Notcoin (NOT) is showing signs of renewed activity after a slight upward move in the last 24 hours. The token has risen by almost 2.96% and now trades at $0.001809. Despite this rise, the weekly trend remains mostly stable, with little change in overall price action.

Market capitalization stands at $179.91 million, while daily trading volume dropped by 17.69% to $21.4 million. This decline in activity reflects reduced speculative participation even as the price edges higher.

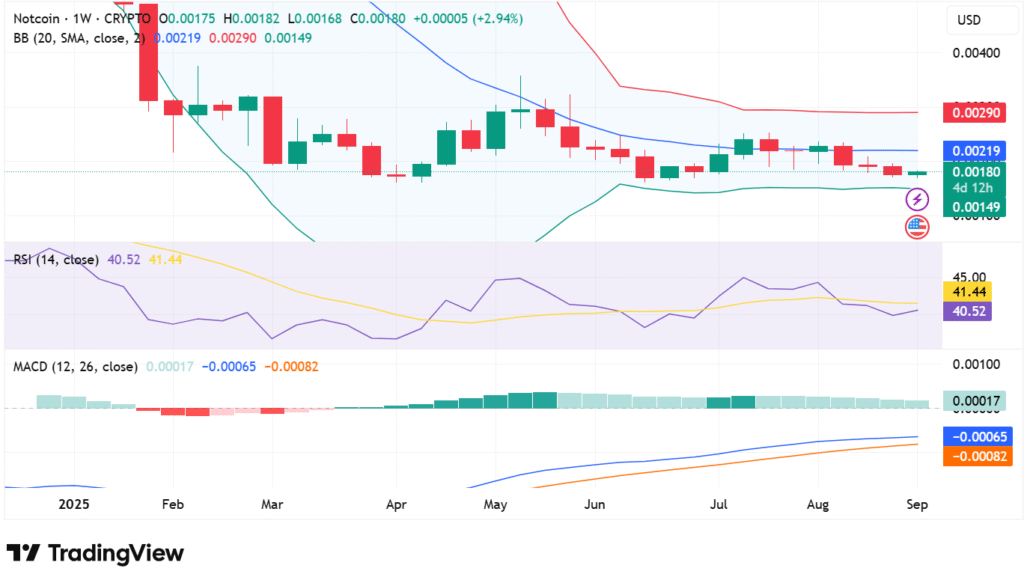

Notcoin technical indicators highlight uncertainty

The current positioning of NOT near its lower Bollinger Band at $0.00149 suggests consolidation. The upper band lies at $0.00290, with the mid-band at $0.00219, setting clear levels for support and resistance. Traders are watching closely to see whether the token can rebound from support or fall deeper toward the $0.00120–$0.00100 range.

Signals reflect mixed prospects for NOT. The RSI stands at 40.52, just below its neutral level of 41.44. This level reflects weak momentum with sellers still dominating. A fall below 40 would indicate more aggressive bear pressure, while a move to 45-50 would switch sentiment to that of a comeback.

The MACD is giving early signals of strength. The MACD line at -0.00065 has crossed over just above the signal line at -0.00082. A positive histogram of +0.00017 shows the beginning of potential gains in a positive direction. The signal is still weak for the moment and requires follow-through from larger activity before an uptrend can be affirmed.

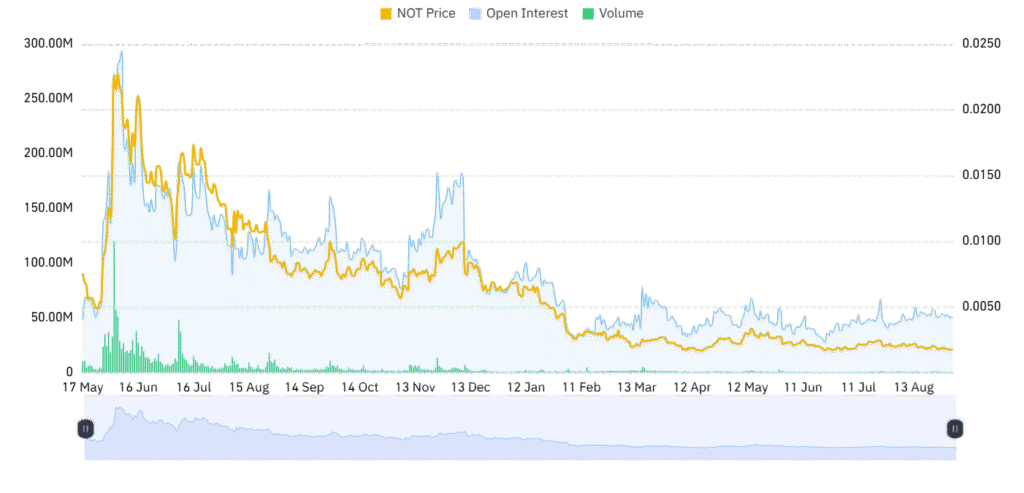

Market participation cools off

Alongside pricing indicators, derivative figures show sliding activity. Current open interest stands at $50.06 million, having fallen 0.37% as spot positions get closed by dealers. The downshift validates the decline of spot trade volume. Meanwhile, OI-weighted funding rate stands at 0.0037%, indicating a weak bullish bias with no aggressive short position signals.

The market remains cautious with players observing for clearer directions before investing further. Until volume builds up and resistance at $0.00219 breaks, NOT is likely to remain in a sideways-to-bearish configuration in the short term.