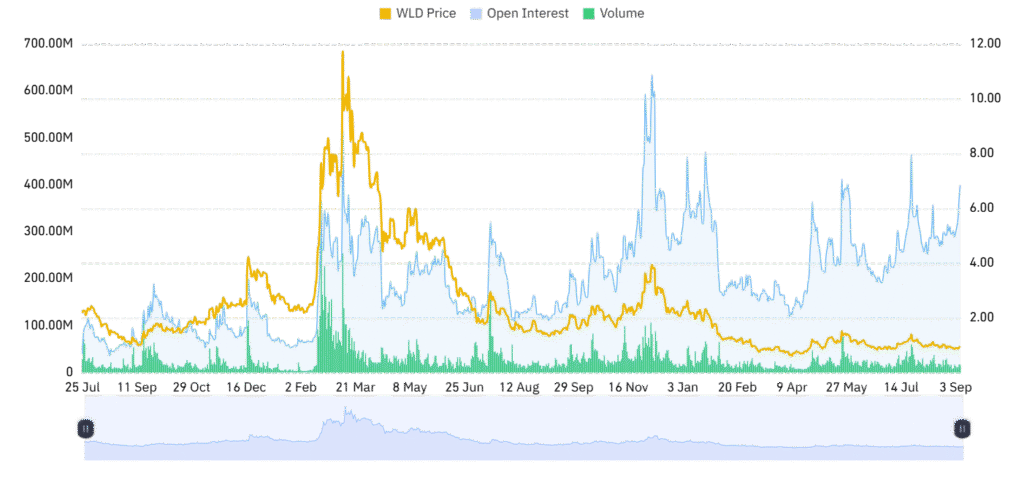

Worldcoin (WLD) is showing strength despite neutral overall conditions. The token has surged 14.29% in the last 24 hours, adding to a weekly gain of 15.49%. At the time of reporting, WLD trades at $1.03 with a trading volume of $399.3 million in the past 24 hours.

This volume reflects a sharp increase of 132.22%, underlining heightened market activity. The market capitalization now stands at $2.08 billion, positioning WLD among notable mid-cap assets.

The recent surge marks a shift in sentiment after weeks of consolidation. Buyers have been defending the $0.85–$0.90 zone, a level that acted as a strong base. This foundation is now fueling attempts at a breakout, with immediate resistance seen at $1.05–$1.10. Sustained momentum above this band could open the path toward $1.40–$1.50, an area that previously capped advances.

Worldcoin technical outlook and trendline breakout

The WLD daily chart illustrates a long-term downtrend stretching from highs above $4.50. A descending trendline has been capping rallies for months, but current action signals an effort to close above it. At $1.04, the price is testing this barrier, and success could confirm a bullish reversal.

The charts’ technical foundation offer calculated objectives to $2.40–$2.50 and suggest a potential 164% increase from the spot price. The daily candle close above the resistance supports the bullish case. The bear risk persists if WLD falls below the key level at $0.95 and penetrates the breakout attempt and possibly directs the price lower to the support at $0.80.

Derivatives market activity rising

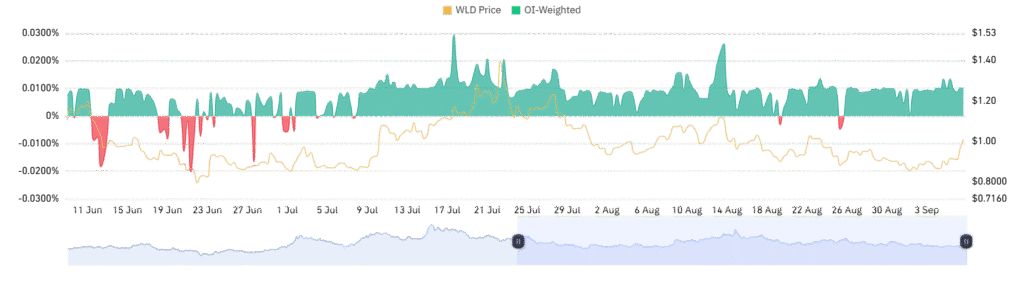

Other than spot trading, the derivatives activity has picked up good pace. The Open Interest has risen by 29.92% to $483.01 million suggesting firmer positioning among traders. Higher Open Interest in the case of a move higher generally depicts positivity in sustaining the gains.

Additionally, the OI-weighted rate for funding is 0.0102%. The positive bias means longs are paying shorts for funding, and leveraged traders are optimistic. However, the rate remains relatively small, suggesting the leverage is there and not excessive. Overall, the two describe a scenario of growing optimism as the Worldcoin asserts against major areas of resistance.