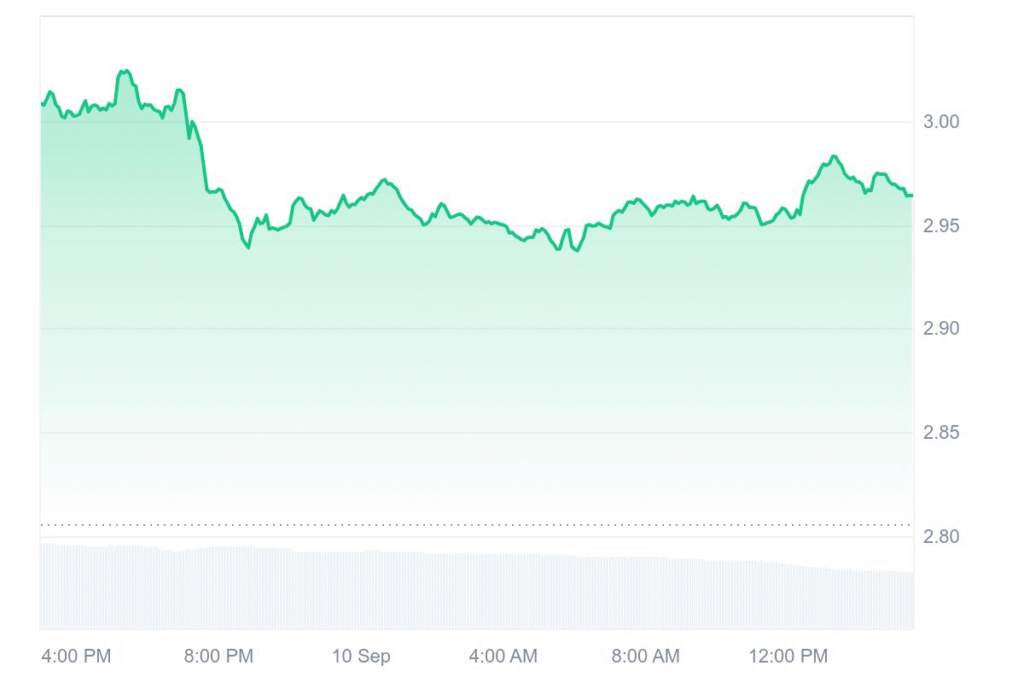

XRP is currently trading at $2.96, having dropped 1.26% in the last few hours. Market analysts have identified a quick dip in the trading volume, presently at $4.5 billion, a drop of 31.64%. Though the short-term drop was seen, the seven-day price shows resilience, having gained 3.85% in the last week. Market watchers are monitoring closely to witness the market’s reaction towards the swing.

Nevertheless, Analysts believe XRP’s small dip does not signify a downtrend in the long run. The cryptocurrency still holds up support levels comparable to those seen in earlier weeks. In fact Market watchers note such short retractions are normal in the aftermath of big price upswings. Short-term traders believe there are opportunities in small corrections.

Ripple holds strong above flag resistance

Crypto analyst Jonathon Carter admits a flag breakout in XRP. Ripple is holding above the flag resistance, he says. Such a formation suggests a potential continuation in the price direction. Carter considers classic signs: 50-day consolidation, breakout volume spikes, and old resistance in turn acting as a cushion for support.

Breakout targets are favorable for Carter. XRP may reach $3.37, $4.00, and even $5.00 in case the momentum persists. Traders and investors are very much on alert in anticipation of any sign for a reversal. Technical analysis projects positivity for medium-term growth.

XRP expected to surpass previous all-time high

According to DigitalCoinPrice prediction that XRP to reach $6.48 in December 2025. It could reach the initial milestone of $3.84 on the path towards reaching higher plateaus. XRP is expected to cross beyond its previous record high and set a corridor for $6.23 to $6.48. Market titans are upbeat on Ripple’s bull run.

Moreover, Changelly offers a more conservative prediction. Its 2025 forecast offers a minimum of $2.74 and a maximum of $3.06. Average price for trading is expected at $3.37, with potential ROI up to 1.7%. Specialists forecast September 2025’s price from $2.90 to $3.36 on average $3.13. Such forecasts are deemed stable, medium-term growth prospects by investors.