SushiSwap (SUSHI) currently trades at $0.5513, with a daily trading volume of $36.99 million and a market capitalization reaching $151.29 million.

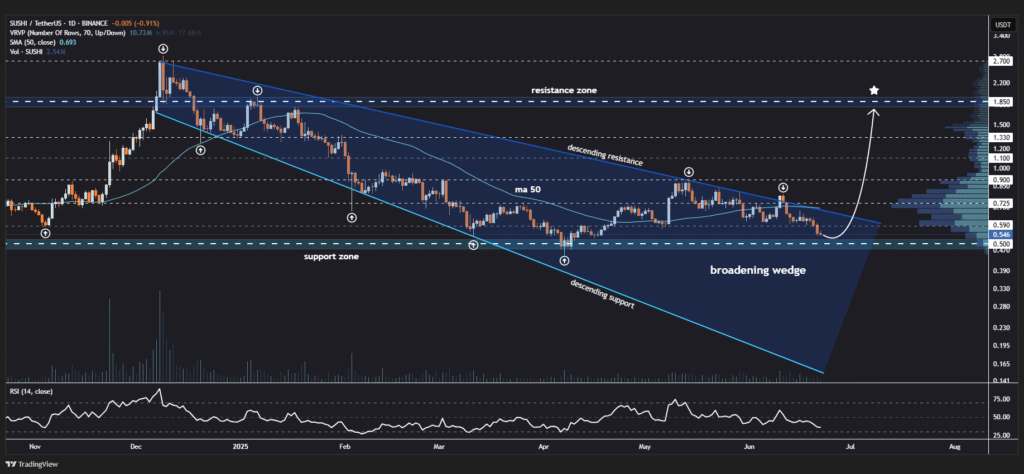

The token now forms a broadening wedge pattern on its daily time frame, showing rising volatility and diverging trend behavior. This pattern forms when prices move between a falling resistance line and a rising support level, widening over time.

SUSHI has been moving between the wedge’s descending upper boundary and a critical horizontal support line placed near the lower side. The wedge, shared by JohncyCrypto on a technical chart, indicates a potential breakout set-up that tends to be seen before large price moves.

The region of support has continually attracted buying demand, and the overhead trendline has rebounded back upward moves several times. Price momentum in the wedge indicates increasing indecision, but it consolidates for a breakout at a point of re-emergent momentum.

SushiSwap nears breakout amid rising volume

If SUSHI manages to break through the wedge’s upper line with significant volume, it may trend towards estimated levels at $0.725, $0.900, $1.100, $1.330, and $1.850. These estimated levels have been drawn based on past zones of resistance and technical confluence that have been evident in chart trends.

A histogram below the chart shows spikes at around key price tests, and these are buyer and seller participation reacting around these wedge lines. Traders typically look at these types of indicators to gauge interest and confidence during uncertain periods.

Below the line chart of volume, momentum indicators are possible but definite tools are not evident. Their fluctuation trend shows that no overriding market force is presently in control.

SushiSwap is consolidating for the moment now as the traders await a decisive breakout or breakdown. Previous trends suggest a large price move is imminent after the narrowing price range.

SUSHI exemplifies the volatility common in DeFi tokens, often making sharp moves based on technical chart patterns. Its price also reflects shifts in investor sentiment across the broader crypto market.