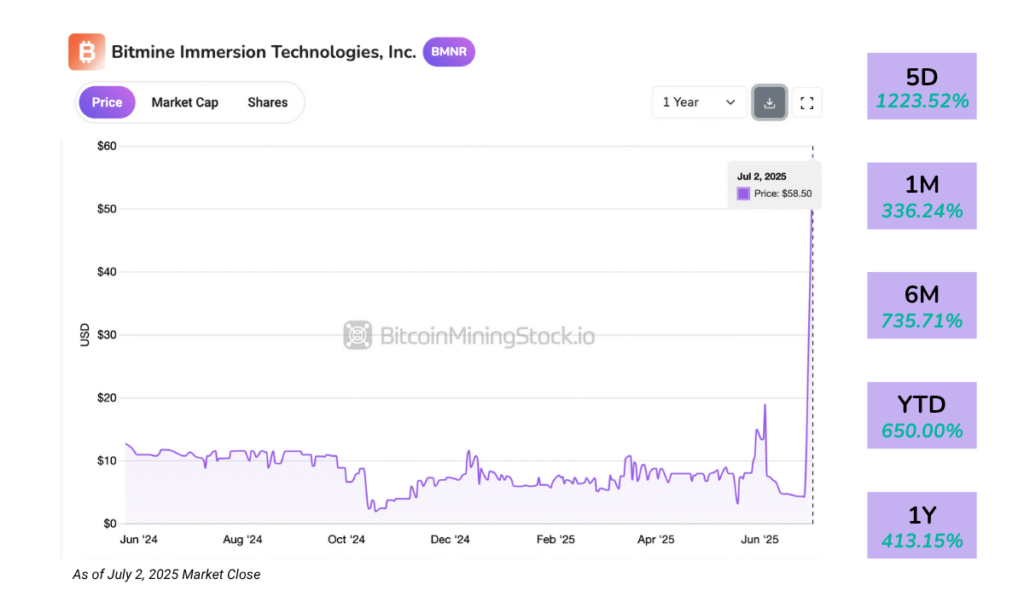

BitMine Immersion Technologies saw its stock price explode after naming Wall Street veteran Tom Lee as Chairman. The company’s shares jumped over 700% in a single day. Now, BitMine is raising $250 million to build a major Ethereum treasury. The firm aims to become the largest publicly listed holder of ETH.

This strategy resembles the Bitcoin playbook that MicroStrategy used years ago. BitMine is not leaving Bitcoin entirely. Instead, it wants to pivot into Ethereum while maintaining its position in the Bitcoin mining sector. The goal is to use Ethereum as a core reserve asset.

BitMine has modest mining power. It runs fewer than 4,000 ASIC machines across five global sites, including in Texas and Trinidad. The mining operation is small when compared to major public miners. However, the firm has diversified beyond mining. It offers mining-as-a-service, leases hash power to institutions, and advises on Bitcoin treasury strategies.

