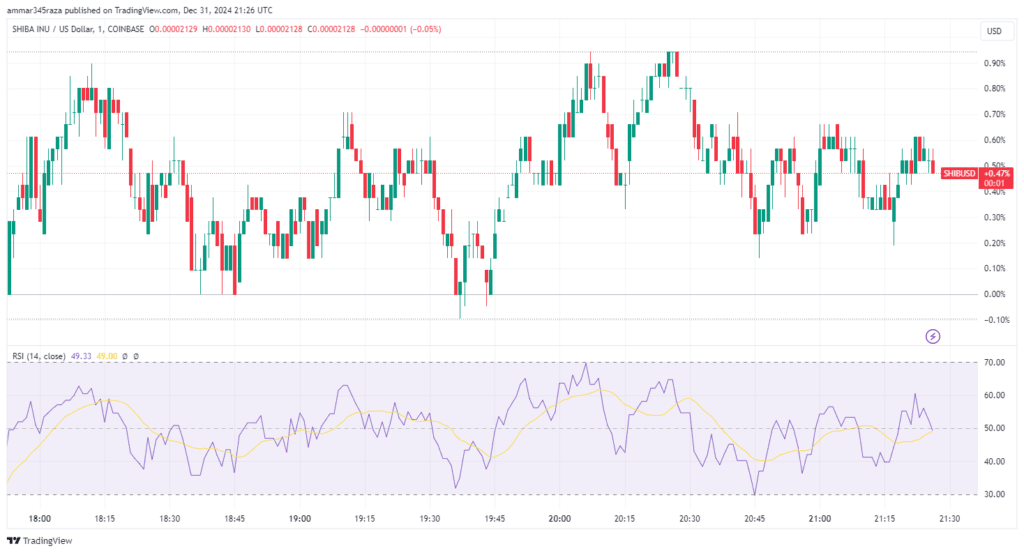

Shiba Inu (SHIB) has faced a 6.45% price drop over the past seven days, but signs of recovery are emerging. The RSI is now at 46.9, indicating a balanced market in which neither buyers nor sellers are taking the lead.

The RSI is one of the most important momentum indicators that chart the strength of price action between 0 and 100. Levels usually interpreted as showing overbought conditions are considered above 70, while below 30, readings may indicate potentially oversold conditions.

This neutral zone has remained in the same conditions since Dec 20, signaling that there is little powerful upward or downward momentum. Traders will continue to be very careful and wait for a definitive sign that will push SHIB out of the range where its price is currently moving.

The RSI for SHIB shows that consolidation has set in, and there is no major pressure to rally or decline. The market seems indecisive at this point in time, with SHIB hovering near critical levels.

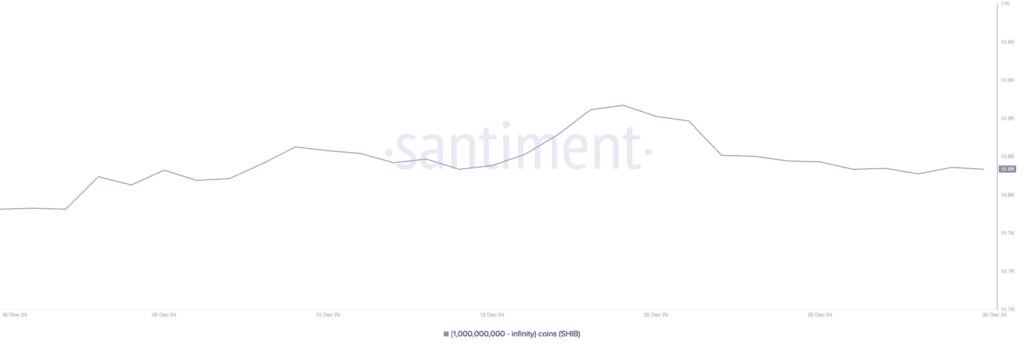

Whale activity in the Shib Inu ecosystem has been neutral, too. For instance, on Dec. 19, whale wallets holding more than 1 billion SHIB totaled their monthly high of 10930 wallets. The total count since then has kept dipping and stood at 10,861 wallets.

This means whales are neither aggressively accumulating nor selling their large amount of holdings. The stability of whale activity usually means a standstill in market direction, as most large investors will wait for clear market cues before moving in substantial numbers.

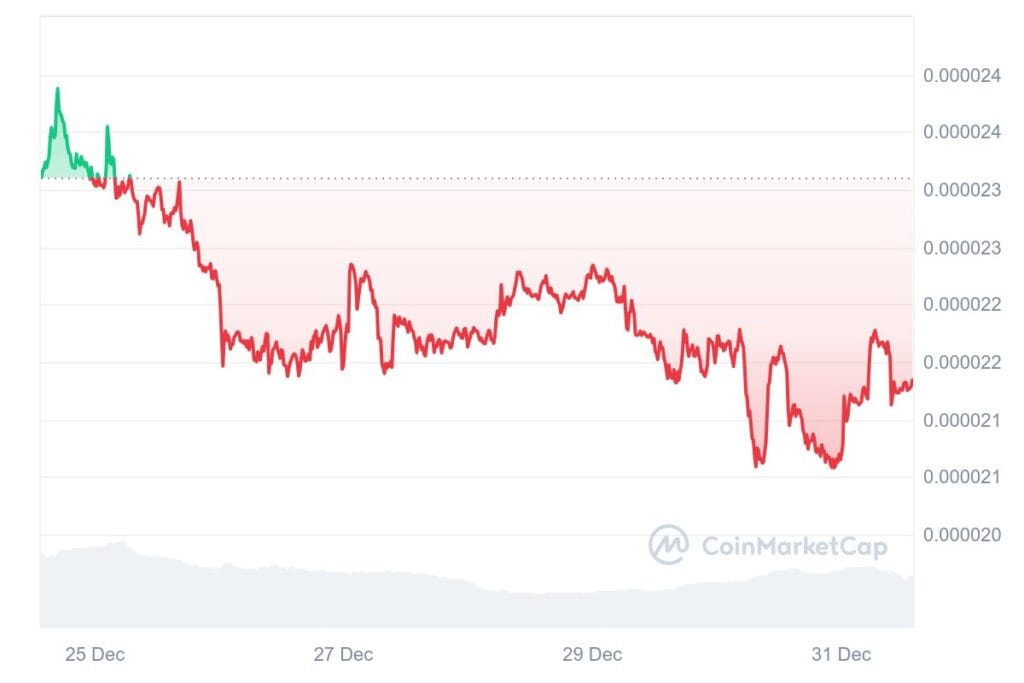

Shiba Inu price faces critical resistance at $0.0000225

If the bullishness intensifies, despite recent downward pressure, SHIB can attempt to climb upward. The immediate resistance stands at $0.0000225. A breakthrough at this level might create further upside action towards targets of $0.000024 and $0.000026.

On the contrary, if selling pressure mounts, SHIB might pull back for support at $0.0000198. A failure to hold at this level could result in further declines toward $0.0000185, a key support area.

For now, the short-term direction of SHIB depends on whether buying pressure will be strong enough to overpower selling activity. Traders are closely monitoring these levels of resistance and support, expecting an upside or downside breakout. The price action of SHIB in the next few days would depend on market sentiments, external factors, and whales.