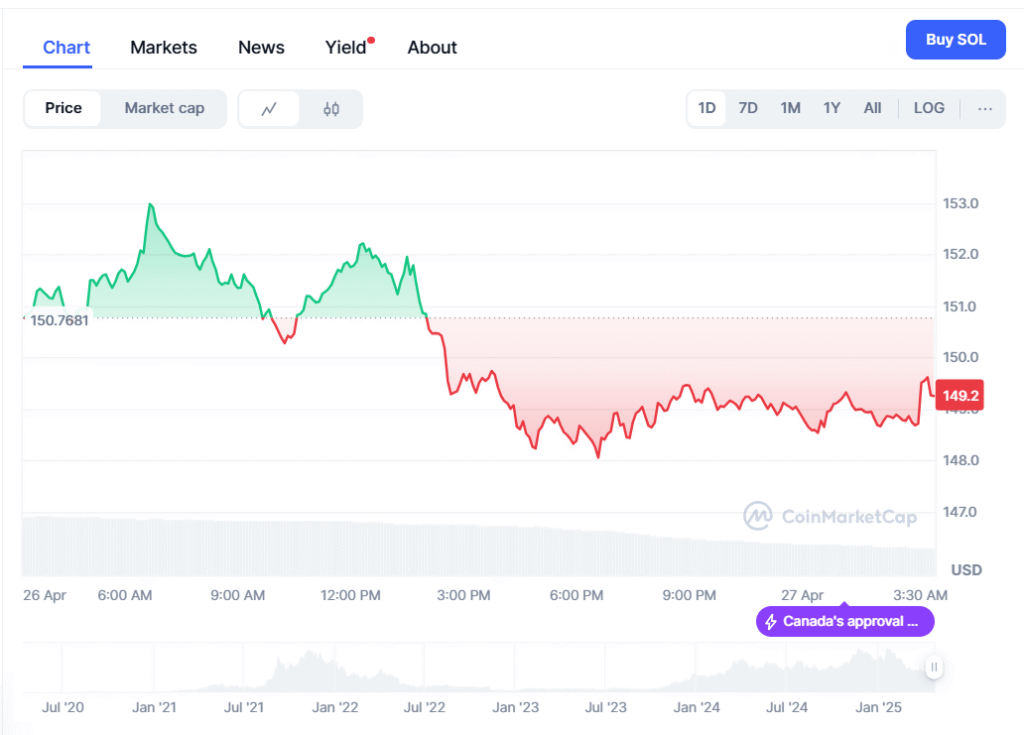

Solana (SOL) is trading at $149.58, down 0.78% in today’s trading. Its 24-hour trading volume declined precipitously by 52.09%, to $2.14 billion. This reduced volume indicates a temporary break from the recent high momentum. Even so, the weekly gains are robust, with SOL increasing 7.59% for the past week, indicating sustained investor confidence.

Analysts identify technical strength behind the price of Solana. Average Directional Index stands at 66.1, reflective of a strong trend. While price is also at 92.3% of its last traded high, this indicates that SOL is operating close to discovery mode. That is, the market continues to explore value, and buyers are working to hold at these levels.

Solana price holds steady around $148

The structure of the market indicates that Solana is consolidating at around $148. The buyers maintain steady pressure, which is evident from a positive ratio of 1.03x, indicating that demand continues to outstrip supply. But the Relative Strength Index (RSI), at 74.16, also indicates that the currency can be considered overbought in the short term, which may trigger retracements or side movements.

Focus now falls on the $150 hurdle. A clear break and hold at this level may trigger new buying interest and propel prices up to the next target at $157. Traders also need to monitor for resistance at $152, which proved to be that important obstacle. Rejection at this point may trigger a pullback or pause, and traders may be offered opportunities for planned entries on declines.

DeFi development to raise $1B for Solana

DeFi Development Corp. plans to raise capital worth $1 billion to add to its holdings of SOL. The objective for this is to strengthen its treasury and engage more actively with the Solana blockchain. It already has around $48.2 million of SOL and plans to run validators, collecting staking rewards that contribute to their long-term investment plan.

This aggressive push follows major management moves, particularly the onboarding of former Kraken and Binance professionals carrying robust crypto-industry experience. After these updates, DeFi Development stock skyrocketed more than 970%, now trading for $54 a share after-hours. The company’s strategy mimics strategies employed by major Bitcoin corporate acquirers, making Solana a legitimate player within the crypto world.