VeChain (VET) is holding out against broader indecision across the crypto markets. In the last 24 hours, the token was mostly static, registering a minor 4.96% boost in trading volume, which came in at $52.8 million. Currently, at $0.02345 per coin, VET has a market cap of $2.01 billion. On a weekly level, the coin has slipped by 2.93%, indicating investors’ cautious stance. But experts notice that this present area creates a good setup for accumulation while VET continues to build a solid foundation.

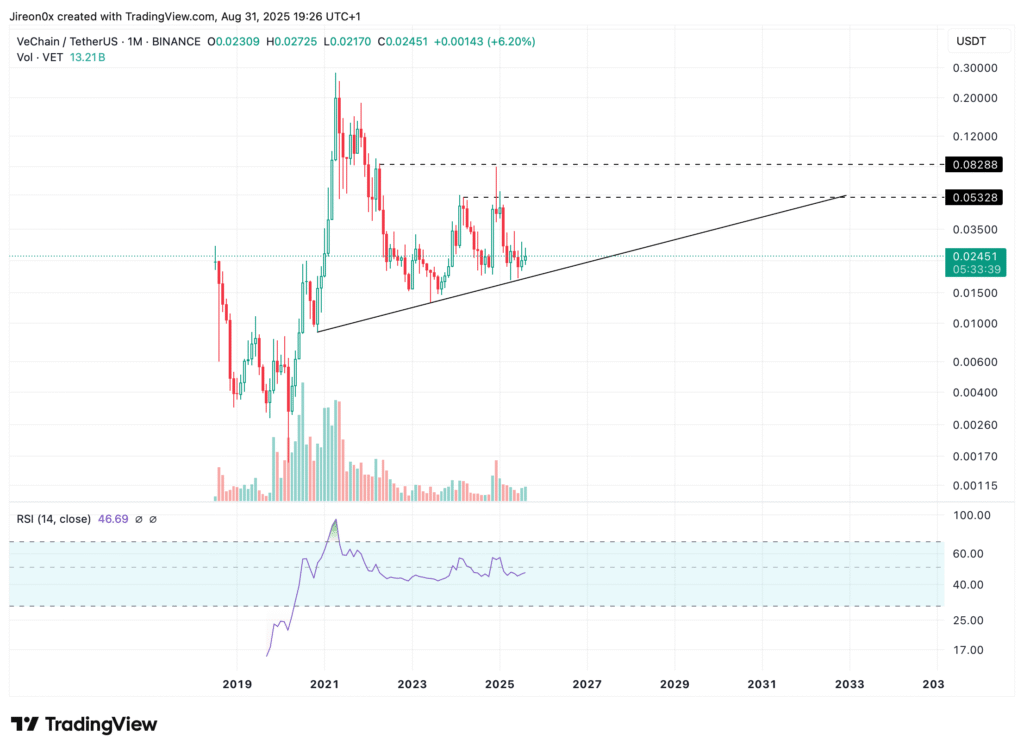

It recently broke out above $0.0245, moving within range of its long-term ascending trendline which provided good support since 2020. This region around $0.023 to $0.025 is considered a confluence zone where buyers continue to return again and again, a sign of strength even in cases of broader selloffs.

VET technical structure signals opportunity

Technically, we have a potentially bullish setup. VeChain has established higher lows since finding a bottom in 2020, a sign of ongoing optimism among investors. Resistance is at $0.05328 as a major initial target, then $0.08288. Both levels previously topped upward advances and thus remain significant breakout levels.

The present graph makes an ascending triangle formation, typically a bullish setup. If VET manages to breakout and close above $0.053–$0.082 level on high volume, then the token has a target on the $0.12 level on the next macro bull run. Relative Strength Index (RSI) stands at 46.69 in a neutral momentum condition. This provides some freedom on the upside side until any situation of overbought occurs, which favors a cautious accumulation scenario.

Market sentiment remains guarded

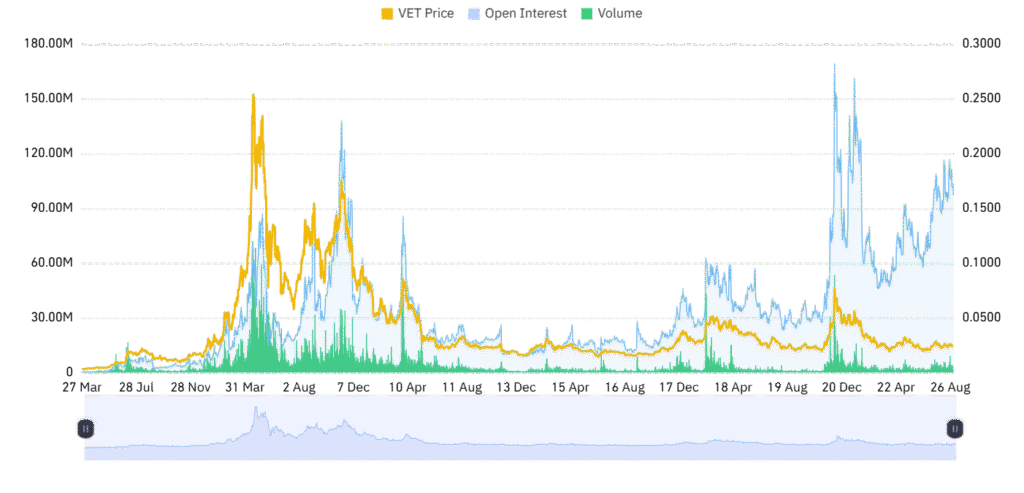

Open interest in VET futures rose lightly by 0.22% to $100.07 million, reflecting careful positioning by traders. Such a rise is in line with reduced volatility versus past bull phases.

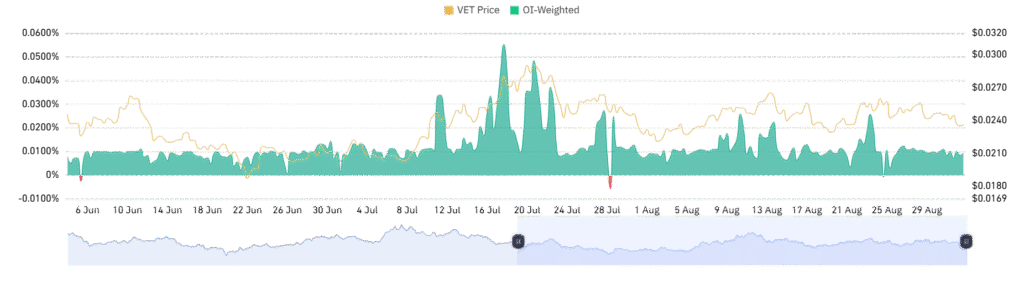

OI-weighted funding rate is at 0.0096 right now, a slightly positive reading that reveals a soft bias toward long positions but without strong conviction.

Volume patterns also confirm the cautious mood. Although accumulation does exist, the inability to create sharp spikes suggests the market is waiting for a clear-cut signal. A breakout above the level of resistance may trigger higher flows, but until such a breakout materializes, VET’s stability bolsters the long-term accumulation theme ahead of a shorter-term momentum trade.