Injective (INJ) traded near $15 at the time of writing, hovering just below resistance around $16.12. That level also falls on the 1.0 Fibonacci extension level. Traders point to INJ as possibly establishing a bull retest setup, with the asset since April establishing an ascending triangle, a harbinger of the upward direction that it may take.

Technical charts show the $16 area as a crucial breakout point. Targets mapped include $20.27, $22.83, and $27.11 if momentum continues. Maintaining levels above the trendline favors buyers, while a fallback could test the $13.46 support. This structure emphasizes careful monitoring for both entry and exit points.

Injective’s current trading price is $15.6, having increased by 18.67% in the last week. This action puts an end to the stalemate of the months and indicates fresh buying signals by the traders. A combination of an inverse head-and-shoulders with a symmetrical triangle indicates that the buyers have regained dominance once again in the marketplace.

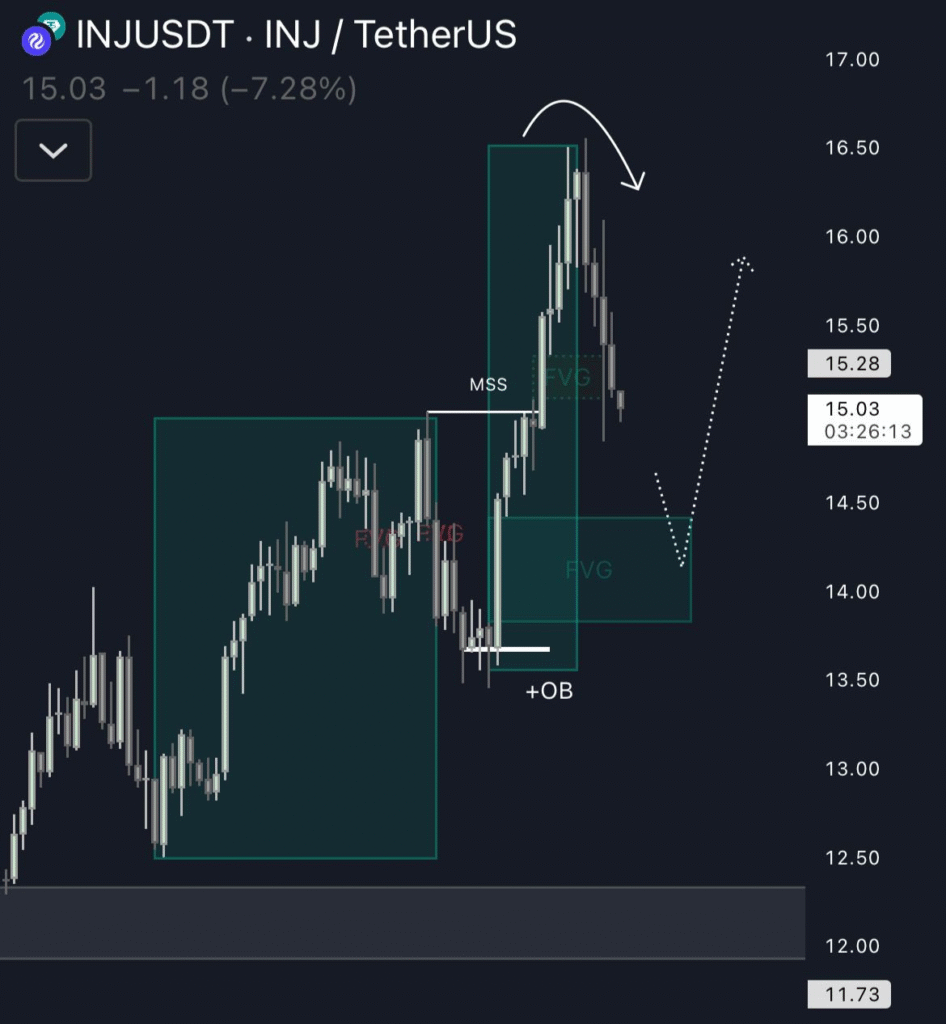

Short-Term pullback tests key demand zone

The SBET Project Launch solidifies the foundation of the INJ. Being the initial on-chain Digital Asset Treasury (DAT), it also broadens the iAssets system. It completes the footprint of Injective in the tokenized real-world asset space, thereby making the project more attractive to retail and institutional investors, and adding confidence to the current price rally.

Even with robust technical configurations, caution persists. History dictates that breakouts can fail as the general market attitude goes sour. Traders spread their bets in alternatives such as Unilabs Finance, captivated by its AI-based ecosystem. The comparison pinpoints investor caution even in the presence of positive momentum for Injective.

Following a recent rally, INJ was rejected at $16.50, triggering a short-term pullback. Traders point to the $14.2–$14.5 area as the next significant demand zone. Should buyers hold this level, a move back to $15.5 or better is on the table. Continuation of the momentum could even bring on major upside, breaking through current resistance.

Injective ETF could drive $2T market demand

Wallet data disclose combined INJ addresses that nearly reached 4,000 in total. Frequent establishment of new wallets also signals new participants. Institutional presence of Injective is further expanding. Institutional focus reached a new level with the SEC filing by the CBOE to list the Canary Capital Staked INJ ETF.

Processing more than $2 trillion within the month, this action indicates increasing activity among the big players. Institutional purchasing may spark more buying demand, giving more support to the rally of INJ during the following weeks.