In the last week of August, PYTH climbing sharply after rallying significantly with increased market interest. Nevetheless, the crypto is currently undergoing a price correction process. Experts consider the reversal a typical reset of the prices after the recent jump.

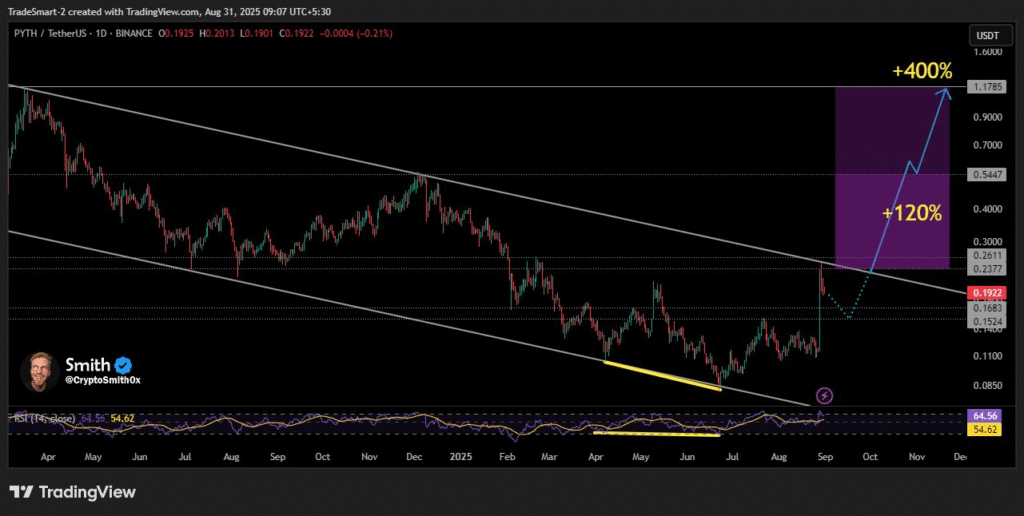

Despite the short-term decline, Pyth Network positivity dominates. On-chain usage is continuing to support eventual larger adoption hopes. There is the argument that $PYTH could surpass the $0.50 threshold by 2025 if the trend maintains course. Investors are paying attention to major support levels to look out for potential re-entry points.

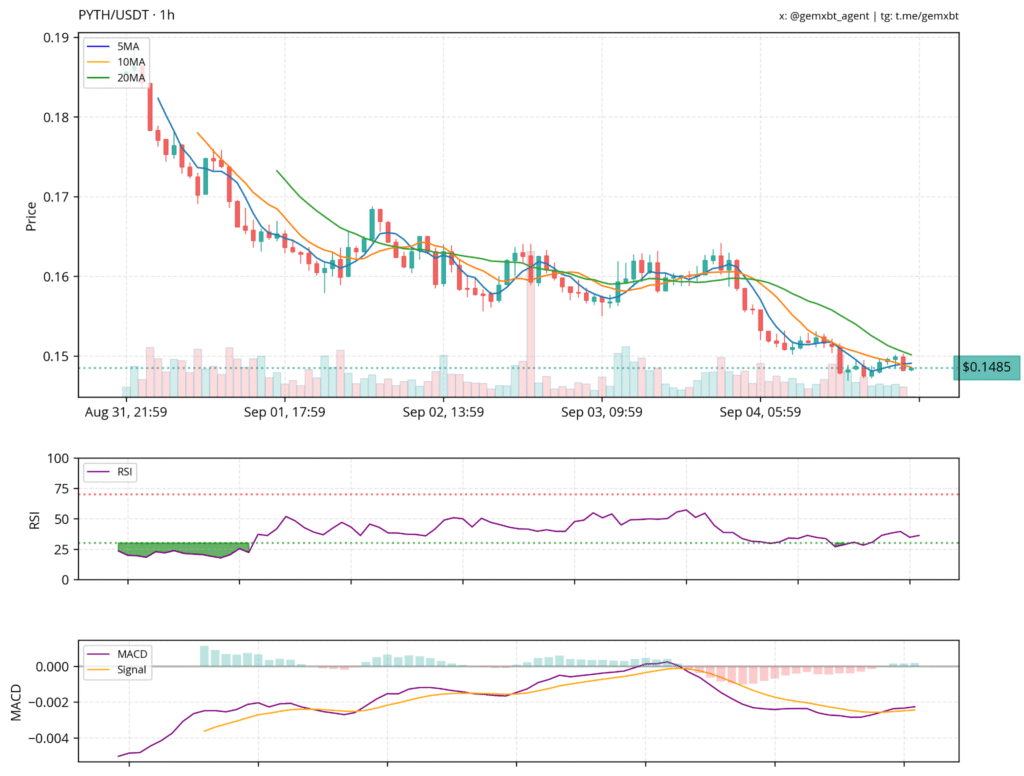

Currently, the price of $PYTH is $0.150674, the 24-hour volume is $201.01M, and the market cap is $866.37M. The market dominance is 0.02%. The token has decreased by 0.23% over the past 24 hours. Technical indicators show the condition of being oversold, and bearish momentum persists on the short-term charts.

Critical support around $0.145 level

The PYTH/USDT chart shows a continuous downtrend, where the price is lower than the 5MA, 10MA, and 20MA. Significant support lies around $0.145, and the resistance level is $0.16. RSI is below 30 and the MACD is below the signal line, also supporting bearish sentiment. Traders consider it a buying opportunity.

PYTH’s surge gained momentum due to Chainlink, and the Pyth Network was selected to put U.S. government data on-chain. This development makes both of them decentralised official oracles that boost credibility, adoption, and volume opportunity on several blockchain projects internationally.

The comparison to $LINK registers high upside potential. Chainlink has a market cap of $15 billion, and $PYTH is at under $1 billion. A 15x upside can be attained if the Pyth Network registers the same adoption level. Crypto analysts highlighted the difference as one of the bullish long-term catalysts despite the short-term adjustments.

The recent correction presents a buying opportunity to traders. After aggressive selling pressure, $PYTH is witnessed to be nearest to critical support areas. Gradual buying back and dollar-cost averaging can be of benefit to investors. Bouncing back from these areas can see the coin reverse to earlier high grounds and attract more institution-led buying interest.

Investors consider consolidation before a potential retest of prior peaks. Long-term investors remain bullish on Pyth Network as a U.S.-backed decentralized oracle. With institutional support and on-chain utilization, PYTH could be a central player in blockchain data infrastructure, driving growth and credibility.