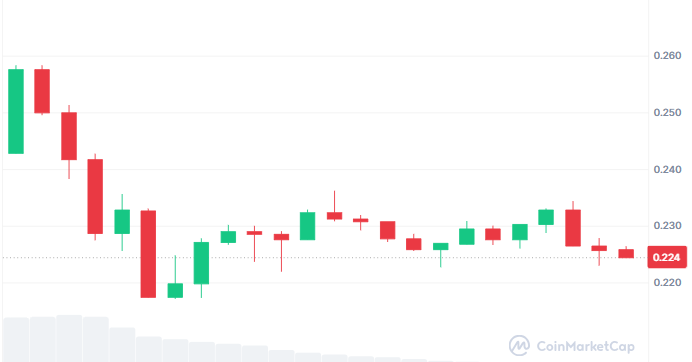

World Liberty Finance (WLFI) is in consolidation after a recent decline, currently trading at $0.2257 USDT. With lower trading volume and sideways price movement, the market appears cautious, waiting to see if WLFI can break key resistance levels or continue its downward trend.

WLFI is trading at $0.2247 USDT right now, down moderately by 0.0014 USDT. After a sharp decline, the WLFI/USDT chart for the 1-hour time frame shows that the price is moving sideways. Trading volumes are down sharply, indicating that market participants are catching their breath and waiting for a clear direction.

WLFI recovery possible above $0.25

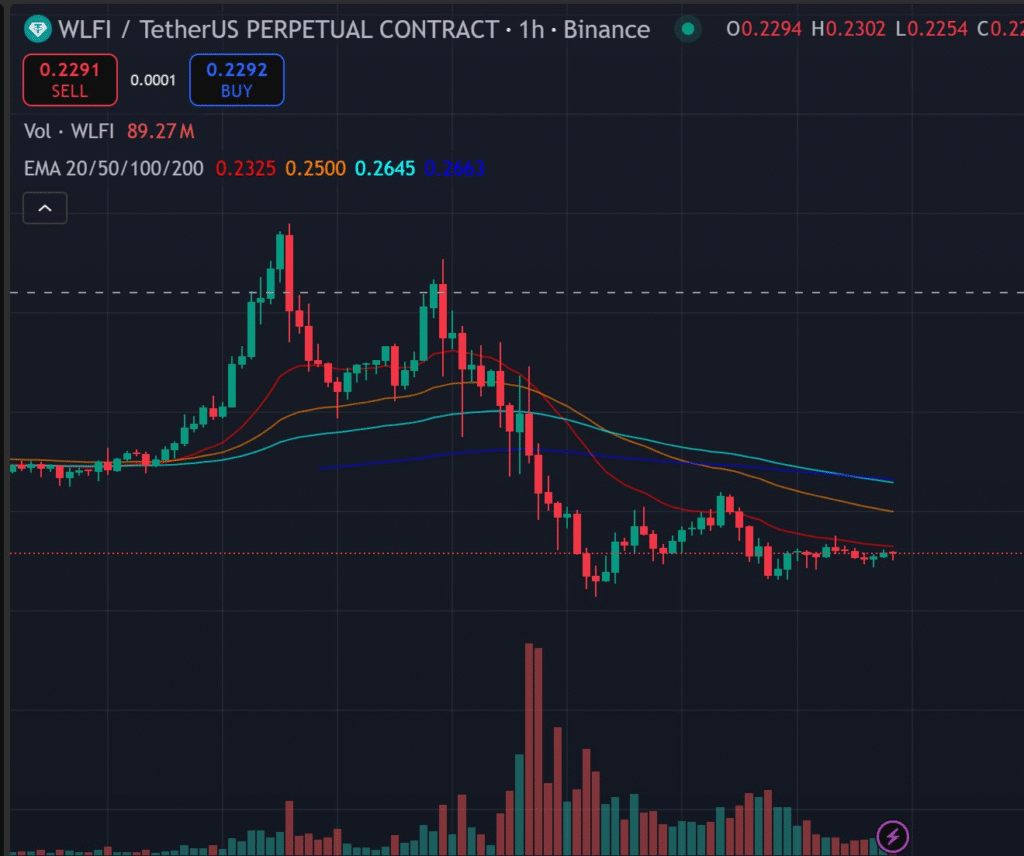

According to Bellstoshi’s post on X, the WLFI/USDT chart shows consolidation after a strong downward move. The exponential moving averages (20, 50, 100, 200 EMA) remain in a bearish alignment, with shorter-term EMAs below the longer ones.

