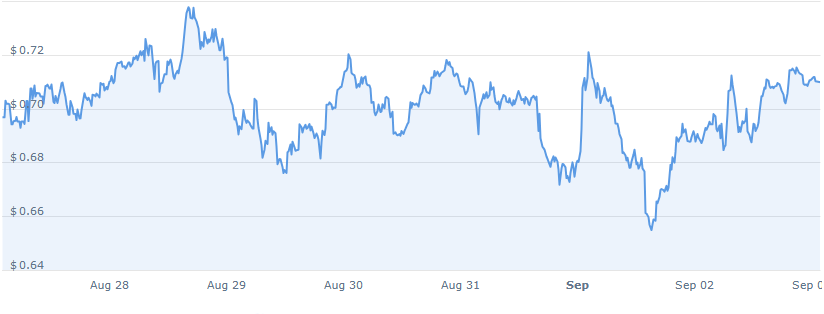

Optimism (OP) is trading at $0.710874 after gaining 3.27% in the last 24 hours. Token market capitalization stands at $1.26 billion with a 24-hour trade volume of $245.85 million and market dominance of 0.03%. Investors are observing major support levels very closely.

Recent analyses on X by AmBitcoin highlight a critical accumulation zone for OP between $0.6172 and $0.6767. It has continuously been challenged with robust demand for purchases being justified throughout. Technical analysts feel that being above that level of support maintains a positive bias with the expectation of a breakout in short order, increasing accordingly.

Price holds above key demand zone

The TradingView daily chart of OP/USD shows that the coin is plotting a tentative intersection. Although price approaches a descending trendline that has acted as resistance once before, it remains trading just above a major demand zone from $0.6860 to $0.6721, and that is positive for further gains.

Technical indicators are mixed. The Relative Strength Index (RSI) is near 49 to reflect a neutral market with no overbought or oversold zone. The Moving Average Convergence Divergence (MACD), however, is negative to reflect bearish pressure. For now, the bullish thrust is still not strong enough to bring out a sound breakout in the short term.

The trade plan that has emerged suggests a number of take-profit points at $0.9456, $1.0881, $1.1665, $1.2853, $1.6880, and $2.1695. The points are at places of earlier resistance locations and Fibonacci retracement points. Breaking first resistance in the neighbourhood of $0.9456 with volume can hasten OP towards the next levels of the rally, justifying a disciplined move upwards.

Risk management is emphasized to protect traders from unwanted shifts. The suggested stop-loss is $0.5476, which would eliminate the bullish case on breach. Traders are urged to limit personal trade risk to 3-5% of capital to allow disciplined risk management while being part of likely upside rallies.

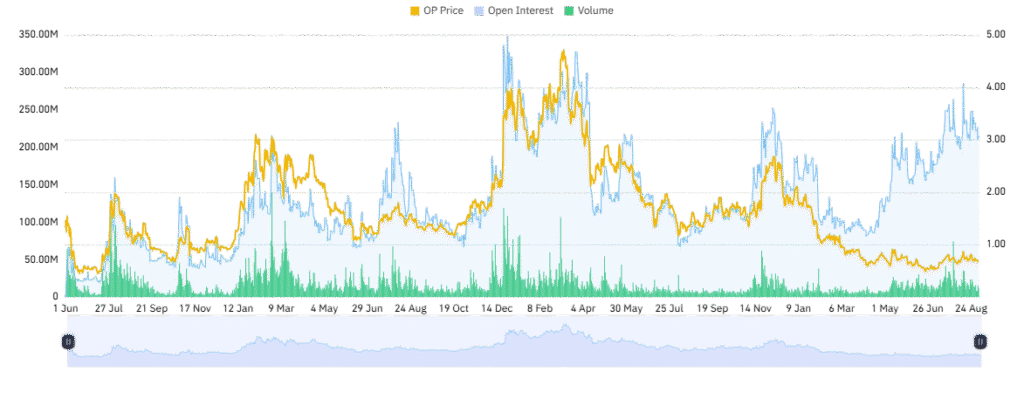

Optimism derivatives data analysis

Derivatives indicators announce a volume reduction of 19.92% to $293.45 million. The open interest remains unchanged at $212.32 million with a slight 0.02% increase.

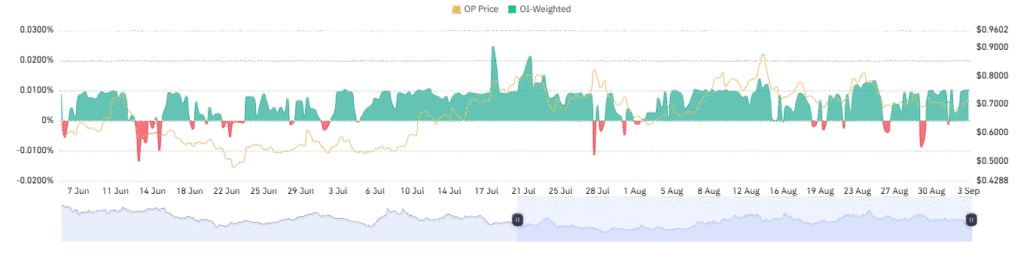

The OI-weighted ratio stands at 0.0100%, indicating low leverage activity. Market participants are cautiously observing derivatives trends for future price signals.

Overall, OP is positively cautious. Major support levels, coupled with modest buy indications and disciplined targets, suggest growth potential.