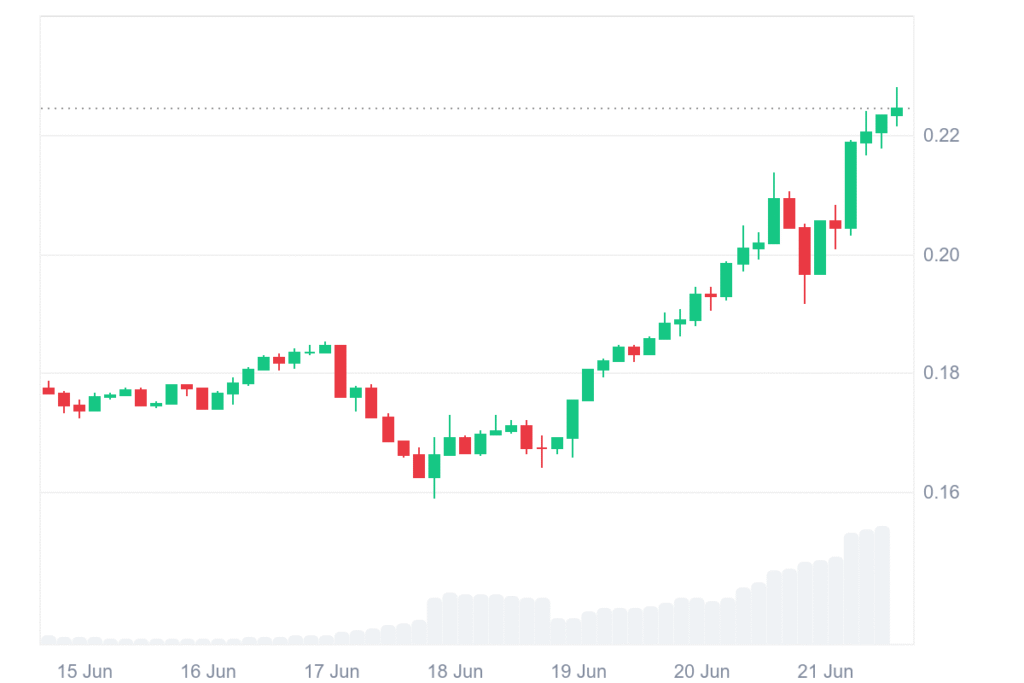

Sei still surprises investors after reaching $0.2269, realizing notable gains on key time frames this week. In 24 hours, Sei posted an 11.34 percent jump in price, exhibiting renewed strength in sentiment towards the token in markets.

Its weekly growth now totals 28.34 percent, indicating a sustained upward trajectory that has attracted greater attention from analysts. Sei’s 24-hour trading volume is $441.7 million, which shows fairly decent activity on cryptocurrency exchanges.

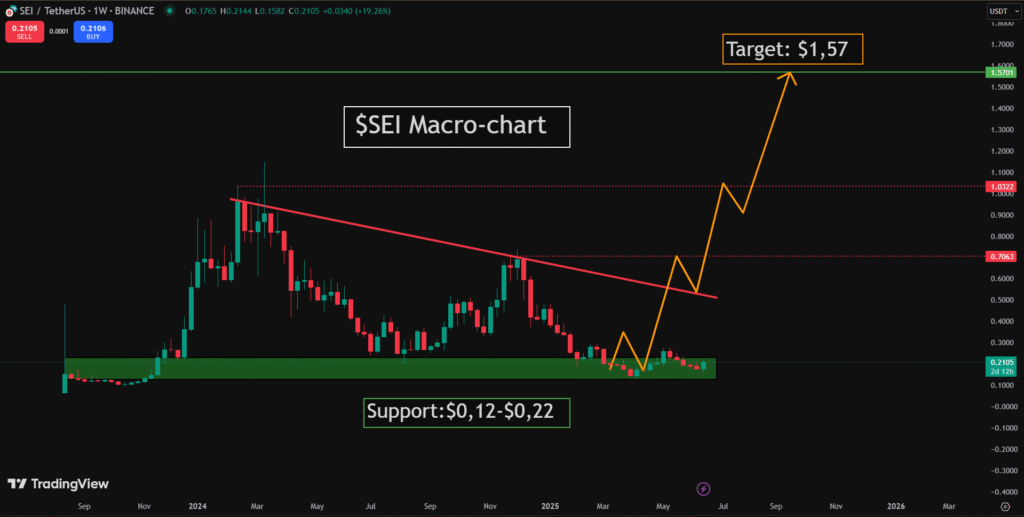

The combined market capitalization reached $1.26 billion, positioning Sei among the higher-valued mid-tier cryptocurrencies in existence today. An in-depth technical chart published by Lars Solberg shows one possible breakout that could send prices to $1.

This macro chart shows an area of consolidation in the range $0.12 to $0.22, where Sei found persistent support in downtrends. A broken red trendline across the chart shows us that a new bullish trend is building after a recent consolidation in prices.

The breakout to the upside indicates building energy, and traders might aim for the $0.70 to $1.00 zone in subsequent sessions.

Sei price eyes a $1.57 breakout opportunity

Further upside could reach $1.57 from this base, which would represent over 600 percent growth from the support area. An increase in volume helps confirm the breakout narrative, with a recent 62.70 percent rise bringing it near $234.7 million.

Although this trend looks promising, analysts warn that failed breakouts occur frequently without follow-through volume and clear resistance levels. Experts note missing resistance checkpoints between $0.33 and $0.70, which traders must watch carefully in the next few days.

Sei has also gained a fundamental advantage, following its selection in Wyoming’s state-backed stablecoin pilot program announcement. The partnership signals growing confidence in Sei’s underlying technology and could lead to greater institutional attention across U.S. markets.

There may still be short-term corrections, so one waits for support tests or new spikes in volume before sharp movements. Future steps will be dependent on technical confirmations and any additional information available pertaining to either the Wyoming initiative or overall marketplace developments.