This implies that the overall trend continues to be south despite recent stagnant price action. Reduced volume across this consolidation is a sign of tentativeness, with neither buyers nor sellers pushing the market aggressively.

If it manages to go through above $0.25–$0.26 with increasing volume, then short covering can occur. Support areas are visible currently at $0.225–$0.226, around which the price has stabilized. A decline below $0.220 can attract further selling, while $0.210 is further support from previous consolidation areas, serving as a likely target on resumption of bear momentum.

To its credit, $0.235–$0.238 acts as initial resistance before $0.250, in line with the 50 EMA and potentially prompting a reversal to the bulls should it be breached. A move to $0.265, in the vicinity of the 100 EMA, would signal a more solid reversal potential.

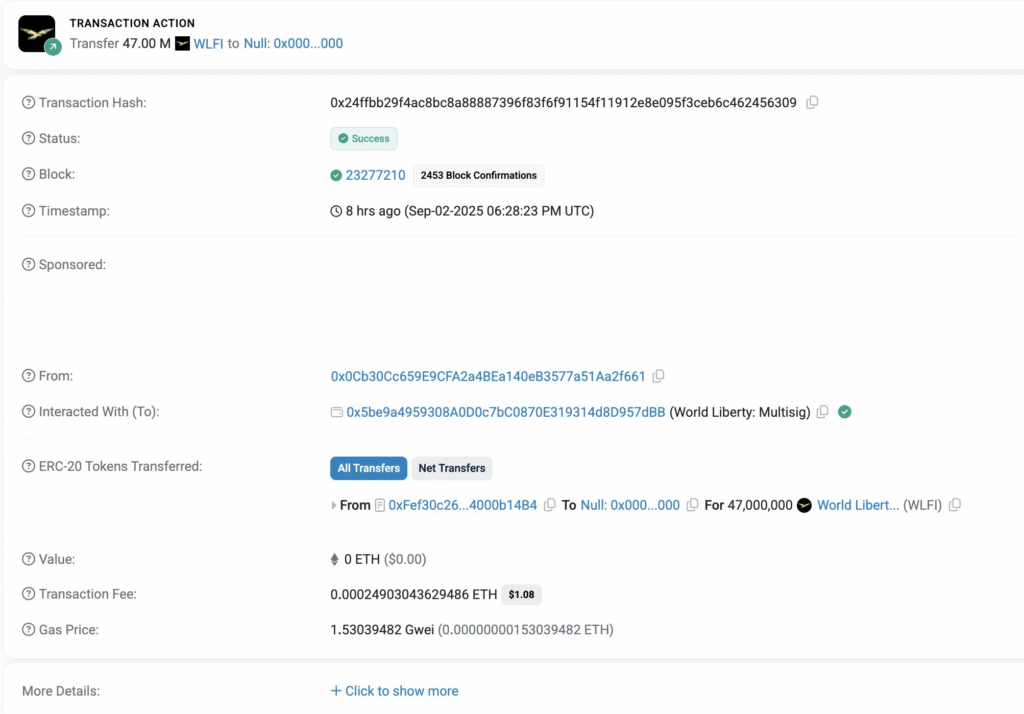

Adding to market activity, Lookonchain’s post on X reported that 47 million WLFI ($11.34 million) were burned 8 hours ago, reducing circulating supply and potentially influencing price action.

With continued consolidation in play, bulls and bears are eagerly looking for a breakout above resistance or down to below support levels.