a rapid upside rush into $100, which will be an increase of over 118%.

Chart predictions align with classic bullish continuation patterns such as an ascending triangle or range breakout. Of note, the risk/reward is favorable on the long side. Support comes nearby at $42, so the risk is fairly low against the target on the upside. A surge of volume on a breakout might speed the rally and initiate a new leg of the upward movement.

Market Sentiment and Participation

Indicators of momentum that don’t rely on price also confirm the bullish argument. Open interest has moved up to $1.95 billion, indicating increased trader involvement. The weighted by open interest funding rate is at the level of +0.0078, indicating consistent dominance by longs that isn’t overleveraged. That makes the risk of sudden liquidation episodes lower and increases the trend’s overall soundness.

On a broader note, the combination of steady price appreciation, positive volume momentum, and increasing market interest reinforces HYPE bulls. Unless the price penetrates the $42 support zone, sentiment is solidly biased to the upside, and traders will be looking to a successful breakout as the next determining factor.