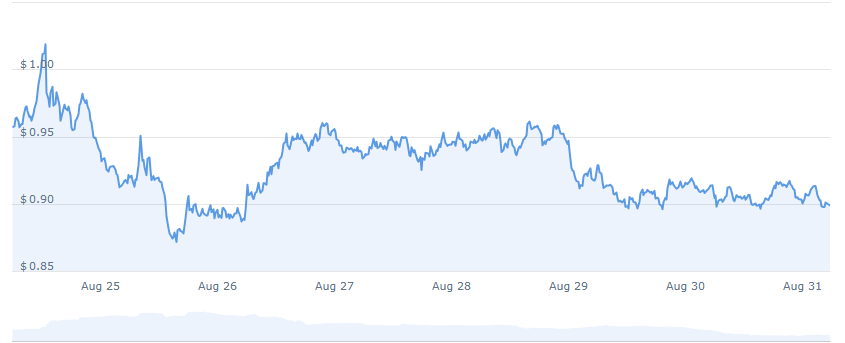

Worldcoin (WLD) is trading at about $0.90 after a slight daily decline, with market signals showing pressure building around significant levels of support. Despite keeping steady open interest in futures, technical indicators suggest ongoing weakness, leaving the token vulnerable to further downside risks unless momentum shifts toward recovery.

The current price of Worldcoin is $0.898.Daily trade is $136.69 million, while market capitalization stands at $1.78 billion with 0.05% market dominance as per CoinCodex. The digital currency has gone down by 1.69% over the last 24 hours, reflecting weak momentum.

The historical background of this asset has included significant volatility. Worldcoin peaked on March 10, 2024, at $11.78, then gradually drifted downwards to reach an all-time low price level of $0.5779 on April 7, 2025. WLD has gone as high as a cycle peak of $1.64 since that low point, unable to retake higher ground.

Derivatives market signals possible turbulence

Fresh WLD/USDT price analysis shows open interest in the derivatives market between $190 million $210 million. Noticeably, open interest failed to drop from $0.96 to $0.90. That means market participants are maintaining or hedging their positions instead of liquidating them, which is generally a signal for a quick change in the next few days.

These are situations that can cause market tension. If open interest continues to increase while prices are flat or decline, then Worldcoin can be setting itself up for volatility. To the downside, a selloff can push the token through its main level of support at $0.88. To the upside, short covering can catalyze rapid moves higher in price as positions are compelled to cover, propelling prices higher.

Worldcoin technical indicators indicate weakness

Technically, WLD remains under pressure. The token is changing hands in the area of $0.90, dramatically lower than the cycle high of $1.64. The MACD indicator suggests a bearish setup, as the MACD line (-0.030) is lower than the signal line (-0.026). The histogram also leans negative, reinforcing downward pressure.

The Chaikin Money Flow (CMF) is 0.12, indicative of consistent outflows with weak buying power. There has been little indication since mid-July that worldcoin is being accumulated for the long term, with significant market participants still reluctant to offer significant support.

If the price fails to maintain $0.88, the next downside risk is $0.57, its historical cycle low. A bullish reversal is then feasible if the MACD predicts a crossover as the CMF advances into more positive or more neutral ground. To see a prolonged bounce back, Worldcoin has to reclaim resistance in the region of $1.00.