PEPE has entered a positive trajectory, reflecting a broader shift from bearish to bullish sentiment. Over the past 24 hours, the token has gained nearly 2.04%, although its weekly performance remains negative at 2.13%. At the current price of $0.00001013, PEPE holds a market capitalization of $4.26 billion.

Trading volume stands at $591.63 million for the day, recording a decrease of 41.55% from the previous session. This decrease in volume indicates hesitant trading, but recovery signals for the market are emerging as buyers regain their confidence.

PEPE technical indicators and pattern formation

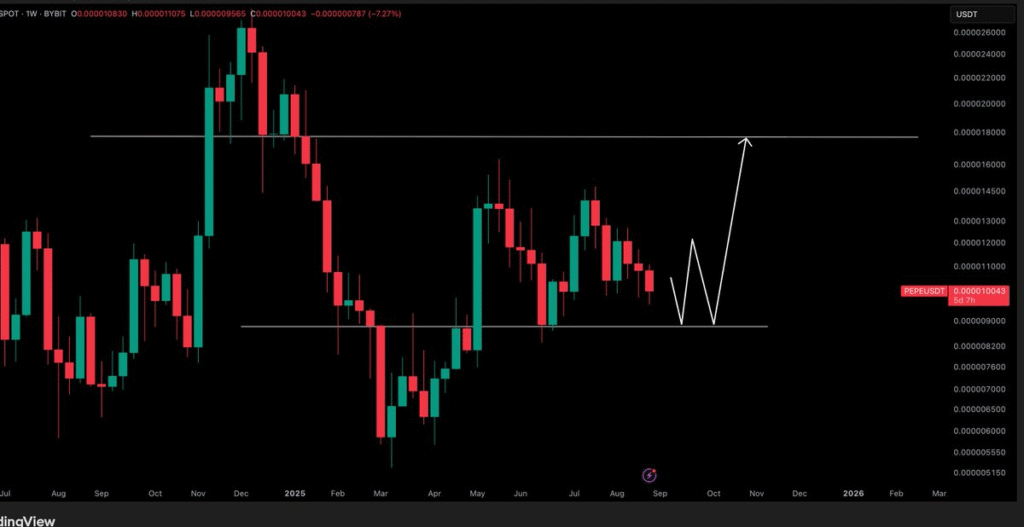

PEPE chart displays price congestion between $0.00000900 and $0.00001800 as the long-standing battlefield between bulls and bears. The token is currently at the lower end of the range, wherein successive tests of support have instilled vigor. Technical indicators are signaling a W-shaped reversal pattern.

This pattern tends to emerge when the pressure of selling subsides, which can signpost a bullish breakout. In case the $0.00000900 support level also stands its ground, building momentum slowly ought to see the prices return to the mid-range and beyond to the resistance level of $0.00001800. A breakout would plot an estimated rise of 77% from current levels of trading. However, failure to hold support could see the prices slide further, potentially as low as $0.00000750.

Open interest and market sentiment

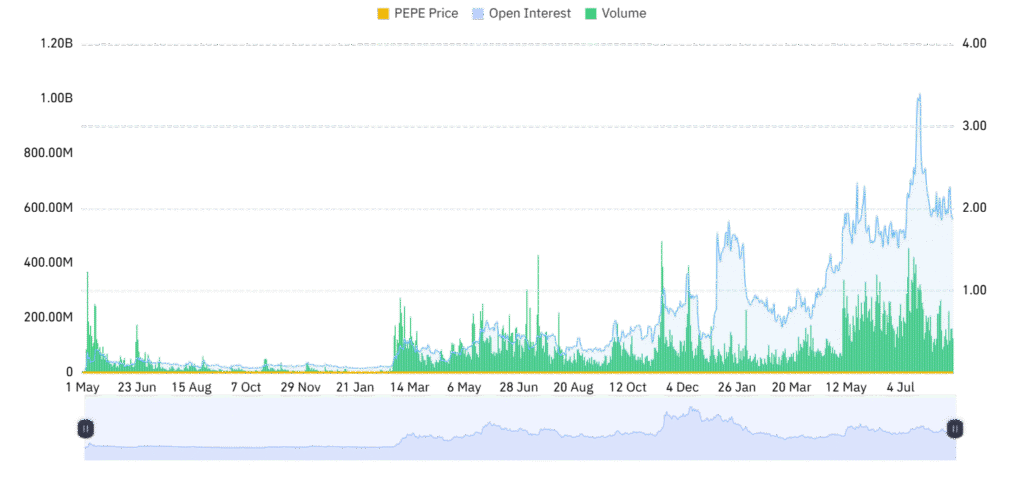

PEPE derivatives open interest has increased by 2.15%, which now stands at $568.96 million. The relentless increase of open positions suggests building speculative interest as more and more traders gain faith in future market trends.

Despite higher open interest, the OI weighted reads at 0.0100%, meaning leverage use remains confined. This balance mitigates near-term risk of sudden liquidations. Meanwhile, liquidity stands firm, and regular trade flow also supports the risk of volatility. All of these factors support the bullish outlook of steeper swings if purchase momentum continues to make headway.