XRP continues to show signs of consolidation as it moves within a massive bull pennant pattern. With price action remaining beneath a resistance level of $2.73, XRP could face a pullback to $2.05 before going on a breakout that could send the price to $11.

As of press time, XRP was trading at $2.25, reflecting a decline over the past 24 hours. Its market cap stands at $129.02 billion. Additionally, a sharp rise in 24-hour trading volume indicates a dynamic and active market environment.

XRP current market dynamics

XRP’s market behavior has been quite volatile in recent months. Price swings often correspond to net inflow and outflow activity. The market’s inflow and outflow of XRP are tracked via the NetFlow data, revealing notable net inflow spikes in November 2023 and Dec. 2024.

These spikes in buying activity coincide with sharp price increases, strengthening the notion of positive market sentiment at those times. When the inflows turned to outflows, the price typically reflected the selling pressure with corresponding declines or stagnation.

The recent market movement has taken XRP to $2.50, which is a high above $3.00. A steady flow of net inflows follows a rising retail price. This offers the potential for the cryptocurrency’s value to push higher if demand remains robust.

Technical indicators: Mixed signals

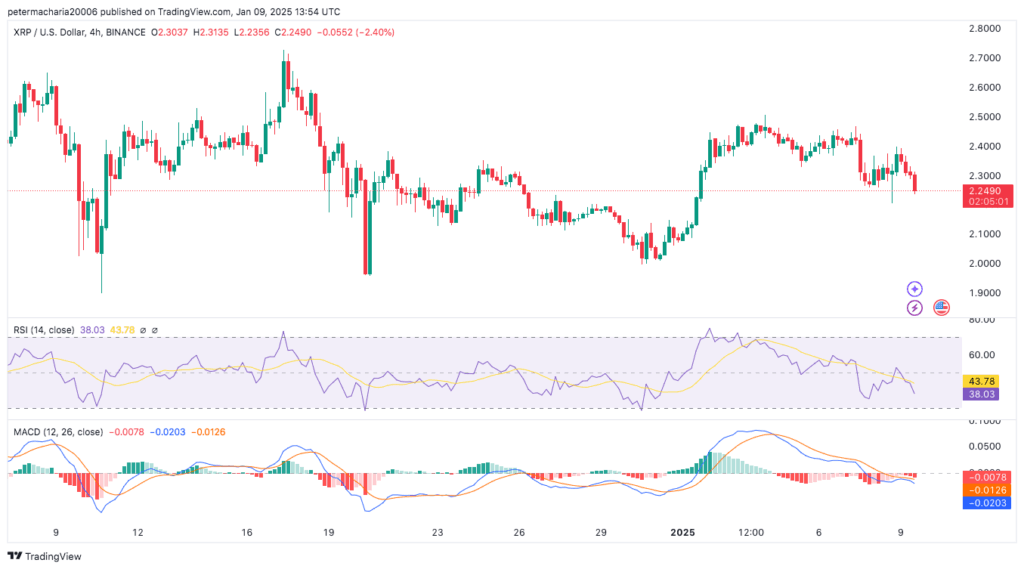

The technical analysis of XRP has both the bullish and bearish stakes pointed as follows: The RSI has recently emerged with 43.78, which is just below RSI 50, indicating an equilibrium. This means that the XRP currency is in a no-bull market, which is in between bullish and bearish phases. Nevertheless, if the RSI increases above 50, that will indicate trends in the momentum.

Currently the MACD signal line is at 0.0157 while the MACD line is at a -0.0126 which is on the bearish side of the divergence. This means that the relative bearish pressure that was signifying contraction of the MAC can histogram is now oriented on MACD is affirming line, which has a meaning of general bearish direction of the chart.