Ethereum is flashing strong long-term signals, drawing attention from market watchers. Key technical indicators suggest ETH is close to a local bottom, presenting what some consider the best risk-reward setup in the market.

A crucial level is the 200-week EMA, a historic support zone. Ethereum has only dipped below it during extreme bear phases, like the 2020 crash and the 2022 downturn. Each time, it rebounded swiftly. Currently, ETH is just 18% away from this level, reinforcing the idea that a bottom is near.

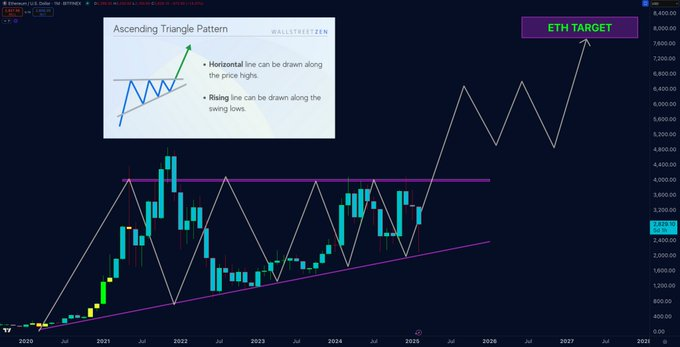

Another bullish aspect is the multi-year ascending channel. Ethereum has been adhering to this framework for years and is approaching the lower boundary, which is traditionally a great place to get in. If this pattern continues, a breakout of $4,000 will be the expected scenario.

The strength of each rejection at this price will prepare Ethereum for a push higher. The successful violation might drive the price toward the area of $8,000-$10,000 within this cycle. The weekly ascending triangle that has been built since 2020 further bolsters the bullish argument.

The formation indicates a period of strong accumulation, and previous similar patterns had ended with a blowout move. The large area of liquidity at a price of about $4,000 also favors this expectation. If the price of ETH penetrates this area, swift price growth might ensue with the help of the market makers.

Ethereum accumulation rises despite retail apathy

Despite weak retail interest, institutional investors keep steadily amassing. Outstanding record ETF inflows and large on-chain redemptions affirm this behavior. Retail circles, meanwhile, are ruled by fear and bearish sentiments reminiscent of prior bottoms.

Everything that matters technically, fundamentally, and sentimentally aligns for a large move. Ethereum rests at a long-term support area where previous reversals have been seen. Those awaiting the perfect buy-in might miss the move. The strong risk-reward setup has many investors perceiving ETH as the top player at the moment.