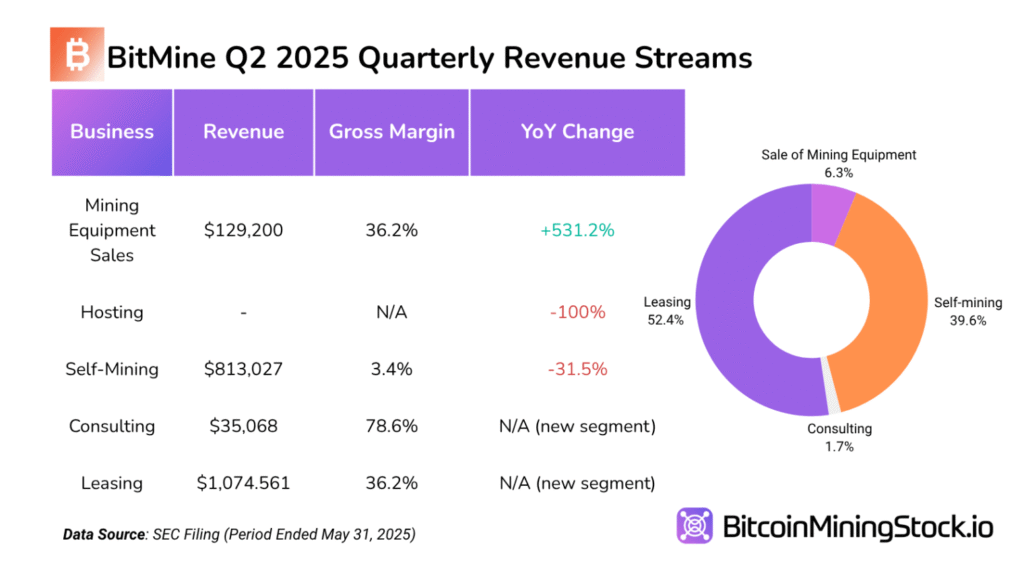

BitMine revenue doubles on ASIC deals

Its latest quarterly results showed solid growth. Revenue hit $2.05 million, nearly double year-over-year. Most of it came from ASIC leasing deals. Self-mining had very thin profit margins, highlighting the challenges of small-scale mining. The company’s consulting segment, while small, delivered high margins and signaled potential for expansion.

BitMine’s balance sheet looks healthy. Cash and crypto holdings grew sharply, and liabilities dropped. However, equity shrank due to continued losses. Still, the company has strong liquidity and little debt. The focus now is Ethereum. The new $250 million fundraising will be used to accumulate ETH.

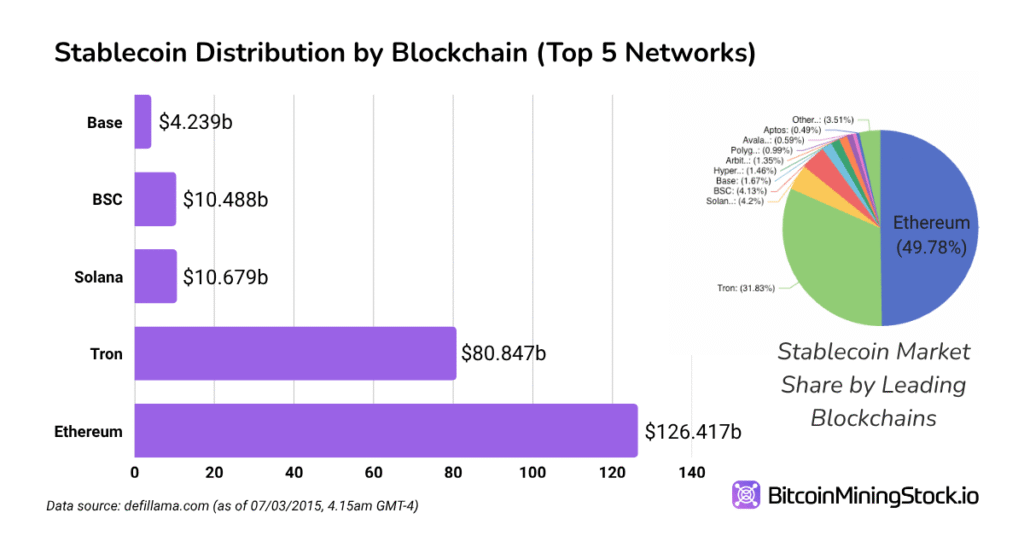

BitMine plans to track ETH per share as a performance metric. The move draws from Tom Lee’s thesis that Ethereum will benefit from stablecoin adoption. Stablecoins, mostly built on Ethereum, could push the network into a leading role in digital finance. BitMine is not alone in this direction.

Ethereum risks loom over treasury use

Other firms are also exploring Ethereum as a treasury asset. However, regulatory risks remain higher for Ethereum compared to Bitcoin. The market now values BitMine more for its vision than its current size.

It trades well above much larger mining peers, with a price tag of over $50 per share. Investors seem to be betting on its potential, not its present performance. If the Ethereum strategy succeeds, BitMine could become a major name in crypto finance.

But the path ahead is risky. Execution will matter. The company now has a chance to lead a new wave of crypto treasury innovation. Whether it becomes the MicroStrategy of Ethereum depends on what comes next.