XRP is gaining new notice as the use of Ripple’s RLUSD stablecoin gathers momentum. Business incorporation cements Ripple’s payments strategy internationally while illustrating utility in its network. Technicians note XRP’s repeating chart patterns that in the past have come before rallies. The focus now is whether XRP can unlock double-digit growth.

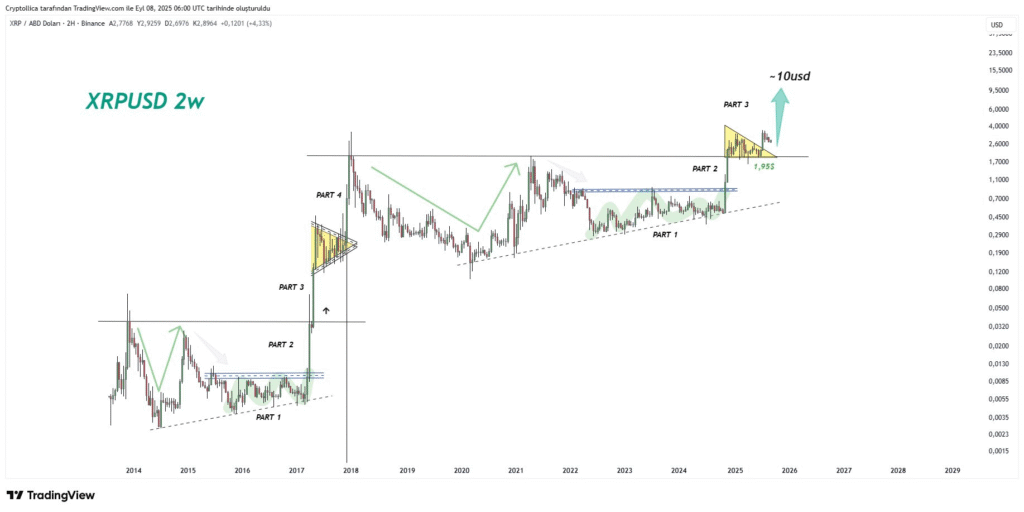

Chart patterns signal a possible breakout

According to analysts on the X, XRP charts mirror past patterns of consolidation in which parabolic movements unwound the triangle shapes. The current market at $3.01 indicates building momentum in a similar pattern. The similarity in the pattern has created speculations of an increase through the highs.

The analyst emphasizes parallels with 2017, when XRP saw an exponential gain. The historical reference boosts market expectations that present structures will spark the breakout into the $10 region. Optimism is growing as long-term investors keep building confidence that big moves are within the realm of possibility in the unfolding chart architecture.

However, protection at $1.95 is essential in order to prevent breakdown into longer-term consolidation. A breakdown of this level may disrupt bullish momentum. Traders watch this threshold closely in order to gauge the near-term direction of the coin.

RLUSD adoption expands Ripple’s payment vision

VivoPower’s EV business, Tembo, is integrating the RLUSD stablecoin in its cross-border payments. The move reduces the settlements cost compared to the banking system. The move secures Ripple’s network with a safer and more efficient asset for cross-border settlements than the RLUSD is.

Ripple has already broadened RLUSD usage in Africa via Chipper Cash, Yellow Card, and VARL agreements. These agreements reflect growing practical use of the XRP Ledger. The adoption of VivoPower is another vote of confidence, indicating that growing use cases could offer more support in terms of prices for Ripple’s in-natively token.

Is $10 next for XRP investors?

The path forward for XRP to $10 is dependent upon regulation guidance, positive macro, and institutional adoption. The SEC resolution removed significant hurdles, while global partnerships and upcoming rate reductions provide a push. These variables in tandem maintain the bulls’ long-term outlook.

At the moment, XRP ranges from $3.14–$3.22, consolidating after settling. Technicians propose that the symmetrical triangle breakout will validate a 25% descent towards $3.50. Should support remain in place and adoption gain further traction, the linchpin could ignite XRP’s biggest growth period yet, mimicking historical breakout tendencies toward double-digit levels.