TRON (TRX) is trading under bearish pressure and is eyeing a decline in its value, mirroring the broader market sentiment. As Bitcoin is moving in a downward direction, it is impacting the overall market, including altcoins. But experts are predicting a bullish reversal for TRX, which may lead to $.42.

At the time of writing, TRX is trading at $0.3385, with a 24-hour trading volume of $798.27 million and a market capitalization of $32.04 billion. The TRX price over the last 24 hours is down by 1.36%, and over the last week it is also down by 4.03%.

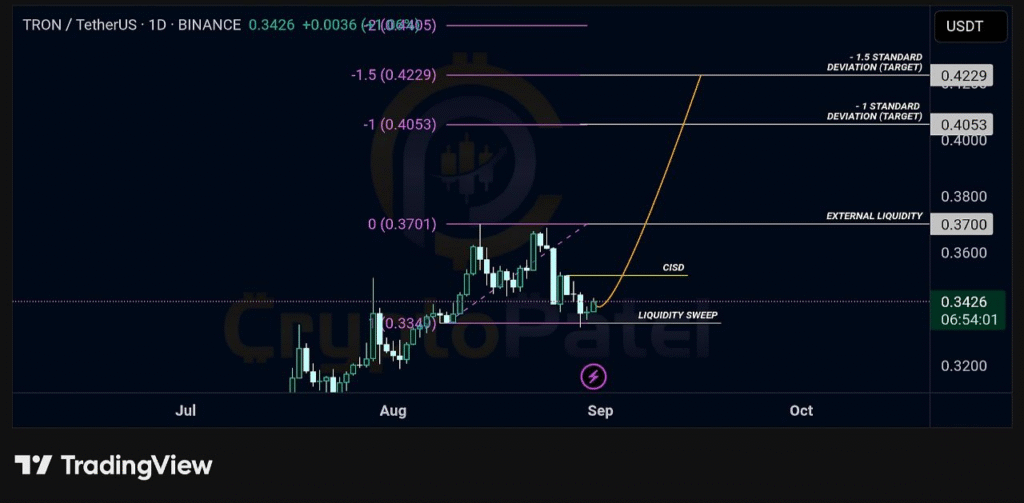

TRON eyes $0.42 after bullish liquidity sweep

According to the crypto analyst Crypto Patel, TRON’s native token, TRX, is showing new bull signs after clearing out downside liquidity and rallying back with strength. Analysts are describing the move as the starting point of a larger bull run, and traders are eyeing the zone of $0.42 as the next big target. Change of structure suggests fading bear pressure and a probable momentum-driven upsurge.

Liquidity sweep and structure break

Previous price action saw TRX clearing the downside liquidity, a movement generally seen as a bullish displacement movement. Clearing of liquidity gets rid of the weak positions prior to buyers taking control and reclaiming higher ground. The verified CISD (Change in Structure Displacement) break at $0.3520 has put credibility behind the bullish side and is showing that TRX now has the foundation it needs and can scale higher.

Targets and risk management

Currently, analysts are plotting three major upside targets for TRX. Initially it is $0.3700, an external liquidity point that can double up as an early checkpoint. Then it is $0.4053, which has been termed the 1 Standard Deviation (SD) level and a stronger resistance point. Finally, the key bullish target is at $0.4229, the 1.5 SD level and a very significant ceiling of this phase of the rally.

Stop-loss management is still necessary, and the stop-loss point of concern is at $0.3306. Below this would eliminate the bull perspective and leave TRX vulnerable to a corrective move. Nevertheless, sentiment remains firmly bullish currently, and bulls are looking to ride the liquidity draw and profit from potential gains on the upwards move of TRX towards higher resistance levels.