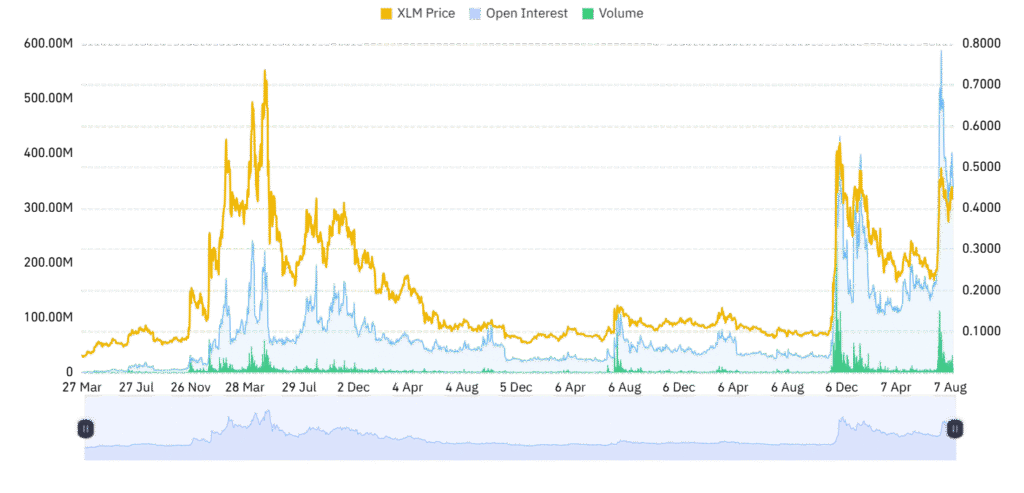

Stellar (XLM) has managed to stand out in a largely bullish market environment, showing resilience in its price behavior. Over the last twenty-four hours, XLM gained nearly 1.21%, though its performance across the past week reflects a decline of 1.86%.

At the time of writing, the token trades at $0.4304 with a market capitalization of $13.47 billion. Daily trading volume sits at $199.64 million, marking a sharp 47.71% decrease within the last day, indicating reduced but still active participation.

XLM Technical setup points to imminent breakout

XLM is settling in a symmetrical triangle shape in the three-day chart, which emerged following a strong rally off the $0.20 level. Such a shape tends to arrive in advance of a cooling-off process prior to the subsequent decisive move.

The range is constricting around $0.40 support and $0.45 resistance, suggesting a breakout either upwards or downwards. Should the buyers be in control, the higher side of $0.45–$0.47 would need to be breached in order for the momentum to continue towards $0.5499, a region confluencing with previous highs and believed to be a key resistance area.

Key levels define bullish and bearish scenarios

The support is steady at $0.40, with additional strength around $0.35, the source of the last significant rally. Should the trend reverse, $0.23 still serves the long-term accumulation area. The case for the bulls is dependent on the market remaining above $0.40 and the breakout over the $0.47 level with decisive volume.

Achieving a daily close above $0.55 could potentially open the door for broader price expansion. On the downside, failure to hold above $0.40 may trigger declines toward $0.35 or even $0.23 if bearish pressure intensifies.

Market signals show mixed sentiment

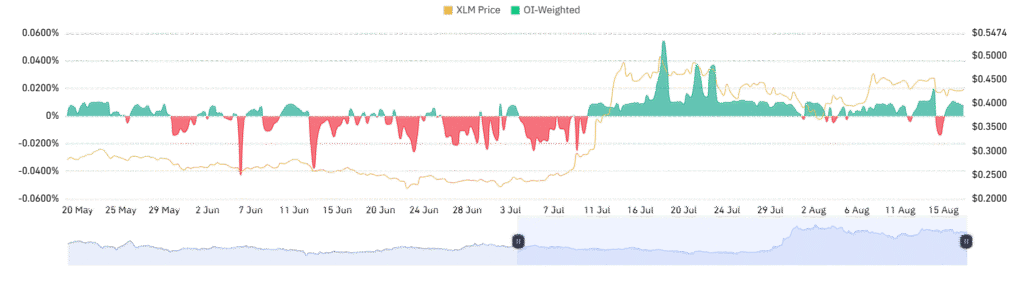

Last trading activity reflects rising volatility and prudent positioning. Open interest declined 1.67% to $341.40 million, indicating a portion of traders have exited and cut leverage exposures. Although this fall occurred, trading volume reveals steady involvement.

Concurrently, OI-Weighted is at 0.0070%, which indicates a slight long bias where traders are tentatively biased towards the bullish side. This prudent optimism, in combination with decreasing open interest, indicates the current market is waiting for a very clear directional breakout before making a stronger commitment.

Overall, Stellar maintains a good shape so long as the $0.40 support is intact. As the consolidation tightens in the symmetrical triangle, the $0.47 resistance becomes the most important portal in the subsequent meaningful move, and $0.5499 the top uptarget.