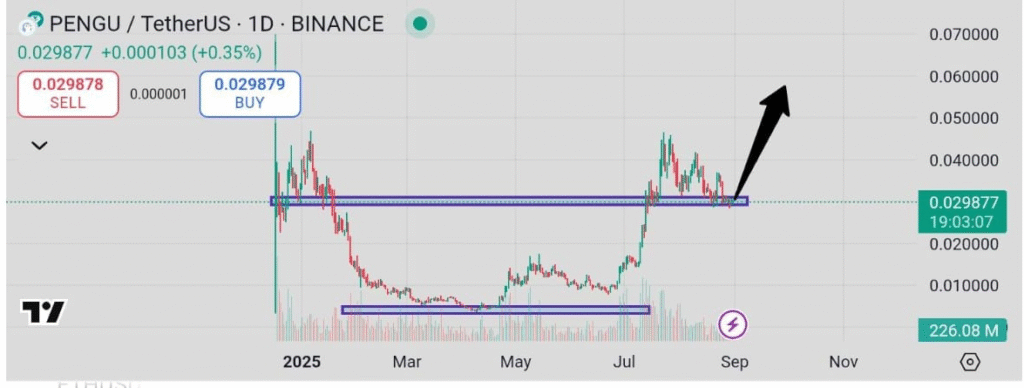

PENGU continues to test a vital support range after a period of market volatility. The token is currently trading at $0.02901, holding just above the $0.027000 level, a zone that once capped rallies earlier in the year. In July, the market successfully flipped this barrier into support, making it a decisive pivot point for the latest moves.

Despite a 1.91% daily decline and an 8.64% weekly slip, trading activity has intensified. Volume surged by 47.55% in the past 24 hours, reaching $282.17 million. This suggests investors are defending the newly established base, using it as a potential launchpad for the next upside phase. The token’s market capitalization of $1.82 billion secures its position within the mid-cap tier, adding weight to its growing influence.

The strong rebound in participation has reinforced the importance of the support range. Market observers point to a breakout-retest pattern forming on the charts. Some technical analysts also highlight a possible cup-and-handle structure, which often precedes extended bullish momentum.

Pengu price targets and downside Risks

If PENGU sustains momentum above $0.027000, the next visible resistance zones are $0.040000 and $0.050000. A return toward the $0.060000 region, which marked previous highs, is also possible if demand continues to build. Beyond that, an extended target sits at $0.070000, aligning with broader bullish projections.

However, risks are always impending. It is a depreciation below $0.027000 with strong sell pressure that can erase the bullish pattern. This can expose the asset to more drops with the next possible stopping being $0.020000. It is the following sessions that will decide whether the token holds its ground or faces more pressure.

Sentiment and market positioning

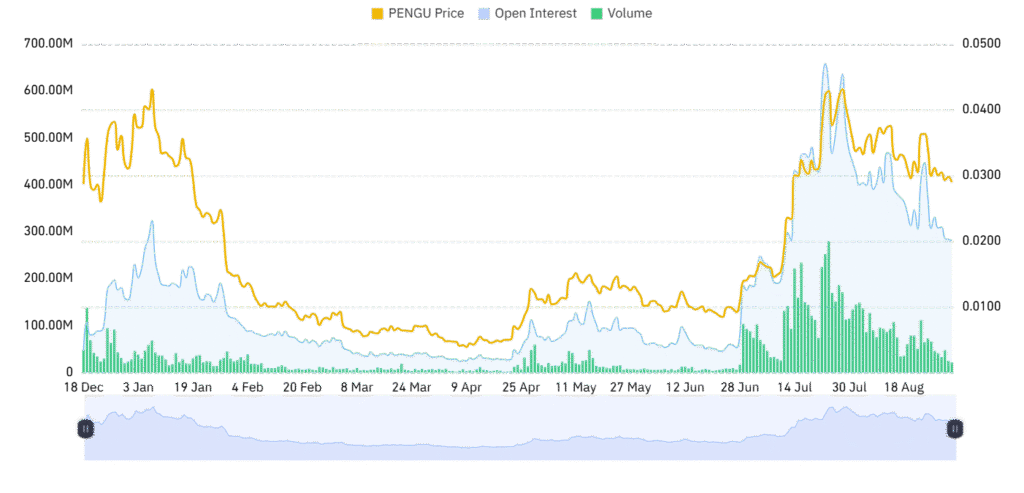

Open interest has dropped by 3.29% to $277.25 million. This is a sign that traders closed positions after recent upmoves and reduced speculative leverage within the market. Funding rates remain slightly positive at 0.0052% and are showing a mild bullish mindset but fairly unbiased overall.

This combination of falling open interest and steady funding implies consolidation. Traders are hedging their bets and patiently waiting for stronger clues before assuming fresh positions. This tug of war between profit-taking and renewed buying may decide where PENGU makes its next big move.

It remains steady at a vital intersection for now. Whether it converts consolidation into continuation or gets a steeper correction is based on how long the support zones hold up against rising tests.